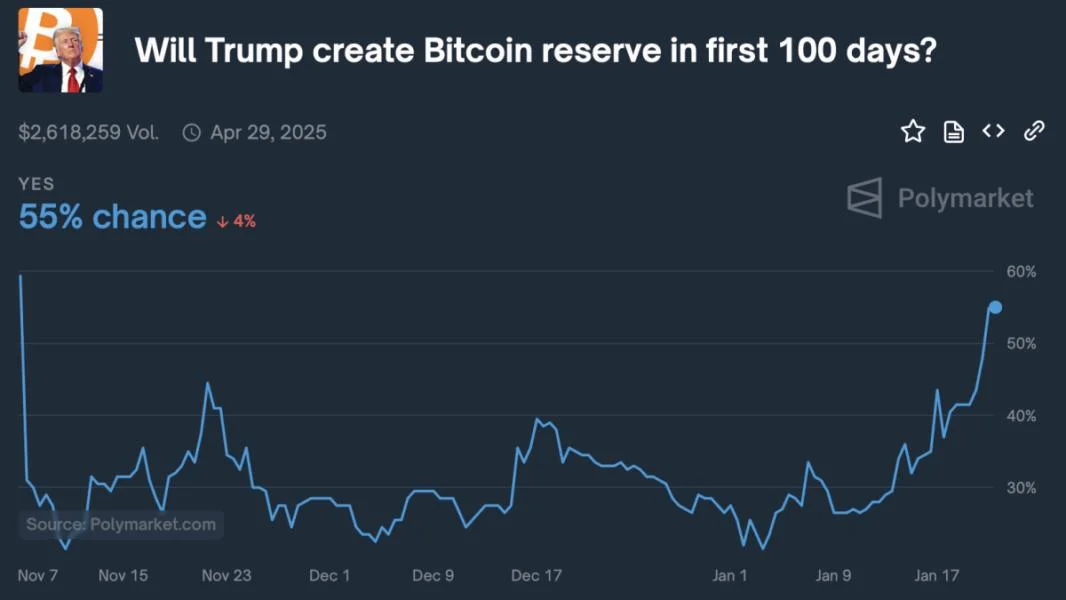

Polymarket predicts 55% chance Trump will create a Strategic Bitcoin Reserve during his first 100 days

Ahead of Donald Trump’s inauguration as the 47th President of the United States later today, Polymarket’s decentralized prediction platform shows fluctuating expectations regarding cryptocurrency-related executive orders. The platform reveals that the probability of Trump signing an executive order to establish a Strategic Bitcoin Reserve (SBR) within his first 100 days has increased from 44% to 55% in the past 24 hours.The Strategic Bitcoin Reserve (SBR) concept involves the U.S. government acquiring and holding bitcoin as a strategic asset, similar to the way gold has traditionally been used as a reserve.Bitwise Head of Research Europe André Dragosch suggested that the potential implementation of a Strategic Bitcoin Reserve is still not fully priced into the market, despite bitcoin touching a high of over $109,000 in the past 24 hours."In the medium to long term, we could see a price pattern similar to the U.S. spot bitcoin exchange-traded fund (ETF) trading launch, where the market was not only heading higher in anticipation of that trading launch but also after net inflows continued to push the market higher," Dragosch told The Block. Additionally, Polymarket shows that the probability of the incoming president signing at least one cryptocurrency-related executive order on his first day in office has decreased from over 50% to 37% in the past 24 hours. Polymarket price predictionsPolymarket cryptocurrency price predictions indicate a 40% chance that bitcoin will hit $120,000 by the end of January. As for altcoins, the platform shows a 46% probability that Solana surpasses $300 by the end of the month, a 22% chance of Ethereum breaking the $4,000 psychological barrier, and a 56% likelihood of XRP surpassing $3.20 within the next week.As Trump prepares to take office, analysts are closely watching the impact of his cryptocurrency policies. According to QCP Capital, institutional investors eagerly await clarity on the administration’s approach to crypto.“The global ripple effects of a clear U.S. 'green light' for crypto adoption have yet to fully materialize,” the analysts said.Trump’s first day in office is expected to see the signing of over 100 executive orders, which will include not only cryptocurrency-related directives but also initiatives to expand artificial intelligence programs, establish the Department of Government Efficiency (Doge), and declassify records surrounding the 1963 assassination of President John F. Kennedy.Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.