S&P 500 jumps to two-week high; Nvidia and Tesla rally

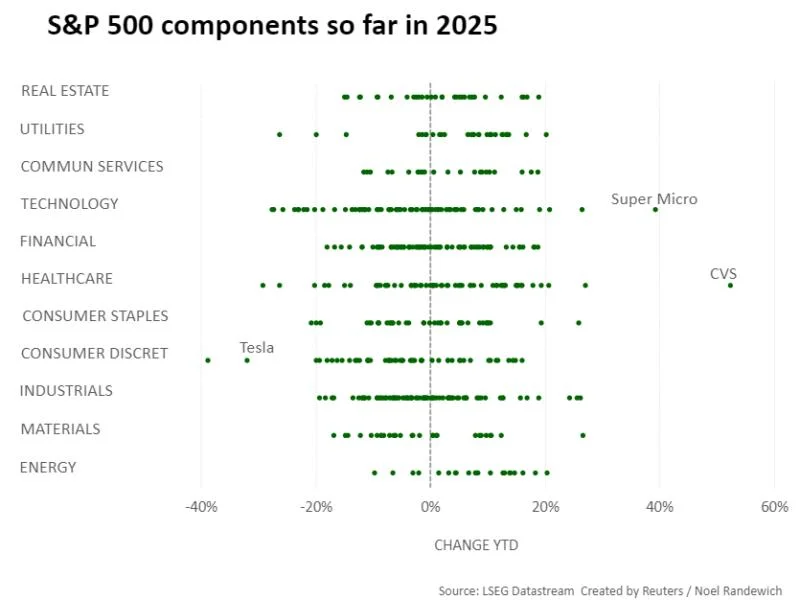

The S&P 500 rallied to its highest in two weeks on Monday, lifted by Nvidia and Tesla following signs that the Trump administration might take a more measured approach on tariffs against U.S. trading partners.U.S. President Donald Trump had anticipated applying reciprocal levies starting on April 2 but a set of sector-specific tariffs is now likely to be excluded, according to media reports over the weekend citing administration officials. A Trump administration official on Monday cautioned that the situation was fluid and no final decisions had been made.Investors scooped up battered technology shares, with Nvidia rallying 3.3% and Advanced Micro Devices jumping 6.6%, sending the PHLX chip index 3.1% higher.Tesla surged 10%, recovering some of its recent steep decline, helped by optimism about scaled back U.S. tariffs. Financial markets have whipsawed in recent weeks due to fears of an economic downturn after Trump announced a series of tariffs last month on major U.S. trading partners, including China, Mexico and Canada.The S&P has recovered about 4% from its recent low on March 13, and it remains down over 6% from its February 19 record high close."Investors are experiencing a slight sigh of relief, but at the same time they are cynical about how long this may last," said Sam Stovall, chief investment strategist at CFRA Research. "The causes of this manufactured correction have not evaporated. They are tariffs and what the impact of tariffs could be on economic growth, inflation and corporate profits."Several companies have cited tariff uncertainty as they lowered their forecasts for upcoming quarters. Data compiled by LSEG as of Friday showed earnings of companies in the S&P 500 are expected to grow by 10.5% in 2025, down by 3.5 percentage points since the beginning of the year.The S&P 500 was up 1.49% at 5,752.18 points.The Nasdaq gained 1.95% to 18,130.97 points, while the Dow Jones Industrial Average was up 1.12% at 42,454.07 points.The domestically focused Russell 2000 index rose over 2% to a two-week high, while the CBOE Volatility Index , known as Wall Street's fear gauge, dropped 1.3 points to a three-week low.A survey showed U.S. business activity picked up in March, while growing fears over import tariffs and deep government spending cuts continued to weigh on sentiment. Investors are awaiting data this week, including the Personal Consumption Expenditure (PCE) price index - the Federal Reserve's preferred inflation gauge - on Friday.Dun & Bradstreet rose almost 3% after the data and analytics provider agreed to be acquired by private equity firm Clearlake Capital in a $7.7 billion deal.Lockheed Martin fell 1.5% after BofA Global Research downgraded the weapons maker to "neutral" from "buy".Crypto stocks rallied with a 3.5% rise in bitcoin prices , with MicroStrategy advancing 8.5% and Coinbase up 6%.Advancing issues outnumbered falling ones within the S&P 500 (.AD.SPX) by a 6.2-to-one ratio.The S&P 500 posted 4 new highs and no new lows; the Nasdaq recorded 41 new highs and 76 new lows.