XRP ETFs Eye SEC Approval with Cboe’s 19b-4 Filing

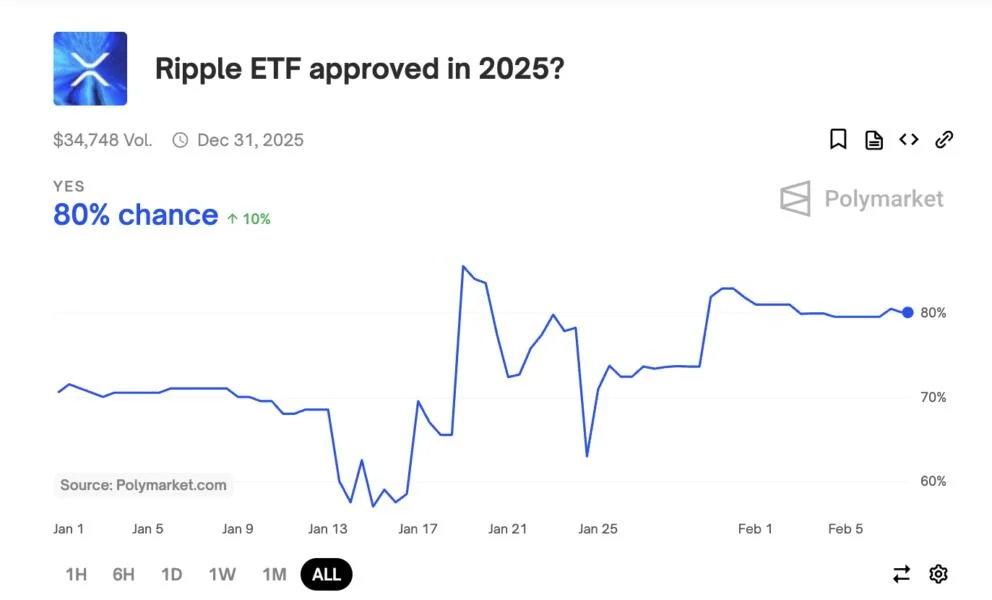

The Cboe BZX Exchange has submitted form 19b-4 filings to the US Securities and Exchange Commission (SEC) to list and trade spot XRP exchange-traded funds (ETFs) for several asset managers. The issuers involved include Bitwise Investment, 21Shares, Canary Funds, and WisdomTree.XRP ETFs One Step Closer?Form 19b-4 is utilized by self-regulatory organizations, such as stock exchanges, to propose rule changes to the SEC. It is a critical component in introducing new financial products, including ETFs, to the market.Fox Business reporter Eleanor Terrett highlighted the procedural nature of these filings.After the SEC confirms receipt of the filing, a 240-day period begins during which it must approve or deny the products. If the SEC approves this filing, it could lead to the introduction of XRP as a tradable ETF.In fact, Grayscale has also filed a 19b-4 application to establish an XRP ETF, joining four other asset managers in this effort.The potential of such an ETF appears quite significant. According to a recent report from JPMorgan, an XRP ETF could generate between $6 billion and $8 billion in revenue within the first 6 to 12 months.On the prediction platform Polymarket, the likelihood of an XRP ETF receiving approval in 2025 has been strikingly high. The odds stood at a notable 80% at the time of this report.This development follows the SEC’s recent acknowledgment of the NYSE’s 19b-4 filings for Grayscale’s Litecoin and Solana ETFs.This was the second acknowledgment for Litecoin and the first for Solana. The acknowledgment was significant due to Solana being classified as a security. “This *MAY* be a good sign for other assets like XRP that were deemed securities under the prior administration that could now be getting a second look,” Terrett wrote. Meanwhile, Cboe’s amended filings for a Solana ETF have yet to receive an acknowledgment from the SEC.Nonetheless, the enthusiasm hasn’t done much for XRP in terms of market performance.It has experienced a downward trend since mid-January.Over the past week alone, the cryptocurrency has seen a substantial depreciation, losing more than 25% of its value. At the time of writing, the altcoin was trading at $2.30, a 6.2% decrease over the past day.