Research Unlock: Arena and The Future of SocialFi

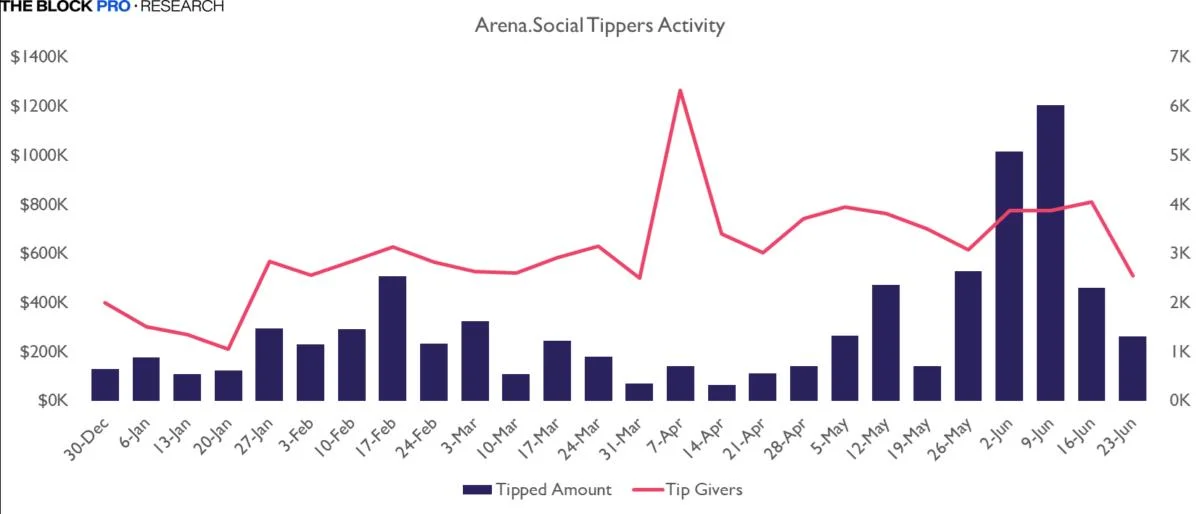

Arena launched in late 2023 as Stars Arena, an improved version of Friend.tech that transplanted the “buy a creator’s ticket, unlock a private chat” mechanic onto Avalanche. Arena was the first SocialFi app to incorporate additional creator tools like a public social feed, which created a more social experience compared to friend.tech’s gated Patreon Socialfi model. However, initial hype surrounding the concept and the protocol itself eventually waned, followed by a contract exploit that led to an acquisition by a new team, forcing a rebuild and a rethink of scope.The team returned in May 2025 with Arena V2, folding a bonding-curve launchpad and native DEX into the social feed, and rebranding ticket holders as first-class stakeholders in a tokenised creator economy.In the two months since relaunch, Arena has morphed from a niche “social trading” experiment into one of Avalanche’s most-used consumer dApps. This report will dissect how those surfaces interlock and why the flywheel is proving sticky.Product Walk-through & User ValueArena Launch Arena Launch distills the entire lifecycle of a meme coin, which includes minting, bonding, and listing, into a 30‑second flow.A creator supplies a token name, symbol, and optional image before the UI deploys a dedicated bonding‑curve contract, which immediately begins selling tokens to the public.Early participants buy at the bottom of the curve, and price ratchets up automatically with each purchase, removing any need for manual pricing or private allocations.Once a predefined liquidity or supply threshold is hit, the contract “graduates”. This means the remaining supply is minted, the AVAX raised is paired with the token and seeded into an AMM pool, and live trading begins on Arena’s native DEX without further action from the founder.As tokens grow in market cap, additional in-app social features, including a private token-gated group chat, a dedicated social feed, a dedicated domain handle, and being automatically added as a tipping token, are unlocked to help token creators grow their communities. 2.5% of every graduating token’s supply is simultaneously airdropped to “Arena Champions”, users who stake the platform’s ARENA token, thereby creating an instant community of aligned holders, which sharply differentiates Arena from pump.fun’s purely creator‑centric launches.ArenaDEXThe Arena DEX is the layer that underpins freshly launched tokens. After a token graduates from its bonding curve, it trades in an AMM pool against AVAX.The pool uses a constant‑product formula reminiscent of Uniswap V2, but with a platform fee calibrated at 0.3%.The fee split itself on ArenaDEX is reflexive; all fees are collected into a fee wallet that can be used for grants, buybacks and other ways to grow the Arena ecosystem, so the take rate is effectively recycled. Still, if turnover subsides, that recycling loop would thin out quickly.Arena.socialWhile Arena Launch and Arena DEX attract speculators, arena.social turns holders into a community.It works by having users sign up or log in with their X accounts before receiving a non‑custodial wallet behind the scenes.Every creator profile issues a ticket, a bonding‑curve social token whose holders unlock gated content, private chat rooms, and future airdrops.Each creator’s “room” is an on‑chain gated feed, where owning at least one ticket grants buyers access to a private group chat, private livestream links or private live audio spaces (Arena Stages) .Because tickets themselves are tradeable, social reputation carries an explicit, liquid price that updates in real time as fans buy or sell. Creators, therefore, capture upside not only when they sell tickets the first time but on every secondary trade thereafter.Tipping is also a native feature. Any post can receive AVAX or whitelisted cross-chain meme‑coin tips (such as WIF or COQ, among others) with a single click, which is a feature meant to attract entire communities from other chains.An AI‑powered discovery module curates trending users and rooms with Arena’s proprietary data, nudging users beyond their own timeline. That algorithm addresses the cold‑start problem that plagued earlier SocialFi experiments such as friend.tech and its clones, where unknown creators can still surface if a few whales tip early, and veteran traders can sift for momentum before everyone else spots it.Yet, arena.social walks a tightrope, where if tipping capital recycles too fast among the same wallets, the economy risks becoming a closed‑loop arcade where value sloshes but rarely enters.To counter this, arena.social’s referral feature rewards users with a perpetual fee for creators and traders who are referred to the platform. The design suggests Arena views new inflows as the lifeblood of creator income and structures feed ranking accordingly.TakeawaysArena’s three surfaces interlock into a self‑reinforcing loop. Social activity (posts and tips) drives demand for creator tickets; Ticket revenue and ARENA airdrops bankroll new token launches; Fresh tokens spark speculative trading that resurfaces across the social feed, stimulating more posts and tips.The design borrows the successful bonding‑curve primitive popularised by pump.fun, but extends it with enforceable liquidity locks, creator revenue share, and a platform‑level staking flywheelMetricsArena.SocialThe average weekly tipped amount on Arena.Social expanded by more than 340% between January’s average of $167K per week to June’s average of $735K per week. The number of unique tippers also grew in parallel, as June’s weekly average stood at 3.58K compared to January’s 1.75KThis indicates users are spending more per capita, as January saw an average of roughly $95 in tips per wallet per week. By June, these figures had pushed the average tip spend to over $205 per wallet, a 115% increase that outpaced headline user growth, suggesting discovery loops and paid-room perks are converting passive scrollers into higher-value patrons rather than simply diluting spend across a wider base.Source: Flipside (@Ali3N), The Block Pro ResearchUser-cohort data reinforces this view, as new wallets constituted roughly 1/3rd of weekly activity throughout June 2025, compared to just 20% throughout January to May 2025, suggesting that creator-ticket discovery loops have been successful at attracting fresh users rather than recycling the existing user set.Source: Flipside (@Ali3N), The Block Pro ResearchMeanwhile, fee intake on arena.social has been modest in absolute terms, having generated ~7.65K AVAX in the first six months of the year, the equivalent of ~$137K, using the price of AVAX as of 30 June, 2025.It is worth noting that the majority of the fees generated by arena.social in 2025 so far have come during brief, concentrated periods. For example, ~30% of the fees generated in 2025 so far have occurred in February, while 23% came in June.Source: Flipside (@Ali3N), The Block Pro ResearchArena.DEXArena’s on-chain exchange came out of the gate fast when it launched in early May 2025. In its first seven days, the DEX cleared ~$25M in trade volume, then settled into a daily average of $4.1M over the subsequent seven-week period.Source: DefiLlama, The Block Pro ResearchArena.DEX has facilitated a total of $98M in pre-bonding trade volume and $228M in post-bonding trading volume, with the platform’s busiest period occurring during the first two weeks of June, where it saw a total of over $141M in volume, or roughly 44% of the total.Source: Flipside (@Ali3N), The Block Pro ResearchActive trader counts followed the same arc, with an opening-week total of ~12.5K wallets, averaging just under 1.8K wallets per day in this period.The platform’s daily average of actively trading wallets has proceeded to actually increase over the subsequent weeks, averaging 2.1K from its second week towards the end of June 2025, suggesting the platform has managed to convert its launch buzz into a core cohort of repeat users.Arena.DEX’s average daily $4.1M of volume divided by 2.1K daily active wallets implies an average trade size of nearly $2K per wallet.For context, pump.swap saw $9.95B in trade volume in June 2025, with ~7.55M unique active wallets, which implies an average ticket size of ~$1.3K per wallet during that month.This implies that, albeit with a one-month sample size in June, the average trading size of wallets on Arena.DEX is both large enough to matter yet small enough to cycle many times a month, echoing the speculative cadence seen on pump.swap but with marginally higher dollar stakes by roughly 53%. Source: Flipside (@Ali3N), The Block Pro ResearchOn the other hand, fee capture, denominated in AVAX, saw ~35K AVAX across the May 7 to June 30 window, with referral-link rebates accounting for just 2.6% of the total. That split implies most trading is organic rather than airdropped via referral farming, a relatively healthy sign for fee stickiness, despite the protocol’s nascency.Dividing the referral rebate amount of ~910 AVAX, the equivalent of ~$16.4K as of 30 June, 2025, by the average number of daily traders at ~2.1K puts the acquisition cost per incremental trader from the referral program at ~$7.8. Arena only supports referral rebates on their tickets products and launch contract and currently does not support referrals on their DEX. However, the team has hinted at a V2 DEX which will likely support referral rebates. Source: Flipside (@Ali3N), The Block Pro ResearchEcosystem contextArena’s footprint is already visible at the chain and sector level.DeFiLlama shows ~$8.2M total value locked (TVL) across Arena’s bonding‑curve liquidity and creator‑ticket staking as of 30 June 2025. That represents ~0.6 % of Avalanche’s entire DeFi collateral base and more than 99% of the chain’s social-fi TVL.In terms of activity, Arena’s last 30‑day swap volume of $284M at the time of writing captures roughly 7% of all Avalanche DEX flow, placing the protocol fourth, behind two Trader Joe pools and Paraswap, while being ahead of Camelot and Platypus. In short, Arena is already punching at mid‑tier DeFi weight despite being live for just around two months.As for cross‑chain social‑fi comparisons, Arena’s TVL is currently 3x larger than friend.tech’s. Its 30-day trailing fees also significantly exceed those of both friend.tech and Fantasy Top, and its cumulative fees have already surpassed Fantasy Top’s as well.It is worth noting that Fantasy Top operates by recycling trading-card NFTs rather than using staking mechanisms, so its TVL is not recorded or directly comparable.DeFiLlama also classifies Arena’s post‑bonding liquidity as DEX TVL rather than Social‑Fi TVL. The $8.2M headline therefore includes both pre‑bonding stake and post‑bonding liquidity to give a full picture of capital actually tied up in the protocol.To summarize, Arena has positioned itself as the emergent centre of gravity for social-fi heading into Q3 2025 and a top‑five consumer protocol on Avalanche by almost any economic benchmark.Ticket & Token EconomyThe cornerstone of Arena’s social economy is the creator ticket. Minted the moment a user claims a profile, tickets behave like continuously re‑priced equity: Supply is elastic, and price tracks demand via a quadratic bonding curve.A ticket supply expands and contracts algorithmically with buy and sell pressure; therefore, price encodes marginal social demand rather than a pre‑set valuation. Each secondary trade incurs up to a 10% fee, but up to 70% that fee streams directly to the creator as a perpetual royalty. Popular accounts, therefore, monetise not only initial interest but the entire life‑cycle of fandom speculation.Moreover, arena’s ticket contract is upgradable, allowing tickets to be upgraded to become transferable ERC‑20s rather than in‑app balances, enabling holders to collateralize them in DeFi pools. Future updates to arena.social rooms would likely allow creators to embed NFT drops or token‑gated livestreams, multiplying non‑speculative reasons to own tickets.ARENA TokenARENA carries a 10 billion supply hard cap, with ~2.5 billion circulating today.Distribution occurs via rolling airdrop claims that convert in‑app “points” into liquid tokens, rewarding actual usage rather than just capital.Staking ARENA tokens upgrades users to “Arena Champion” status. Champions earn 2.5 % of the total supply of every token that completes the Arena Launch bonding curve, gets boosted future airdrop weights and the right to vote on governance proposals.The market capitalization of ARENA grew from a $9.3M market cap at the beginning of the year to a peak of over $55.5M by mid-June 2025.It has since declined somewhat considerably, currently standing at a ~$32M market cap as of 30 June, 2025, yet is still up by a considerable 240% year-to-date (YTD).Source: CoinGecko, The Block Pro ResearchTakeawaysArena’s first two months on Avalanche prove that a well-engineered bonding-curve primitive, when embedded directly inside a social feed, can spin up meaningful, self-funding liquidity.Looking forward, the roadmap items that matter most would be staker-reward vaults, a potential Avalanche L1 migration, and deeper utility for creator tickets. Delivering on these fronts will determine whether Arena evolves from a meme-token crucible into a lasting social-finance super-app.For now, the data show a nascent but healthy economy whose growth, capital efficiency, and user stickiness outpace early expectations.Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.