Tokenized bond market may 30x by 2030 — fintech exec

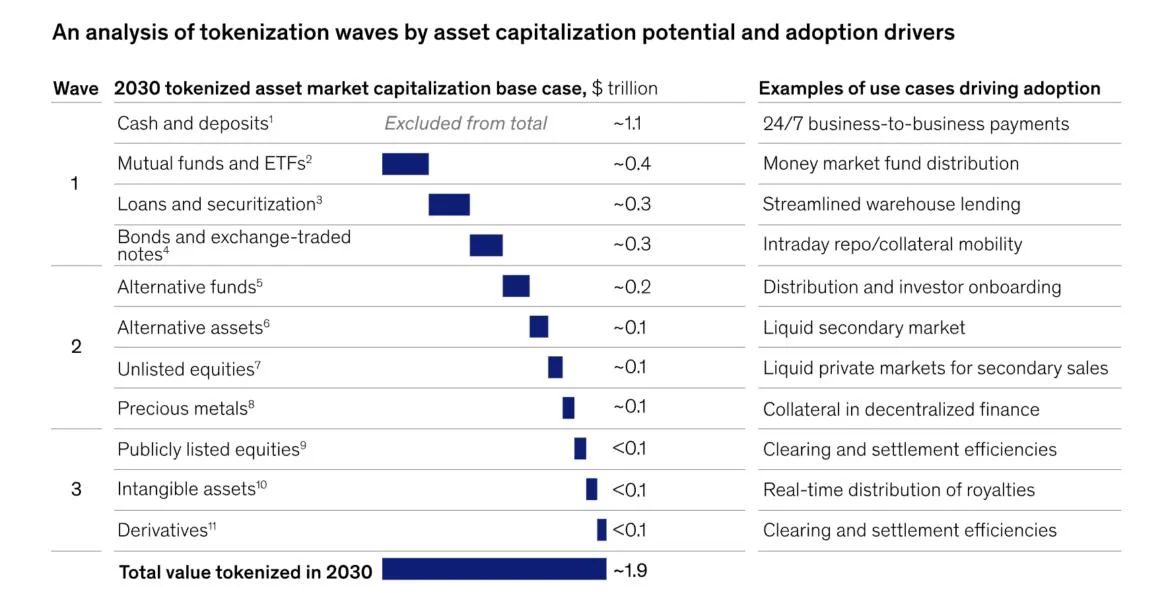

The tokenized bond market may surge to at least $300 billion by 2030, representing a 30x gain from current levels. Lamine Brahimi, co-founder of Taurus SA — an enterprise-grade digital asset company — told Cointelegraph these were base case figures.Brahimi cited research from McKinsey, which said the $300-billion estimate was a base case that included government, municipal and corporate bonds.According to the executive, tokenizing bonds allows for near-instant settlement times, reduces transaction costs, and can democratize the investment process through fractional ownership.Tokenized real-world assets (RWAs), which include bonds, stocks, stablecoins and other real-world items, are projected to reach a $10-trillion market cap by 2030 as the world moves onchain.The future will be tokenizedDuring a recent interview at the World Economic Forum’s Davos summit, BlackRock CEO Larry Fink said every stock and bond should be tokenized onchain.Fink likewise said that the tokenization of real-world assets would democratize investment markets by lowering the barrier to entry.Data from RWA.xyz shows that the tokenized US treasury sector currently has a market capitalization of over $3.4 billion.The Hashnote Short Duration Yield Coin (USYC) commands the largest market share at an asset value of over $1.2 billion.BlackRock’s United States dollar Institutional Digital Liquidity Fund (BUIDL) has the second-highest market cap at over $642 million.In July 2024, BUIDL became the first tokenized treasury fund to reach the $500-million milestone and managed to keep its lead as the largest tokenized treasury product until December 2024.At the time of this writing, $2.4 billion of the $3.4 billion in tokenized treasuries are on the Ethereum network.Although tokenization of real-world assets promises to reduce transaction costs for buyers and issuers, challenges remain.Some tokenized bond pilot programs do not take full advantage of the permissionless and cost-saving features of blockchain technologies.The presence of unnecessary human intermediaries in the bond tokenization process introduces redundancies that drive up costs and neutralize the value proposition of onchain finance.