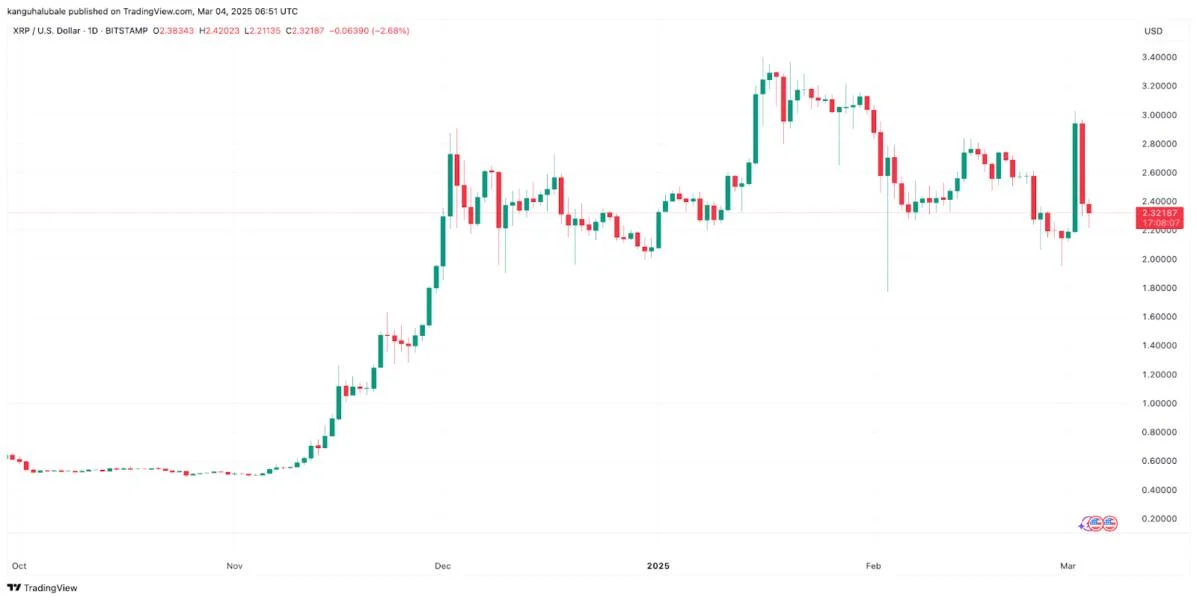

Why is XRP price down today?

XRP price action mirrors the bearishness in the cryptocurrency market on March 4, down 16% in the last 24 hours to trade at $2.32 at the time of writing.What to know:XRP price makes a major U-turn to undo all the gains made on March 2.Cryptocurrencies bleed across the board as Trump’s tariffs take effect.Nearly $58 million worth of XRP futures positions have been liquidated over the last 24 hours, with long liquidations amounting to $50 million.XRP price technicals hint at further declines if key levels do not hold.XRP leads crypto market bloodbathXRP price fell alongside other cryptocurrencies as President Donald Trump’s tariffs against Mexico and Canada came into effect.Key points:Bitcoin is trading at $83,500, 10% down over the last 24 hours and 3% lower than before Trump’s strategic reserve announcement.Ether has lost more than 12% of its value over the last 24 hours to trade just above $2,000. XRP, Solana and Cardano (ADA) bore the brunt of the latest market drawdown among the top 10 cryptocurrencies.As a result, the global crypto market capitalization is down 8% on the day at $2.76 trillion.This broader correction stems from a shift in risk appetite fueled by the implementation of Trump’s tariffs.What to know:US President Donald Trump’s tariffs on imports from Canada, Mexico, and China are set to take effect today, March 4. Trump announced these tariffs—ranging from 10% to 25%—a few days after returning to the White House. An additional 10% tariff on Chinese imports will also go into effect, doubling the rate to 20%. In a statement to reporters at the White House, the President said:“Tomorrow — tariffs 25% on Canada and 25% on Mexico. And that’ll start. They’re going to have to have a tariff.”This triggered a sell-off in crypto markets, with investors reassessing their exposure amid fears of tighter economic conditions. It also compounded the technical and market-driven challenges facing XRP today.Over $50 million in long XRP positions liquidatedXRP’s drop on March 4 is accompanied by significant liquidations in the derivatives market, signaling strong selling pressure.Key points:Over $49.7 million worth of long XRP positions have been liquidated over the last 24 hours alone, compared to $8 million in short liquidations.Bullish traders are forced to sell their positions when long positions are liquidated.The scale of these liquidations mirrors the period between Feb. 24 and Feb. 26, when a total of $80 million in long XRP positions were wiped out, accompanying a 17% drop in price over the same period.XRP’s open interest (OI) has also dropped sharply over the last 24 hours, down 25% from $4.45 billion on March 3 to $3.34 billion at the time of writing, signaling a decline in trader participation.Although the funding rate flipped positive on March 1, it has dropped from 0.0103% to 0.00032% over the last 24 hours, suggesting a weaker bullish conviction.XRP price needs to hold above $2.20Today’s drop in XRP price is part of a correction that began on March 3 that saw the relative strength index (RSI) turn down sharply following its drop from four-week highs above $3.00.Key levels to watch:XRP bulls are focused on defending the psychological support at $2.20, embraced by the middle boundary of the descending parallel channel.XRP could extend the decline to the recent range low at $1.76 (formed on Feb. 3) and the support level at $1.55, where the 200-day SMA currently sits.The bullish case for XRP depends on flipping the resistance at $2.48 into support, where the 100-day SMA and the channel’s upper boundary are.A close above this level will signal another escape from the bearish channel, paving the way for a return to $3.00.This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.