Why is Bitcoin price up today?

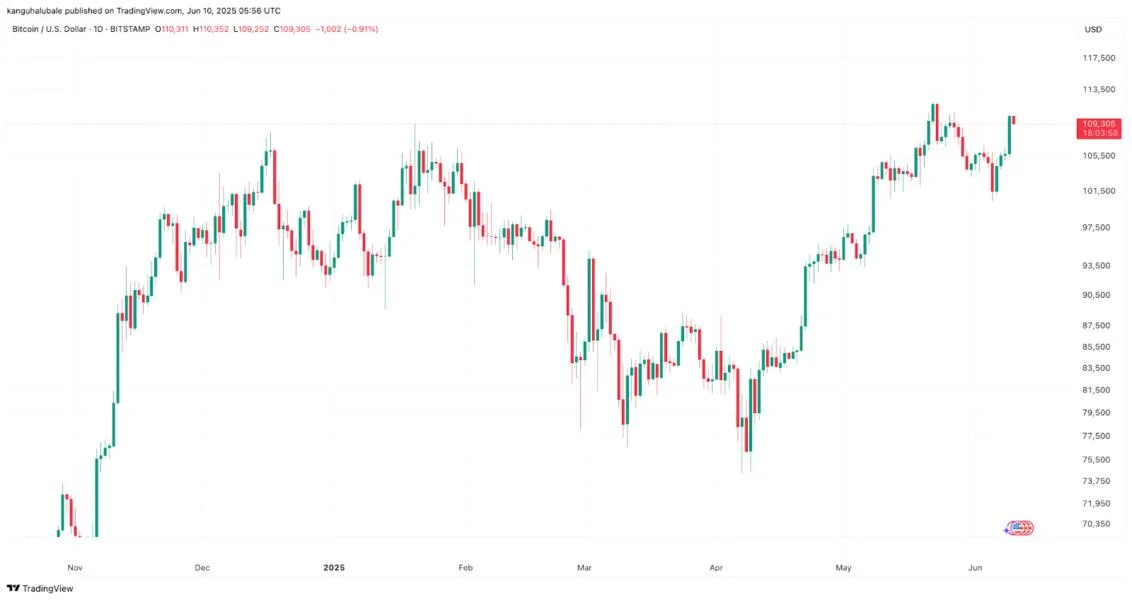

Key points:Bitcoin gained 3.6% to above $109,000 on June 10, fueled by US-China trade talks and high open interest in the futures market.A BTC price bull-flag is in play on the chart, targeting $158,000.Bitcoin is up today, rising over 3.6% in the last 24 hours to over $109,300 on June 10. Data from Cointelegraph Markets Pro and TradingView shows that the pair climbed as much as 5% to an intraday high of $110,532 on June 10 from a low of $105,400 on June 9. Let’s take a look at the factors driving up Bitcoin price today.US-China trade talks boost risk appetiteBitcoin received a fresh boost from renewed risk appetite amid growing optimism that the ongoing US-China trade talks in London could lead to a positive outcome.🔥 NEW: US-China trade talks resume Monday in London.Karoline Leavitt calls it a push for more comprehensive talks. pic.twitter.com/fAH0CSu9wiThese negotiations, aimed at easing tariffs, signal potential de-escalation of trade tensions. Historically, positive trade developments boost risk-on sentiment, driving capital into assets like Bitcoin. BTC price rallied to new all-time highs in May after the US and China closed a 90-day trade agreement. Positive trade outcomes may also counter any inflationary pressures from upcoming CPI data, reducing fears of tighter Federal Reserve policies that could dampen crypto markets.Meanwhile, markets have ruled out any possibility of rate cuts at the June 18 FOMC meeting, with the odds of the lending rates remaining unchanged standing at 99.9%, as per the FedWatch tool. OI rises with Bitcoin’s price reboundAn increase in open long BTC positions in the futures market preceded Bitcoin’s rally to $110,000. Bitcoin’s total open interest (OI) in the derivatives market increased to a two-week high of $77 billion on June 10, data from CoinGlass shows. The chart below shows that Bitcoin’s OI has jumped 8% in the past 24 hours, suggesting increased demand for leveraged BTC positions.Additionally, Bitcoin CME futures OI also hit a 14-day high of 151,915 BTC on June 10, worth approximately $16.6 billion, as per Glassnode data. The derivatives trading volume has jumped 112% over the last 24 hours to $114.3 billion, reinforcing the intensity of the demand-side pressure.Bitcoin’s bullishness on June 10 is accompanied by significant liquidations in the derivatives market. Over $195 million worth of short BTC positions have been liquidated over the 24 hours, compared to just $9.3 million in longs.Bearish traders are forced to close their positions when short positions are liquidated.Bitcoin’s bull flag targets $158,000The pair is expected to resume its upward momentum after breaking out of a bull flag pattern on the daily chart, as shown in the figure below. The pattern was confirmed when the price closed above the flag’s upper boundary at $105,600 on June 8, signaling the start of a massive upward move.The flagpole’s height sets the target, which projects Bitcoin’s price ascent to $158,000 or approximately a 44% increase from the current price.Another bullish indicator is the relative strength index, which is moving within the positive region at 61, suggesting that there is still room for more upside before “overbought” conditions set in.As Cointelegraph reported, Bitcoin’s breakout from a cup-and-handle pattern is likely to open the path toward $140,000.This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.