Trump signs reciprocal tariff order, includes non-monetary provisions

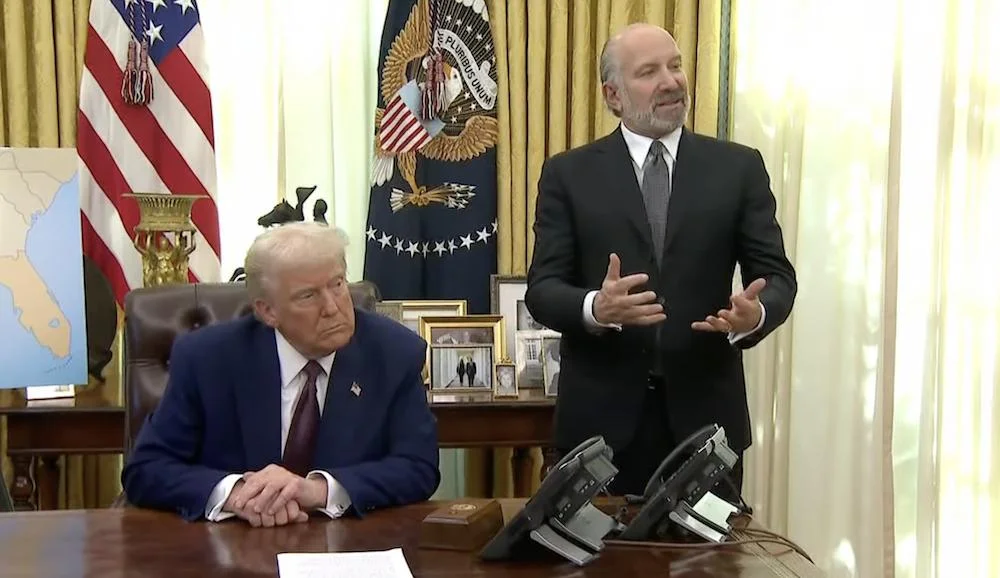

US President Donald Trump has officially signed an executive order to place reciprocal tariffs on the country’s trading partners, which included provisions for non-monetary policies and defined value-added taxes (VATs) as meeting the criteria for a reciprocal import tax.President Trump tapped Secretary of Commerce Howard Lutnick, Secretary of State Marco Rubio, and Secretary of the Treasury Scott Bessent to study the issue and submit their findings.Tariffs will not be levied immediately and will be imposed following the submission of the report, which Lutnick said would be ready by April 1. Speaking from the Oval Office, Lutnick told reporters:“If [other countries] drop their tariffs, prices for Americans are coming down. Our production is going up, and our costs are going down. Remember, it’s a two-way street — that’s why it’s called reciprocal.”The order follows on the heels of recently announced tariffs on China, Mexico and Canada as markets grapple with the economic implications of an extended trade war and macroeconomic uncertainty. The tariffs on Mexico and Canada were ordered but have been paused until March 1.How markets reacted to previous rounds of Trump tariffsCryptocurrency and stock markets tend to drop sharply following news or rumors of a trade war as investors flee risk-on assets for safer investments like US government securities.President Trump’s initial announcement of tariffs against China, Mexico and Canada caused the price of Bitcoin to fall below $100,000 and led to more than $2.2 billion in Ether (ETH) liquidations within 24 hours.The import duties included a 25% import tax on goods from Canada and Mexico, as well as an additional 10% import tax on goods from China.Crypto markets rebounded just one day later, with Bitcoin crossing back up to $101,731 on Feb. 4 after the US president delayed the tariffs on Mexico and Canada for 30 days.Trump later announced a 25% tax on aluminum and steel imports, which sent the price of Bitcoin tumbling from $97,000 to $94,000.Bitcoin's price recovered within 24 hours and climbed back up to the $97,000 mark following the initial dip brought on by market fears of the tariffs.