SEC cancels controversial crypto accounting rule SAB 121

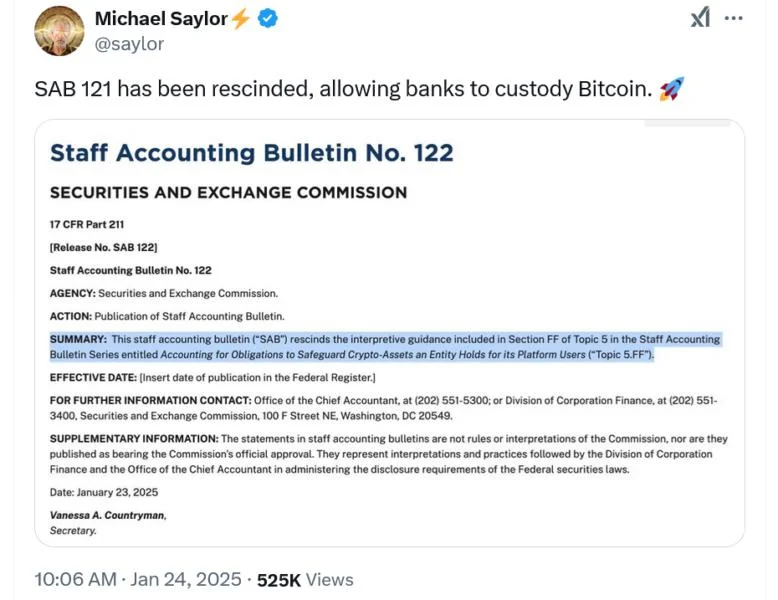

Update (Jan. 23, 1:21 am UTC): This article has been updated to add information throughout.The Securities and Exchange Commission has canceled a controversial rule that asked financial firms holding crypto to record them as liabilities on their balance sheets.A new Staff Accounting Bulletin on Jan. 23 said it “rescinds the interpretive guidance” of SAB 121, an agency rule published in March 2022 that the crypto industry has long sought to cancel. “Bye, bye SAB 121!” SEC Commissioner and the agency’s crypto task force lead Hester Peirce wrote in a Jan. 23 X post. “It’s not been fun.”Bye, bye SAB 121! It's not been fun: https://t.co/cIwUc0isUE | Staff Accounting Bulletin No. 122The SEC published SAB 121 in March 2022, which asked financial firms holding crypto on behalf of customers to report the assets as a liability on their balance sheet. The crypto industry pushed back on the measure, saying it would make holding crypto administratively more difficult.House Financial Services Committee Chair French Hill said in a statement to X he was “pleased” to see the “misguided SAB 121 rule has been rescinded.””Holding reserves against the assets held in custody is NOT standard financial services practice,” Hill said.Other opponents, such as Representative Wiley Nickel, claimed it would prevent American banks from being able to custody crypto exchange-traded products at scale, potentially creating a concentration risk by handing more control over to non-bank entities.Senator Cynthia Lummis added that SAB 121 “was disastrous for the banking industry, and only stunted American innovation and advancement of digital assets.””I am THRILLED to see it repealed and get the SEC back on track to fulfilling its intended mission,” she added.The cancellation of SAB 121 marks the first significant move by the SEC under President Donald Trump, led by acting chair Mark Uyeda.A bill to repeal SAB 121 initially received bipartisan support in the House and Senate but was then vetoed by former President Joe Biden on June 1, 2024.The House failed to override Biden’s veto about five weeks later, falling 60 votes short.