Solana CME futures volumes reach $12.1M: Was the launch a dud, or is more to come?

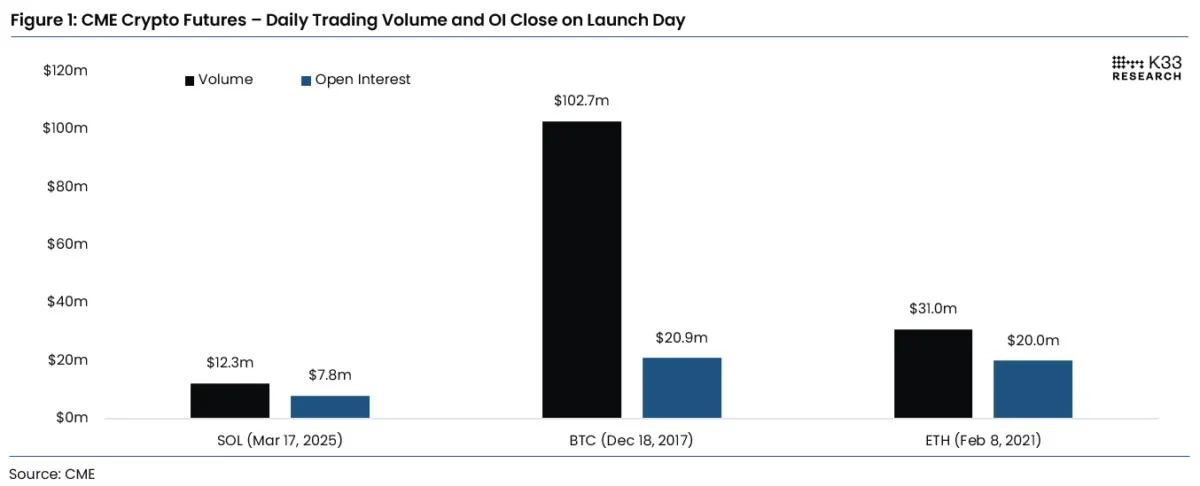

Solana futures (SOL) on the Chicago Mercantile Exchange (CME) went live on March 17, with a trading volume of $12.1 million on day 1, which fell short compared to Bitcoin (BTC) and Ethereum’s (ETH) CME futures debut. Vetle Lunde, Head of Research at K33Research, compared the difference between Bitcoin , Ether and SolanaCME futures trading performances on their launch day, and it is clear that SOL’s CME futures volume and open interest came in far below its competitors. However, Lunde pointed out that if normalized volumes to the market cap are evaluated, SOL’s launch “aligns closer to the two.”Was the SOL CME futures launch a dud?Throughout the current bull market, spot ETF approvals and CME futures contract launches have consistently boosted investor sentiment and put wind behind the sails of various cryptocurrencies. Comparing the normalized volumes adjusted for the market cap differences of BTC, ETH and SOL on their first CME futures trading day provides a fairer comparative analysis.Normalized volume measures trading activity relative to a crypto asset’s market cap, offering a transparent evaluation across different cryptocurrencies. This metric is valuable since it allows an understanding of institutional engagement with respect to a crypto asset’s market cap. As shown above, Bitcoin has the highest normalized volume with 0.0319%, while ETH and SOL fell behind with 0.0173% and 0.0166%, respectively. A greater normalized volume suggests higher investor interest per unit or market cap for Bitcoin. Additionally, the similarity between ETH’s and SOL’s normalized volumes (roughly 0.017%) indicates that Solana’s trading activity scale is similar to Ether’s despite the trading volume differences of more than $20 million on day 1 between ETH and SOL’s CME futures. Related: Solana deletes ‘cringe’ ad criticized for being ‘tone deaf’ on gender issuesWill SOL CME futures follow ETH or BTC’s performance?Following the debut of Bitcoin CME futures on Dec. 18, 2017, BTC declined by 26%, dropping from $19,000 to $14,000 by Dec. 31, 2017. The correction continued into 2018, marking the beginning of a collective crypto bear market. Ether price registered a rally of 150% to a new all-time high at $4,384, 93 days after the CME futures launch on Feb. 8, 2021. Following a new all-time high, a sharp correction occurred, but the altcoin rallied again toward the end of 2021 to attain its current all-time high at $4,867 in November 2021. Considering the price trends of Bitcoin and ETH, SOL’s price may experience a less enthusiastic rally. The absence of upward price movement after its CME futures launch suggests a lack of investor excitement.However, from a long-term perspective, SOL’s presence in the CME increases the opportunities for Solana's liquidity and price discovery as it attracts institutional engagement. A wider impact could potentially unfold over time as better market conditions and favorable bullish price and protocol revenue projections draw traders’ interest. Related: Bitcoin stalls under $85K— Key BTC price levels to watch ahead of FOMCThis article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.