Monex Takes $67M Hit from Coincheck's Nasdaq Debut Despite Crypto Boom

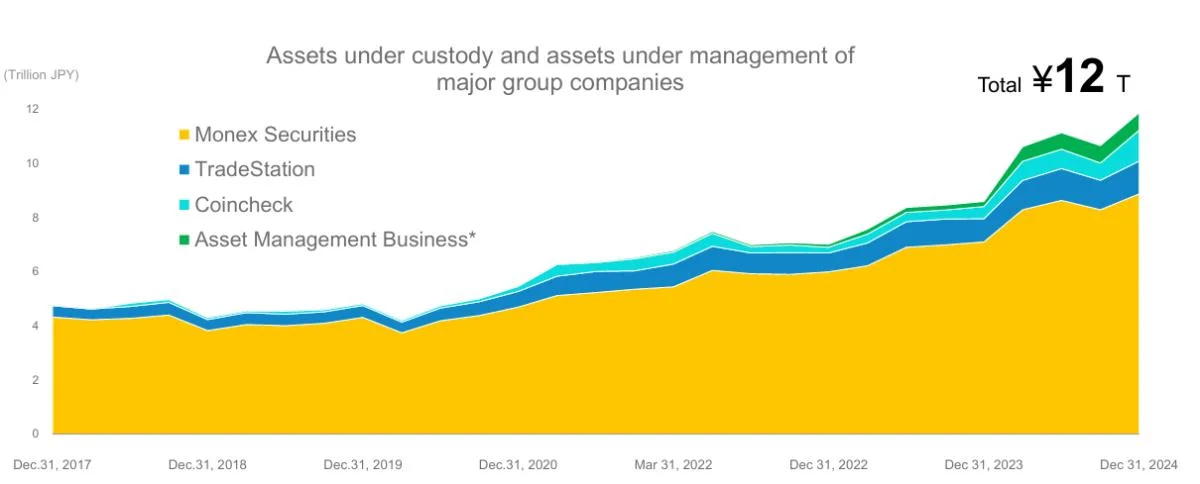

Japanese financial services firm Monex Group Inc. reported a third-quarter net loss of ¥9.9 billion ($67 million), primarily due to one-time expenses related to its cryptocurrency subsidiary Coincheck's Nasdaq listing, even as its core businesses showed strong performance.Monex Posts ¥10B Loss on Coincheck Listing Costs The company recorded ¥17.1 billion in one-time expenses related to Coincheck Group N.V.'s December listing, including ¥13.7 billion in share-based compensation expenses and ¥3.4 billion in professional fees. Excluding these costs, the company's operational performance remained robust, driven by strong crypto trading volumes and steady brokerage revenues.Coincheck's marketplace trading volume more than doubled to ¥245.6 billion in the quarter, reflecting broader crypto market momentum. The U.S. segment maintained steady performance with quarterly profit of ¥1.5 billion, while the Japanese operations benefited from the strategic alliance with NTT DOCOMO.The company's total assets under custody and management reached ¥12 trillion, marking significant expansion of its business base. Monex Securities, now an equity-method affiliate following its partnership with NTT DOCOMO, saw its mutual fund balance grow to ¥1.96 trillion, up 8% from the previous quarter.Source: MonexLooking ahead, Monex Group maintains its focus on achieving a 15% ROE while balancing growth investments with shareholder returns. Dividend and BuybackIn a separate announcement, Monex declared a special year-end dividend of ¥10 per share, funded by proceeds from the sale of its Hong Kong subsidiary, Monex Boom Securities. This comes in addition to the ordinary dividend of ¥15.1 per share, bringing the total year-end dividend to ¥25.1.The company continues to execute its ¥5 billion share buyback program announced in July 2024, having repurchased ¥2.7 billion worth of shares as of January 31, 2025. Monex maintains its target of achieving a 15% ROE while balancing growth investments with shareholder returns.The Crypto BetNearly a year ago, Monex completed the acquisition of a majority stake in 3iQ Digital Holdings, a Canadian crypto asset management firm. This deal, first announced in December 2023, brought 3iQ and its subsidiaries under Monex's ownership.To support 3iQ's growth, Monex invested $7.5 million in its Managed Account Platform (QMAP). This platform provides institutional investors with access to a variety of crypto hedge funds, focusing on strategies designed to meet the needs of global institutions. The investment reinforces 3iQ's position in institutional digital asset management.Additionally, Monex has introduced a new service in partnership with Tokyo-based NTT Docomo, allowing customers to purchase mutual funds using credit cards. By integrating NTT Docomo’s d CARD, users can earn up to 1.1% back in d POINTs on their monthly mutual fund contributions. Monex expects this rewards system to encourage regular investments by offering added financial incentives.