Riot Platforms posts Q1 loss, beats revenue estimates

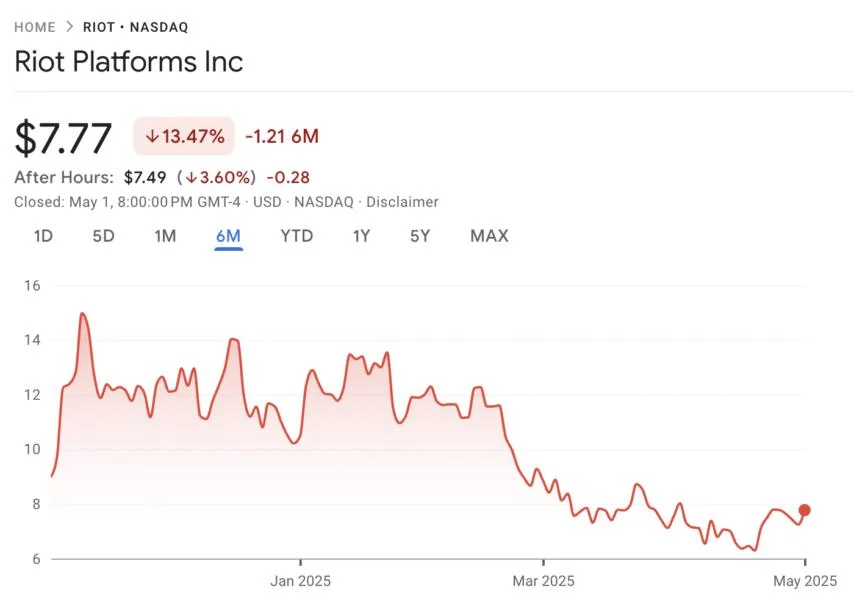

Bitcoin miner Riot Platforms reported its highest-ever quarterly revenue, but still posted a loss as mining costs have nearly doubled compared to the same period last year amid efforts to expand its facilities.“We achieved a new record for quarterly revenue this quarter, at $161.4 million,” Riot CEO Jason Les said in a May 1 report for its first quarter 2025 earnings. The company just surpassed Wall Street estimates of $159.79 million by 1%.Riot’s Q1 revenue was a 50% jump compared to the same quarter a year ago.Riot blames “halving event” for expensesThe firm reported a net loss of $296,367 over Q1, a 240% decrease from the $211,777 net income it posted in the year-ago quarter.Riot said that the average cost to mine Bitcoin over the quarter was $43,808, almost 90% more than the $23,034 it cost to mine Bitcoin in the same period last year.“The increase was primarily driven by the block subsidy ‘halving’ event, which occurred in April 2024, and a 41% increase in the average global network hashrate as compared to the same period in 2024,” Riot said.Shares in Riot Platforms (RIOT) closed May 1 trading up 7.32%, trading at $7.77, according to Google Finance.Meanwhile, Riot produced 166 more Bitcoin during the quarter than it did over the same period in 2024. At the time of publication, with Bitcoin trading at $97,072, that equates to approximately $16.13 million.Riot currently holds 19,223 unencumbered Bitcoin, worth approximately $1.86 billion at the time of publication.On April 23, Riot announced that it had used its massive Bitcoin stockpile as collateral to secure a $100 million credit facility from Coinbase as the cryptocurrency miner eyes continued expansion. Les said the $100 million loan from Coinbase’s credit arm marked Riot’s “first Bitcoin-backed facility.”This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.