Why is XRP price down today?

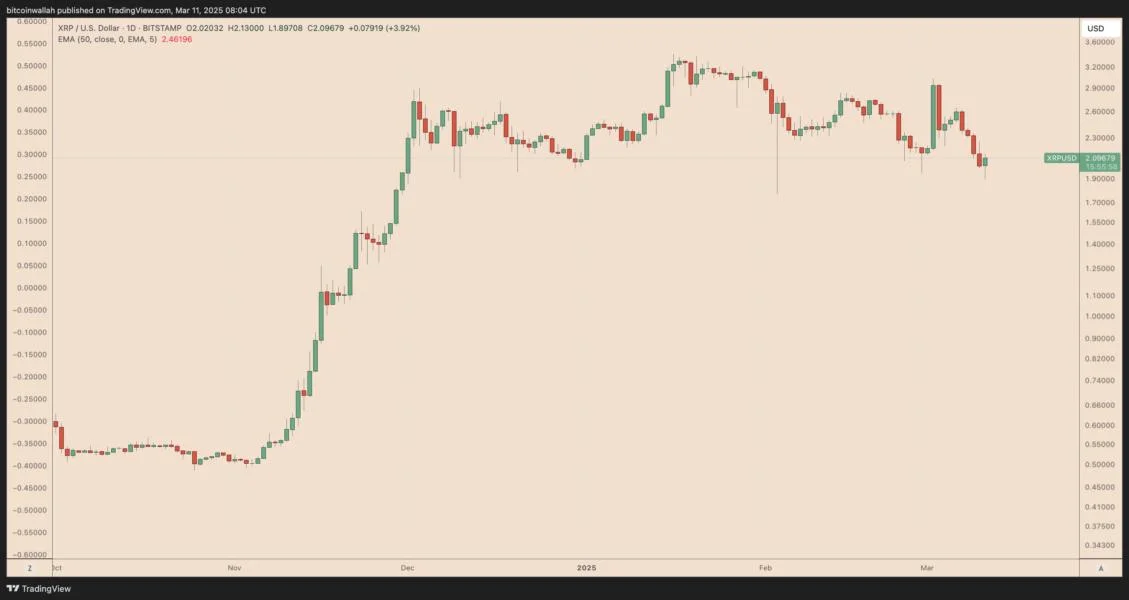

XRP mirrors the bearishness in the cryptocurrency market on March 11, with its price down approximately 7.50% in the last 24 hours to $2.08. At its intraday low, it was trading for $1.90.Key catalysts driving the XRP prices lower today, include:Heightening US recession fears.US President Donald Trump’s digital asset stockpile letdown.A textbook bearish technical setup.US recession fears hurt XRP priceEscalating concerns over a potential US economic slowdown have dampened investor sentiment across financial markets, hurting XRP and the broader cryptocurrency sector.Key points:Crypto and tech stocks saw a large sell-off on March 10 due to rising US recession fears.JPMorgan raised the US recession risk to 40%, up from 30% at the start of 2025, citing extreme US policies as a key risk.The Trump administration’s recent imposition of tariffs on imports from Mexico, Canada, and China has heightened fears of a global trade war.President Trump’s acknowledgment of a potential recession during a "period of transition" has further unsettled investors.Goldman Sachs has also increased its 12-month recession probability to 20%, up from 15%, warning that the forecast could rise if Trump maintains current policies.The Nasdaq E-Mini Futures has dropped by nearly 6% over the past week, coinciding with a 1.18% plunge in the 10-year Treasury note yields.The US dollar index dipped 1.88% in the same period, while the combined market cap of cryptocurrencies has fallen by 8.85%.On the other hand, the Euro and Japanese Yen are rising.Together, these performances indicate a growing rush toward what investors consider “safe havens,” especially as the Trump trade war hurts US economic growth prospects.White House Crypto Summit fails to impress XRP bullsXRP's price took a sharp hit following the White House’s inaugural Crypto Summit on March 7, as hopes for its inclusion in a US strategic crypto reserve were swiftly dashed.Key takeaways:Initial excitement faded after President Donald Trump’s team clarified that Ethereum, Solana, Cardano, and XRP were used as illustrative examples, not official selections for the US reserve.Trump’s crypto strategy favors altcoin reserves but excludes new purchases, limiting XRP’s chances of institutional accumulation.No evidence exists that the US government holds XRP, further diminishing investor optimism.Conversely, Bitcoin remains the clear winner, with the US government holding approximately $17.7 billion in BTC, reinforcing its dominance.The XRP/BTC pair has dropped by 15% in the past two weeks while consolidating within a historical distribution zone.A break below the 200-2W exponential moving average (200-2W EMA; the blue wave) at around 1,700 satoshis could send XRP/BTC toward the 50-2W EMA (~1,700 satoshis).XRP risks 45% crash aheadXRP’s price decline today is furthermore a part of its prevailing head-and-shoulders pattern.Key points:An H&S pattern forms when the price forms three consecutive highs, with the middle peak (head) higher than the other two (shoulders).As a technical rule, the pattern resolves when the price breaks below its common support (neckline) and falls by as much as the pattern’s maximum height.As of March 10, XRP had formed what appears to be the H&S pattern’s right shoulder and was heading toward the neckline support at around $2.A decisive breakdown below the support level could send the XRP price toward $1.11 by April, down by over 45% from the current prices.Can XRP resume its bull run?A rebound from $2 neckline support could delay or invalidate the H&S pattern.Interestingly, the level aligns with two other support levels: the lower trendline of XRP’s prevailing symmetrical triangle pattern and the 50-3D EMA.A bounce, followed by a decisive close above the triangle’s upper trendline, could trigger a breakout scenario toward $3.44.The upside target is measured after adding the triangle’s maximum height to the breakout point (considered to be at the triangle’s apex point at $2.05).This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.