Tether acquires 32% stake in Canadian gold-focused firm Elemental for $89 million

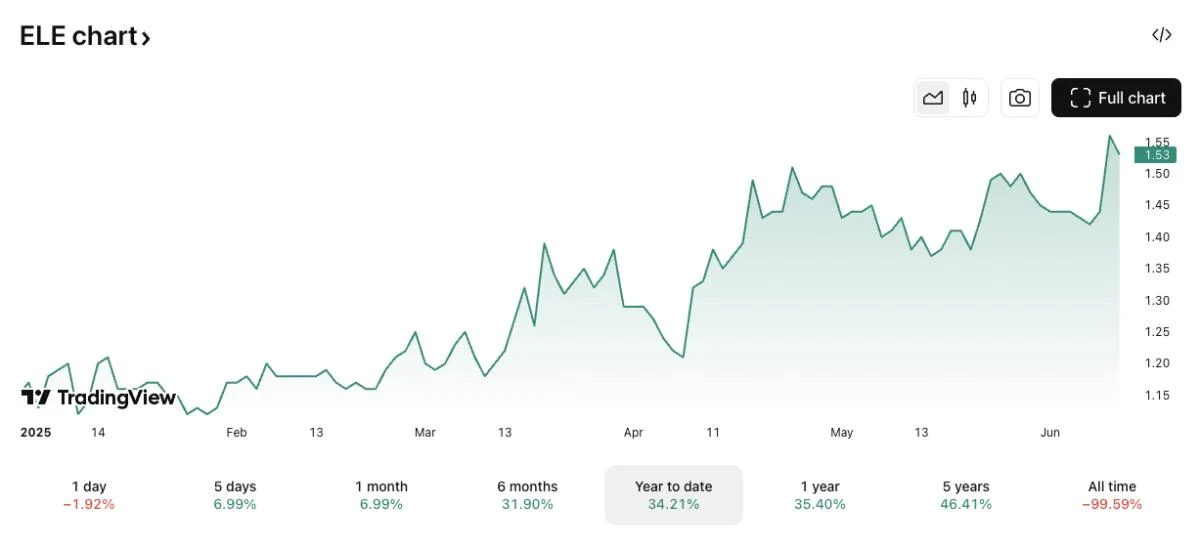

Stablecoin and gold-backed token issuer Tether has acquired an approximate 31.9% stake in Canadian precious metals royalty company Elemental Altus Royalties Corp. through its affiliated but independent investment arm, Tether Investments.The investment offers Tether diversified exposure to global gold production through a royalty and streaming model that sidesteps the direct operational risks of mining, the firm said in a statement on Thursday. Elemental provides funding to mining companies in exchange for royalties on future revenue or the right to purchase metals at discounted prices.At the acquisition price of 1.55 CAD ($1.14), Tether Investments' 78,421,780 common shares in Elemental are worth around 121.6 million CAD ($89.2 million). ELE shares fell 1.9% on Wednesday but are up 34.2% year-to-date, according to .ELE/CAS price chart. Image: .Including the 4,360,511 shares it already holds, Tether's total ownership will rise to 82,782,291 common shares — representing approximately 33.7% of the company's outstanding shares, Elemental noted in a separate statement."Building on previous discussions with Tether, we are very pleased to officially welcome Tether as the company's new major shareholder," Elemental CEO Frederick Bell said. "Their unmatched ability to support the company in its next phase of growth is exciting for all shareholders and is a positive for the gold royalty sector. Tether is one of the world’s largest companies, largest holders of US Treasuries, and a growing investor in the gold space."The move is part of Tether's broader strategy to integrate long-term, stable assets like gold and bitcoin into its ecosystem — both as a financial hedge and to support its goal of building robust and decentralized infrastructure for the digital economy, it said. The shares were acquired from La Mancha Investments S.à.r.l., with the transaction completed offshore via a private agreement on June 10.Tether's option to acquire more Elemental sharesTether Investments also signed an agreement with AlphaStream Limited and its wholly owned subsidiary, Alpha 1 SPV Limited, on Tuesday, granting it the option, though not the obligation, to acquire an additional 34,444,580 Elemental common shares (currently worth around $38.7 million) in an offshore deal. The option can't be exercised before October 29, 2025, unless approved by Elemental, and is subject to certain terms and conditions, Tether noted. If the option is exercised, Tether would hold 117,226,871 common shares, representing about 47.7% of the company's outstanding shares."Tether's growing investments in gold and bitcoin reflect our forward-looking strategy to build a more resilient and transparent financial system," Tether CEO Paolo Ardoino said. "Just as bitcoin provides the ultimate decentralized hedge against monetary inflation, gold continues to be a time-tested store of value. By gaining exposure to a diversified portfolio of gold royalties through Elemental, we are strengthening the backing of our ecosystem while advancing Tether Gold and future commodity-backed digital assets. This is not just about investment — it's about building financial infrastructure for the next century."Tether Group recently disclosed holdings of over 100,000 BTC ($10.7 billion) and nearly 80 tons of physical gold, alongside its Tether Gold (XAUT) token, backed by physical gold, which has become a key part of the firm's product and risk strategy, it said."We believe in financial systems that are backed by real assets, not just promises," Ardoino added. "Our investment in Elemental complements our long-standing belief that tangible assets like bitcoin and gold will underpin the most durable forms of digital value."Tether Investments stated that it may seek further collaboration with Elemental's leadership on governance and long-term strategy, subject to applicable regulations and market conditions.Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.