Wall St poised for lower open as tariff woes persist; Tesla falls

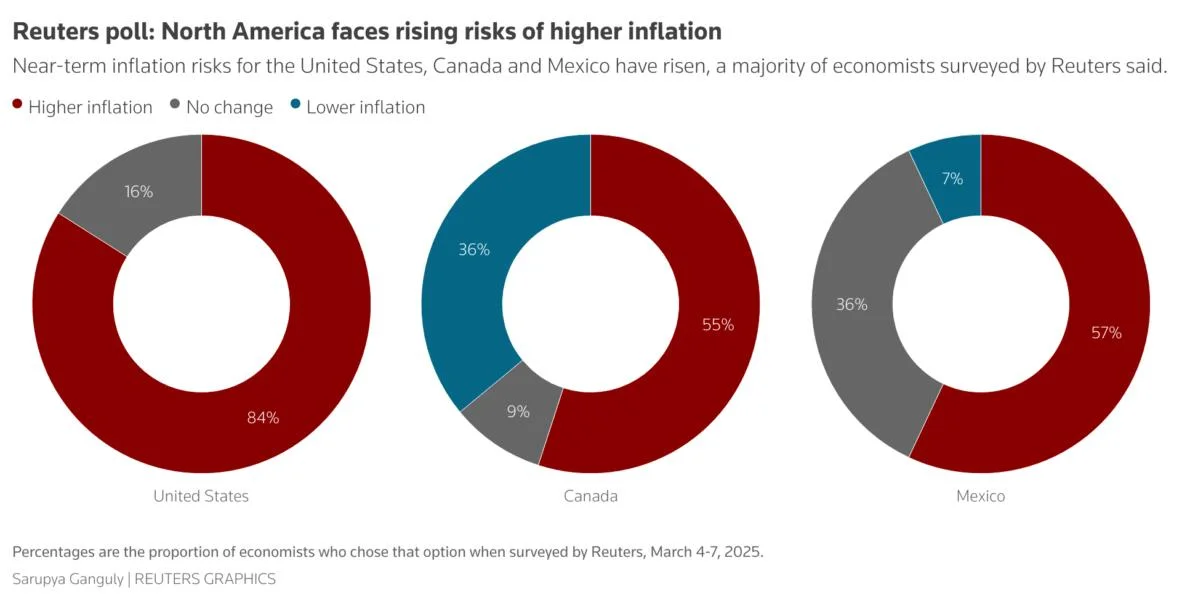

Wall Street's main indexes were set to open lower on Monday as President Donald Trump's comments over the weekend fanned worries that a trade war could trigger an economic slowdown, while Tesla declined following a bearish brokerage forecast.At 08:41 a.m. ET, Dow E-minis were down 485 points, or 1.13%, S&P 500 E-minis were down 81.75 points, or 1.40%, and Nasdaq 100 E-minis were down 343.25 points, or 1.70%.Mega-cap growth stocks felt the heat. Nvidia fell 2.6% in premarket trading, while Meta and Amazon.com were down 2.7% each.Electric-vehicle maker Tesla was down 3.7% after UBS cut its forecast for the automaker's first-quarter deliveries and lowered its price target on the stock.Futures tied to the more domestically focused small-cap Russell 2000 index fell 1.3% as investors sought refuge in the safety of Treasury bonds. JPMorgan Chase , Goldman Sachs and Bank of America dropped over 2% each. The broader banks index (.SPXBK) has fallen more than 8% so far in March, more than double the decline on the S&P 500.In an interview on Sunday, President Donald Trump declined to predict whether the U.S. could face a recession, at a time when investors are concerned that his fluctuating trade policies on Mexico, Canada and China could dampen consumer demand and corporate investment.China's retaliatory tariffs on select U.S. imports are set to take effect on Monday, with U.S. tariffs on certain base metals anticipated later in the week."It's been a very rough patch for markets and all of that centers around uncertainty over tariffs," said Art Hogan, chief market strategist at B. Riley Wealth.A Reuters poll showed 91% of economists view the odds of a downturn to have increased under Trump's rapidly shifting trade policies. HSBC also downgraded U.S. stocks.The S&P 500 recorded its largest weekly drop since September on Friday, while the Nasdaq fell over 10% from its December high on Thursday.Since last week, the CBOE Volatility index has been at levels not seen since December.Data on inflation, job openings and consumer confidence are due later in the week.On Friday, investors took some comfort from Fed Chair Jerome Powell's comments that the economy was on a strong footing, but he also underscored the need for caution on lowering borrowing costs.The Federal Open Market Committee will convene next week and traders expect policy rates to be left unchanged for the first half of this year, according to data compiled by LSEG.U.S.-listed Chinese stocks such as Alibaba fell 3.4%, Bilibili lost 4.7% and Xpeng declined 3.3%, after data from China heightened concerns about a recovery in the world's second-largest economy.Crypto stocks such as MicroStrategy slid 6%, while Coinbase and Riot declined 5.5% each, tracking lower bitcoin prices.Drugmaker Eli Lilly dropped 1.1% in choppy trading. Novo Nordisk said its drug CagriSema helped obese patients with type 2 diabetes cut their weight by 15.7% after 68 weeks, but shares fell, likely on the lower-than-expected weight loss.