Reuters Econ World: Crypto joy

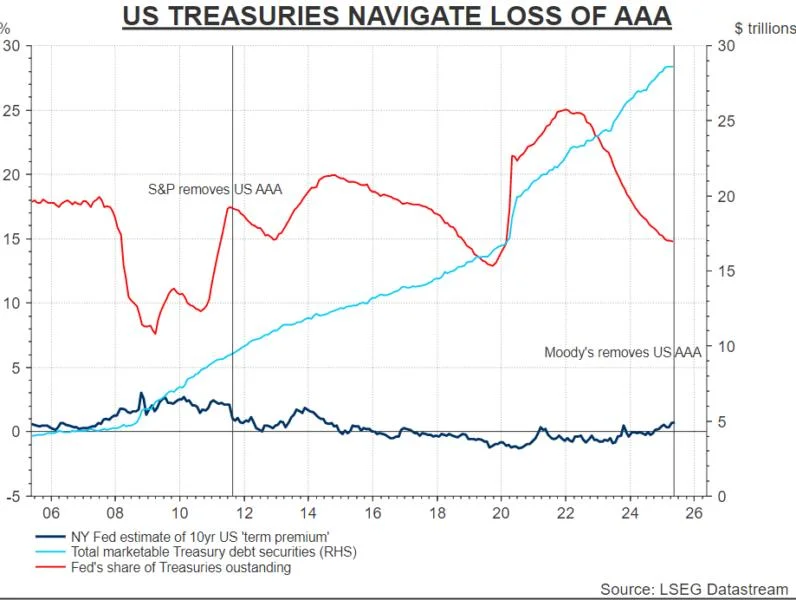

It’s a tale of two markets right now - crypto and everything else. has surged to an all-time peak above $111,000 as the regulatory and business environment improves for cryptocurrencies. JPMorgan CEO Jamie Dimon, a longtime crypto sceptic, told investors this week that America’s biggest bank will let clients buy bitcoin. “I don’t think you should smoke, but I defend your right to smoke,” Dimon said. “I defend your right to buy bitcoin.”Crucially, an industry-backed bill that would create a regulatory framework for cryptocurrency tokens known as stablecoins is advancing through the U.S. Senate.Democrats had united to filibuster the GENIUS Act legislation earlier this month amid concern over President Donald Trump’s various crypto ventures. But the Senate voted this week to end the filibuster.Against this backdrop, we have Trump’s meme coin dinner tonight. He’s hosting buyers of his $TRUMP coin at an exclusive dinner at his private country club outside Washington D.C. In total, investors spent an estimated $148 million on the coin to secure their seats at the dinner, with the top 25 holders spending more than $111 million, according to crypto intelligence firm Inca Digital. An initial announcement said these 25 VIPs would also get a tour of the White House. That detail has since been deleted from the $TRUMP .The stablecoin legislation requires tokens to be backed by 1:1 low-risk liquid assets including U.S. Treasury bills with maturities under 93 days. Major stablecoin players such as Tether are already among the biggest holders of U.S. Treasuries globally and, if passed, the bill is expected to provide a boost to U.S. short-term debt markets. But a link-up between crypto and U.S. government securities also risks creating new market vulnerabilities. Interestingly this week, Brazil’s central bank highlighted how stablecoins were in Brazil capital flows.At the longer end of the U.S. yield curve, concerns about the U.S. fiscal picture are weighing on . The House of Representatives has passed Trump’s budget bill, sending it on to the Senate, which is expected to spend weeks debating and revising it before it goes to Trump to sign into law.The tax and spending package is expected to add $3.8 trillion to the U.S.'s $36.2 trillion in debt over the next decade. Bond vigilantes are not impressed - yields on 30-year Treasury bonds - a proxy for super long-term U.S. government borrowing costs - reached 5.108%, their highest since October 2023. Globally, yield curves are steepening and stocks are down.Trump’s budget bill is likely to bake in outsized deficits for years to come. I talk to Reuters Editor-at-Large for Finance & Markets Mike Dolan on this week’s Econ World podcast about what that means for markets and the U.S. economy. Listen .European stocks have been outperforming their U.S. counterparts but the European Central Bank (ECB) this week that they were “out of sync” with a world gripped by geopolitical and trade uncertainty.The is still just limping along but there is a growing case for the ECB to hold off on further rate hikes after next month’s policy meeting. An inflation challenge is starting to creep up on the horizon, giving policymakers .And finally, a proposal for the Federal Reserve to release detailed economic forecasts after some of its meetings is from the heads of its regional banks who worry it will be hard to agree on a common outlook and risks further confusing the public.Who knew it was possible to be even more confused?The headlines The chartThe U.S. lost its last AAA credit rating this month but as points out in a recent even now, at just over 2%, the real 10-year cost of Treasury borrowing is basically where it was in 2008, when the U.S. had a triple A rating from all three major rating agencies.The podcast“We are at the mercy of markets in terms of telling us when this is going to be a problem.”Reuters Editor-at-Large for Finance Mike Dolan on this week's episode of Reuters Econ World.On this week's show, we look at the U.S. fiscal picture. Listen . The real worldDubai: Trump's Gulf tour reshapes Middle East Kyiv: Ukraine pitches Russia sanctions plan to EU as US waversWashington: Trump's plan could launch new era of weapons in spaceThe week aheadMay 23: Japan inflation May 25: Fed Chair Powell speechMay 29: U.S. jobless claims