'Trumpcession' warning

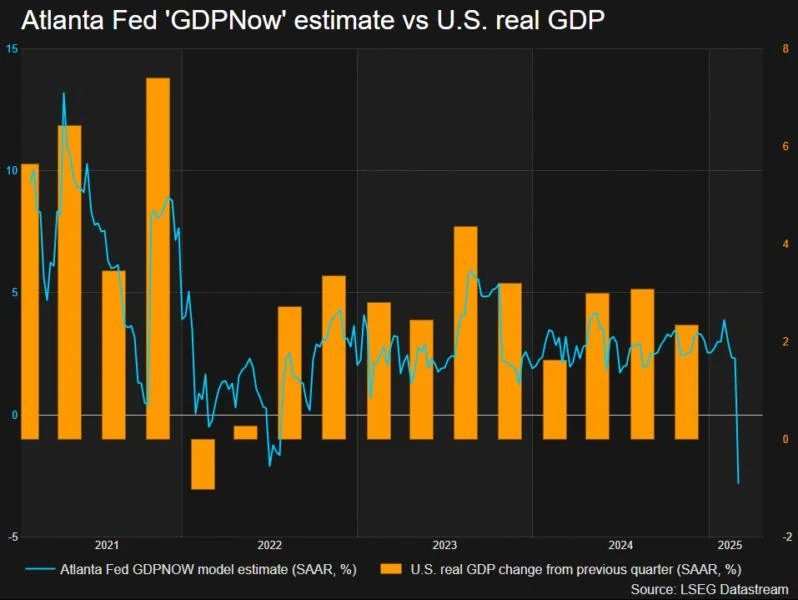

TRADING DAY Making sense of the forces driving global markets The divergence between U.S. and European equity markets, a trend that emerged earlier this year, is widening. There are several reasons for Wall Street's retreat - U.S. President protectionist trade agenda, rich valuations, the flagging 'Big Tech' rally, and mounting evidence that U.S. growth is slowing. Europe, meanwhile, started the year beaten down, relatively cheap and heavily under-owned, so a bounce was always likely. But the rebound is now accelerating thanks to the seismic geopolitical shifts underway that appear to be sparking an equally seismic shift in the continent's fiscal policies. Stocks are surging on hopes of growth-boosting defense and infrastructure spending, and a possible peace deal in Ukraine. The euro and bond yields are now rising too, while the dollar and Treasury yields are heading in the opposite direction.Trump's agenda appears to be exacerbating the U.S. economic slowdown. Could it even trigger a so-called 'Trumpcession'? A recession still seems highly unlikely, but it's definitely on investors' radar. More on that below.But, first, here are some of today's key market moves. • Wall Street's main indices slump as much as 2.6% on signs of continued U.S. economic weakness with U.S. President Trump confirming that Canada and Mexico tariffs start on Tuesday. Bitcoin on a rollercoaster, surging 20% from Friday's low after Trump floats new U.S. strategic reserve that would include crypto tokens, but sinks nearly 10% on Monday.U.S. yields fall, curve flattens following another weak economic indicator, this time the manufacturing ISM. Euro jumps 1% and euro zone yields rise sharply on fiscal spending hopes and prospects for Russia-Ukraine peace deal. German stocks rally 2.6%, the biggest rise since November 2022, to close at a record high. Atlanta Fed shock sounds 'Trumpcession' warning "Trumpcession". If you haven't heard the term before, you will now, as a closely watched real-time U.S. economic weathervane is signaling that GDP is shrinking at the fastest pace since the pandemic lockdown.The Atlanta Fed's 'GDPNow' model estimate for annualized growth in the current quarter was a stunning -2.8% on Monday, down from +2.3% last week. A month ago the model showed that growth in the January-March period was tracking close to +4.0%.These estimates are published regularly as new economic data is released, and can be quite volatile. There were 11 in February alone. Friday's shock reading of -1.5% was led by a record-high $153 billion trade deficit in January, most likely as firms front-loaded imports ahead of tariffs, and Monday's decline was driven by soft manufacturing activity. There's every chance -2.8% turns into a positive reading in a few weeks.True, the Atlanta Fed number is an outlier for now. The New York Fed's equivalent 'Nowcast' real-time tracking model was last revised on Friday to +2.9% annualized growth in Q1 from +3.0%. And the Dallas Fed's 'weekly economic index' was showing +2.4% on Feb. 27.But the Atlanta Fed's 'GDPNow' real-time estimates are historically the most reliable of these models, and the negative figures didn't come out of nowhere. A lot of 'soft' economic indicators, like sentiment surveys, have been extremely weak recently, and some 'hard' economic activity indicators are flashing red too.Consumer sentiment in January slumped the most in three and a half years, retail sales dropped by the most in nearly two years, real spending fell at the fastest rate since early 2021, and retail giant Walmart has warned of a tough year ahead. It's perhaps no surprise that Citi's U.S. economic surprises index has slid into negative territory, hitting the lowest point since September.A common thread running through all of this is the huge level of uncertainty being created by Trump's agenda: trade protectionism, particularly tariffs; his apparent growing closeness with Russia and distance from traditional allies like Europe; and the 'DOGE' (Department of Government Efficiency) scythe being taken to federal spending and employment. NEGATIVE WEALTH EFFECTMarkets are certainly signaling there could be trouble ahead. The Nasdaq has lost as much as 9% in 10 days, with 'Big Tech' down even more. Investors are seeking the safety of U.S. Treasuries: the two-year yield on Friday fell below 4.00% for the first time since October, and the 10-year yield has tumbled 60 bps since mid-January.These moves could matter to the real economy because of the 'wealth effect'. As Moody's' Mark Zandi noted recently, the top 10% of American households now accounts for around half of all consumer spending. That's a record. They also own a lot of stocks, and if Wall Street is heading south, they are more likely to tighten their belts.Economist Phil Suttle said he expected Trump's agenda to weigh on the economy this year, but didn't expect it to have such an apparently negative impact so quickly. But if the "blunt and chaotic" implementation of Trump's spending and trade policies hit growth harder than imagined, the Federal Reserve may cut rates in the second quarter, Suttle reckons.The Fed's rate-cutting cycle is on hold for now, largely because of the uncertainty surrounding Trump's trade and fiscal policies. But an impending "Trumpcession" probably wasn't on policymakers' mind when they pressed the pause button. It likely is now. What could move markets tomorrow? U.S. tariffs on Canada and Mexico kick inNew York Fed President John Williams participates in Bloomberg News eventMore PMIs from Asia, including Japan If you have more time to read today, here are a few articles I recommend to help you make sense of what happened in markets today.ECB may fear stumbling into stimulus: Mike Dolan Critical minerals take center stage in world politics: Andy Home EXCLUSIVE-Germany weighs special funds for defense and infrastructure, sources say Trump threatens to lose patience as Europeans float proposals for Ukraine ceasefire . You can also follow me at [@ReutersJamie and @reutersjamie.bsky.social.]Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the , is committed to integrity, independence, and freedom from bias.Trading Day is also sent by email every weekday morning. Think your friend or colleague should know about us? Forward this newsletter to them. They can also .