Strategy’s softening pace of bitcoin buys reflects shrinking premium and rising corporate treasury competition, K33 says

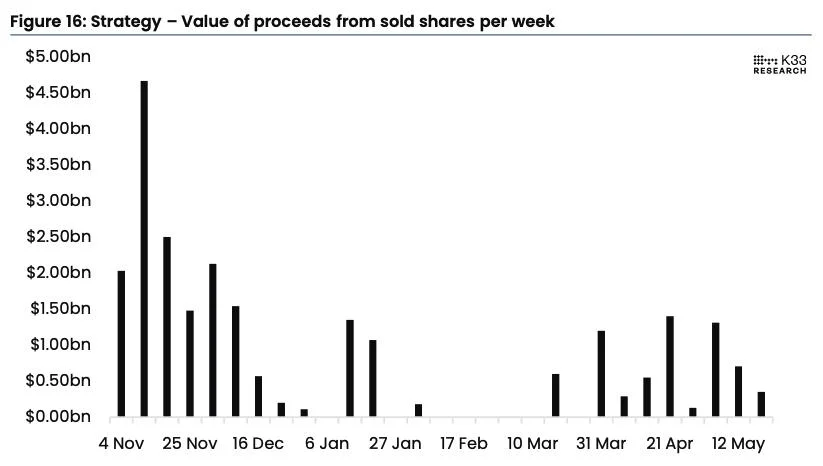

Strategy (formerly MicroStrategy) has continued its aggressive bitcoin acquisitions in recent weeks, albeit at an increasingly softer pace than its November peak.This slowdown can be attributed to a declining premium for Strategy's Class A common stock, MSTR, to its bitcoin holdings and increased competition in the corporate treasury accumulation race, K33 Head of Research Vetle Lunde noted in a Tuesday report.On Monday, Strategy announced it had purchased another 4,020 bitcoins for about $427.1 million at an average price of $106,237 per bitcoin between May 19 and May 25. Proceeds from Strategy's latest $21 billion MSTR ATM program represented $348.7 million of the capital raised for the acquisitions — down from $705.7 million the week before and $1.31 billion between May 5 and May 11, Lunde noted."Generally, the pace of utilization of its new $21 billion at-the-market offering is considerably slower than the pace of the first $21 billion ATM offering," he said. "The seven weeks between November 4 and December 16 saw MSTR, on average, raise $2.13 billion from its ATM, compared to the average weekly raises through the ATM of $788 million over the past three weeks."The value of the Strategy proceeds from the sold shares per week. Image: K33.More competition and a declining premiumNew corporate treasury initiatives involving bitcoin are seemingly emerging every week. There are now more than 70 companies that have adopted some form of bitcoin treasury, with Twenty One and Nakamoto recently joining the likes of Metaplanet, Semler Scientific, and KULR in adopting a bitcoin acquisition model pioneered by Strategy and its co-founder, Michael Saylor. On Tuesday, Trump Media and Technology Group became the latest to launch a corporate bitcoin treasury strategy backed by a $2.5 billion private placement from around 50 institutional investors."This gives traders more options when buying equity in BTC treasury companies, potentially dampening some demand from MSTR itself," Lunde said.Furthermore, as Strategy's bitcoin holdings grow in value, sustaining its prior 2x premium to net asset value requires increasingly greater investor demand."The past week, particularly Friday, saw a sharp retracement of MSTR's market premium to its BTC holdings, declining from 185% to 163%, with premiums hitting lows not seen since April 8," Lunde added. "Aggressive dilution accelerates the contracting premiums, potentially forcing MSTR into more moderate ATM raises than the ones witnessed in November when premiums surged higher despite aggressive dilution."MSTR premium to NAV. Image: K33.A relatively small niche of the global bitcoin marketStrategy now holds a total of 580,250 BTC — worth over $63.3 billion — bought at an average price of $69,979 per bitcoin for a total cost of around $40.6 billion. That's the equivalent of more than 2.75% of bitcoin's total 21 million supply and implies around $23 billion of paper gains, with BTC hovering just below its all-time highs at around $109,000, according to The Block's Bitcoin Price page. "While bitcoin trades at all-time highs, signs of euphoria remain modest in derivatives and the spot market and are currently arguably only showing in BTC treasury companies, which currently experience thriving demand," Lunde noted. "That said, apart from MSTR, most of these treasury companies reflect a relatively small niche of the global BTC market and, in our opinion, do not represent a large looming threat to BTC's strong momentum."Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.