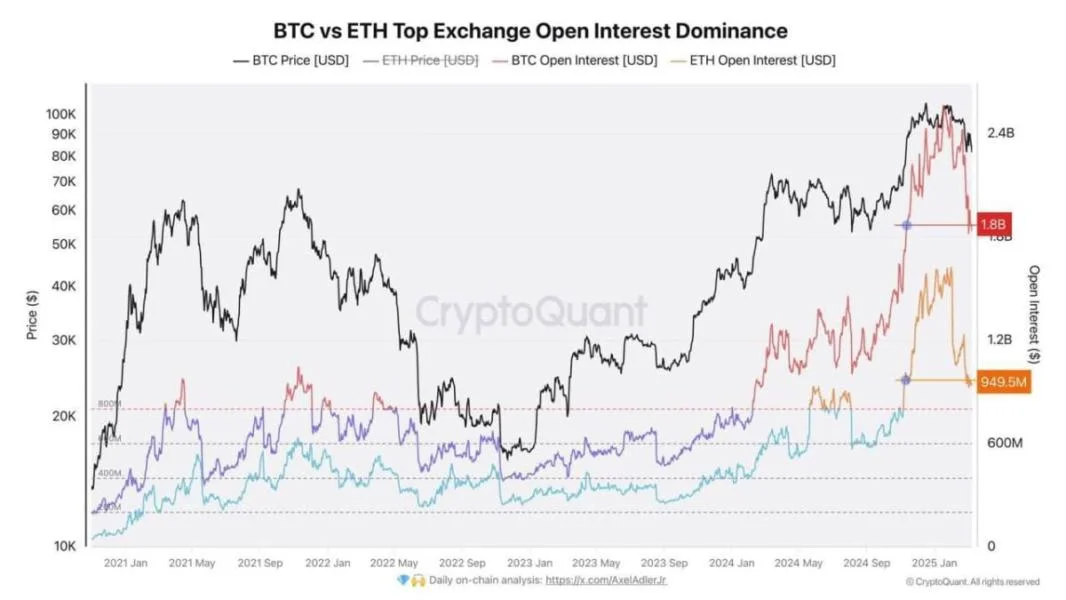

Open interest for Bitcoin and Ethereum futures plummets, potentially indicating a washout of leverage

Recent CryptoQuant data reveals a pronounced decline in Bitcoin and Ethereum futures open interest — suggesting a potential leverage washout — as speculative positions are unwound."In total, positions worth $1.368 billion have been closed across both instruments, and a partial market reset has been completed," CryptoQuant analyst Alex Adler said in a post on X.com. This significant reduction in open interest could potentially stabilize the market by reducing excessive speculative activity.Bitcoin and Ethereum exchange futures open interest. Image: CryptoQuant.Adding to this picture, total crypto liquidations in the past 24 hours have reached around $949.50 million. Notably, long liquidations have accounted for about $734.26 million, compared to $215.24 million on the short side, according to Coinglass data.Bitcoin CME Gap as a price magnetAdditionally, a pivotal technical factor in the current market landscape is the Bitcoin CME gap. According to MMConsult co-founder Christopher Jaszczynski, Monday's Bitcoin downturn saw the digital asset's CME futures price drop to approximately $76,700, effectively filling the gap that had been present since November 5, 2024.Despite this, a remaining unfilled gap persists between $84,200 and $85,900, drawing significant market attention. The clustering of orders between the $84,200 and $85,900 range could act as a magnet, drawing the price back to "fill" the gap. In effect, the gap level becomes a temporary support, leading to a potential retracement.For context, CME Bitcoin futures operate 23 hours daily, from Sunday evening to Friday evening, with a 60-minute daily trading halt. In contrast to this, Bitcoin spot markets trade continuously 24/7. These differing trading hours can lead to price discrepancies, resulting in gaps when the futures market reopens at a different price than its previous close.Broader market dynamicsOn the macro front, the DXY Index—which measures the strength of the U.S. dollar against a basket of major currencies—has seen one of its sharpest one-week declines since 2013. This recent drop is occurring at a faster rate than during President Trump’s first term, a period that coincided with the 2017 Bitcoin bull run. Although a weakening dollar generally benefits risk assets, the DXY still sits at a relatively strong 103.5, remaining above the critical 100 level.U.S. dollar index has fallen over the past month, but still sits above the critical 100 level. Image: TradingView.Additionally, the global cryptocurrency market cap is currently around $2.75 trillion, marking a 3.9% decline over the last 24 hours, according to CoinGecko. Bitcoin dominance is 59%, while Ethereum accounts for 8.44% of the total market cap.Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.