Trump tariff turmoil sees global crypto funds shed another $795 million in weekly outflows: CoinShares

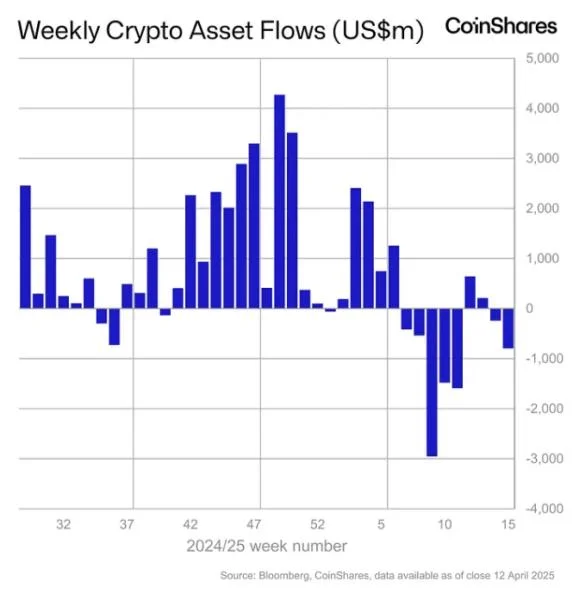

Global crypto investment products run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered further net outflows of $795 million last week, according to CoinShares data.Recent tariff activity from President Trump continues to weigh on sentiment towards the asset class, CoinShares Head of Research James Butterfill wrote in a Monday report. That wave of persistent negativity has seen total outflows since early February reach $7.2 billion — effectively wiping out year-to-date inflows, which now stand at just $165 million, Butterfill noted.Weekly crypto asset flows. Images: CoinShares."However, a late-week price rebound helped lift total assets under management from their lowest point on April 8 (the lowest since early November 2024) to $130 billion, marking an 8% increase following President Trump's temporary reversal of the economically calamitous tariffs," Butterfill said — with the exception of China.Despite dropping below $75,000 earlier in the week, bitcoin rebounded back above $84,000 on Friday, according to The Block's Bitcoin price page. Meanwhile, the GMCI 30 index of leading cryptocurrencies has gained around 13% over the past seven days.US and bitcoin continue to dominateUnsurprisingly, U.S. investors led the net outflows, with $763 million exiting crypto funds in the country last week. Products based in Switzerland, Hong Kong, Sweden and Germany also witnessed significant outflows of $34.3 million, while those in Canada, Brazil and Australia attracted modest net inflows totaling $2.7 million.Bitcoin-based investment products saw the largest outflows of any asset globally, registering $751 million in net outflows last week, although year-to-date inflows remain at around $545 million, Butterfill noted. However, short-Bitcoin products also witnessed net outflows of $4.6 million.The U.S. spot Bitcoin exchange-traded funds accounted for $707.9 million in net outflows alone, according to data compiled by The Block — registering negative flows every day last week.Global Ethereum-based investment products witnessed the second-largest net outflows of $37.6 million last week, with international funds unable to overcome $82.5 million in outflows from the U.S. spot Ethereum ETFs.Solana, Aave and Sui investment products also witnessed modest net outflows, while XRP, Ondo, Algorand and Avalanche-based funds saw minor net inflows.Easing macro tensions?While China responded with matching retaliatory tariffs of 125% on U.S. goods on Friday, initially appearing to escalate trade tensions, potential carve-outs for electronics and semiconductors suggest a willingness to negotiate and an acknowledgment of the economic interdependence between both nations, reassuring investors, BRN analyst Valentin Fournier told The Block."The combination of cooling inflation, rate cut expectations and easing geopolitical stress as digital assets pick up momentum makes for an increasingly favorable environment," Fournier said. "We expect risk assets to continue grinding higher, with bitcoin likely to retest the $90K resistance in the near term."Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.