Why is Cardano price down today?

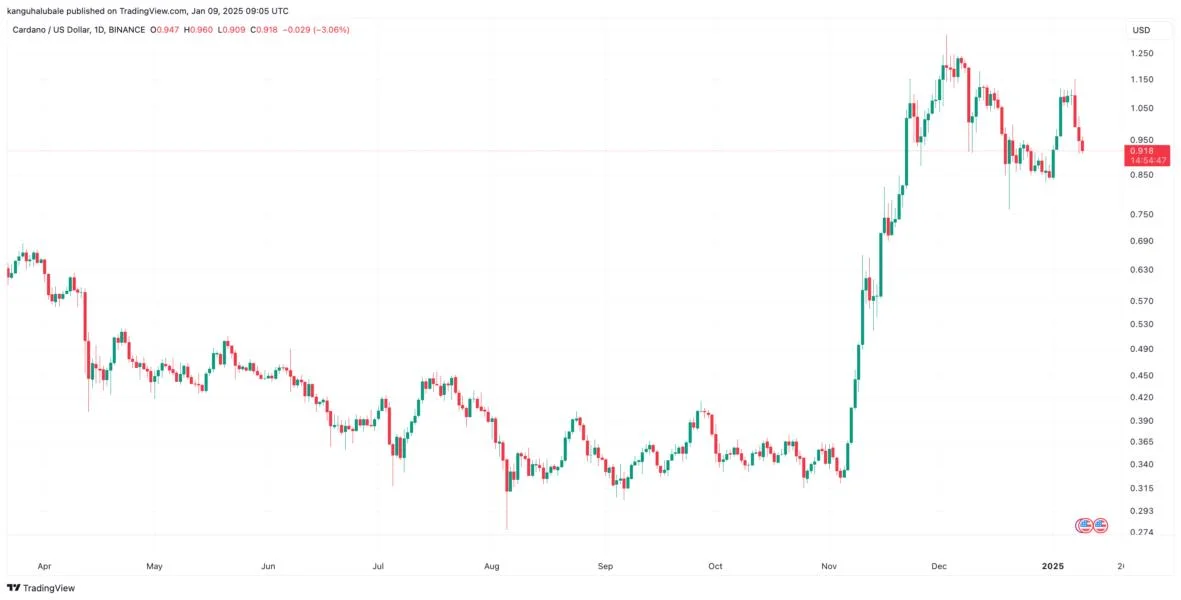

Cardano (ADA) continued its losing streak on Jan. 9, dropping 8% over the last 24 hours to trade at $0.918. A weakening technical structure and several onchain signals suggest that ADA could slip lower in the near term. Let’s look at the factors driving Cardano price down today.Reducing network activity weighs down ADA priceThe Cardano network has seen a remarkable drop in user engagement since the beginning of December. Data from Artemis shows that the number of daily active addresses on the Cardano blockchain has dropped from 96,700 on Dec. 3 to around 38,200 on Jan. 9. Similarly, daily transactions have declined from approximately 144,300 to 54,600 over the same period.Additional data from DefiLlama reveals that the total value locked (TVL) on Cardano also decreased in December. The chart below shows that the TVL fell by over 31.5% from about $708.9 million on Dec. 3 to approximately $485 million at the time of publication. The TVL dropped by $105 million between Jan. 7 and Jan. 9, representing an 18% decline in less than 72 hours.Among the leading projects in Cardano’s DeFi ecosystem, LenFi—a decentralized open-source lending and borrowing protocol—stands out, with its TVL dropping by 53% over the last month and 10% in the past 24 hours. Other Cardano-based protocols, such as Liqwid (lending), Minswap (DEX), and Indigo (lending), also registered TVL declines of 6.5%, 9% and 8.7,% respectively, over the past 24 hours.The declining network activity and reducing TVL on Cardano indicate diminished user interaction, decreasing demand for ADA tokens and negatively impacting its price. Cardano’s open interest (OI) has also decreased by over 17% over the last three days, reaching $1.10 billion on Jan. 9. The current decrease in OI coincides with the ongoing price drop, which infers a waning interest from futures traders.Technical ADA price correction?The technical setup reveals ADA in a technical price correction within a bull flag, as shown on the weekly chart below. If the support provided by the lower boundary of the flag at $0.782 holds, the ADA could bounce back to continue its uptrend.The technical pattern will be confirmed once the price breaks above the upper boundary of the flag at $1.072, clearing the way for a rise toward the bullish target of the flag at $4.40.The same chart also shows that ADA price faces resistance levels at $1.00 and $1.50, with some analysts predicting further downside if current support levels break. “ADA showing weakness at $0.92,” said pseudonymous technical analyst Kwantxbt in a Jan. 9 post on X. The analyst said those considering long positions should probably “wait for confirmation of support at $0.85” before making any move. If this support is lost, ADA could drop toward the 200-week simple moving average (SMA) at $0.763 and later to the psychological level at $0.60.The daily relative strength index has dropped from 63 to 44 over the last three days, suggesting increasing selling momentum that threatens to pull ADA lower in the near term. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.