Superchain will reach 80% of Ethereum L2 transactions in 2025 — Optimsm exec

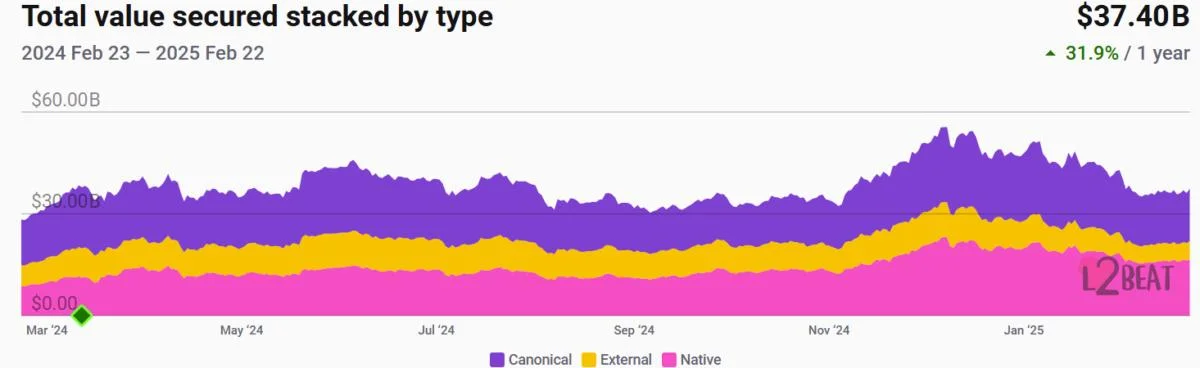

Ethereum’s fragmented layer-2 ecosystem has given rise to a dominant market player in Optimism, whose Superchain collective has attracted builders from several major firms from across the blockchain industry and beyond. In an interview with Cointelegraph, Optimism’s chief growth officer, Ryan Wyatt, said Superchain now accounts for 60% of Ethereum layer-2 transactions. It’s on track to reach 80% by the end of the year. In actual numbers, Superchain currently has more than $4 billion in total value locked and sees 11.5 million daily transactions, Wyatt said. Superchain is a collective of layer-2s that are using Optimism’s OP Stack to scale the Ethereum network. So far, companies such as Coinbase, Kraken, Sony, Uniswap and Sam Altman’s World have joined the collective.“Every chain in the Superchain helps create a flywheel effect by contributing revenue back to the Optimism Collective, participating in governance, and supporting core development of the OP Stack,” said Wyatt.Beyond just OP Stack developers, Ethereum layer-2s have seen significant growth over the past year. The total value secured across all Ethereum L2s peaked at around $55.5 billion in December, according to industry data. L2s are likely to see even bigger growth once interoperability upgrades are implemented. For MetaMask developer Consensys, solving this so-called interoperability puzzle is a key priority. The company’s research director, Mallesh Pai, told Cointelegraph Magazine that crosschain swaps on L2s will be implemented this year. L2s and DeFiWhile much has been written about Ethereum’s performance since the Merge — the price of Ether (ETH) has declined roughly 70% against Bitcoin (BTC) over that period — the network remains a dominant hub for decentralized finance. This dominant position is also being shaped by L2s, which are helping scale the network’s DeFi capabilities. “In the Ethereum ecosystem, we expect DeFi activities to continue moving into L2s,” said DeFi educator Finematics. “These new networks will continue to play a pivotal role, enhancing Ethereum’s capabilities and allowing for greater transaction throughput.”Layer-2s are sucking up a greater share of stablecoins, which remain one of DeFi’s biggest use cases. By December, Ethereum layer-2s held $13.5 billion worth of stablecoins, according to data from Tie Terminal. This was significantly higher than the value of stablecoins held on BNB Smart Chain, Solana and Avalanche, according to Web3 data analyst Matthias Seidl.The overall stablecoin market now exceeds $226 billion, according to Tie Terminal data.