US stocks weekly: Trading fire

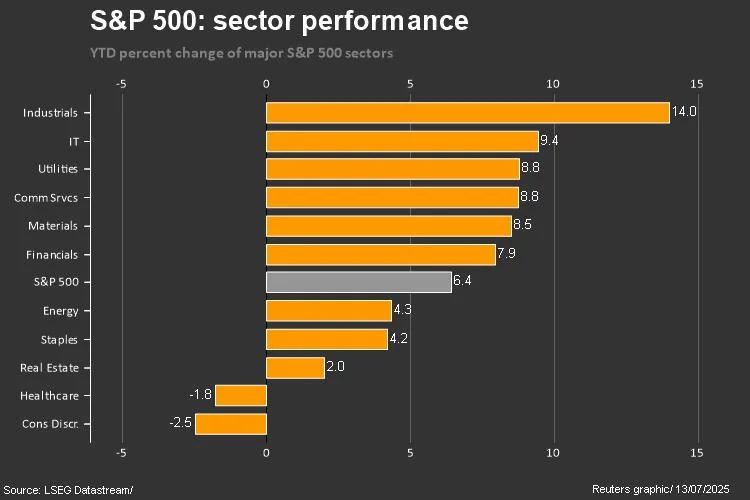

** S&P 500 breaks two-week winning streak, edges down 0.3% as latest Trump tariff salvos weigh ** Dow retreats 1%, while Nasdaq Composite down fractionally** Indeed, DJI kicked off week looking poised to leap over the velvet rope, but by Fri ended three-week winning streak, as did IXIC** And despite its weekly drop, SPX trying to do something this July it hasn't done in more than 65 years, though traders tense given trendline, potential July turn** This, as growth (.IGX) has been chugging along vs value , and looks can be deceiving: Small caps suddenly pack a punch** U.S. 10-Year Treasury yield , at around 4.42%, on pace to rise for a second week in a row** Majority of sectors painted red: Financials and Consumer Staples suffer most splats, while Energy captures the flag** Financials fade 1.9%. JPMorgan Chase falls after HSBC downgrades stock. JPM registers 3% weekly lossFor the week, S&P 500 banks index (.SPXBK) off 2.5%, KBW regional banking index slips just 0.6%** Consumer Staples fall 1.8%. Conagra Brands sags after packaged food maker says tariff costs will dent annual profitHershey appoints burger chain Wendy's CEO Kirk Tanner as its top boss; HSY shares melt** Materials dip 0.3%. Freeport-McMoRan rises as Trump to impose 50% tariff on U.S. copper imports, to start on Aug 1** Consumer Discretionary edges up 0.1%. Tesla slides on Mon as Musk's planned launch of new political party rattles investors, but then rallies on Thurs after announcing annual shareholder meeting, just prior to a deadline under Texas law** Tech ticks up 0.2%. Chip bellwether Nvidia becomes first public co in world to hit $4 trln market value on AI dominanceSemiconductor index up nearly 1%Though, Fair Isaac , better known as FICO, dives as Fannie Mae and Freddie Mac to allow use of rival credit scoreAnd First Solar dims after Trump order seeks to end subsidies for solar and wind energy projects** Industrials firm 0.6%. Delta Air Lines soars on strong 2025 profit forecast, betting on lower seating capacity to lift ticket prices, boosts travel stocksNYSE Arca Airlines index ascends 2%** Utilities rise 0.7%. AES Corp jumps on report of potential sale amid takeover interest from major investment firms** Energy rallies 2.5%. Group tracks crude prices higher amid renewed Houthi attacks in Red Sea, concerns about U.S. tariffs and forecasts for less U.S. oil production Exxon Mobil flags hit to Q2 profit. Still, XOM advances ~3% on the week** Meanwhile, crypto stocks surge premarket on Fri as Bitcoin scales record peak, and drone plays take flight as Hegseth ordered production boost ** SPX performance YTD: