Metaplanet plans to leverage growing bitcoin treasury to acquire digital bank, cash-generating firms: FT

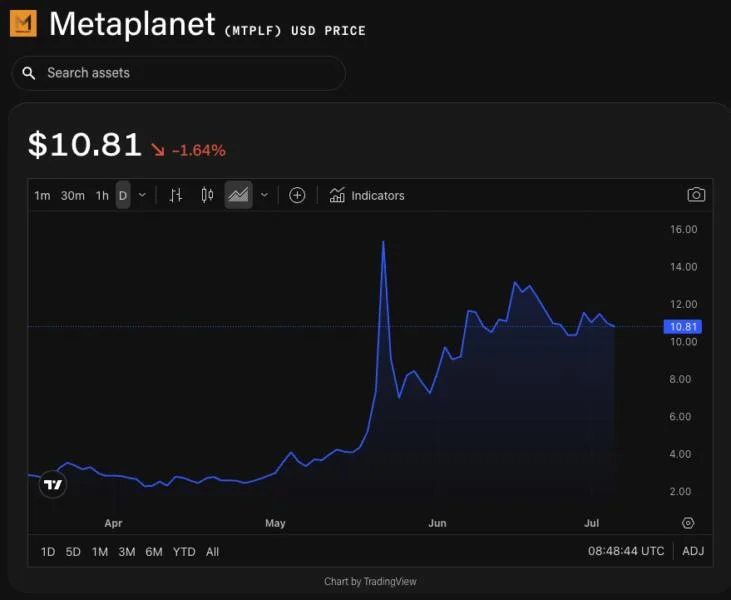

Japanese hotelier-turned-bitcoin treasury company Metaplanet ultimately plans to leverage its growing BTC stash to acquire cash-generating businesses, the Financial Times reported on Tuesday.CEO Simon Gerovich told the outlet that Metaplanet was in a "bitcoin gold rush" that could serve as a launch pad to expand into areas like digital financial services. However, it is still "really, really early days" in Metaplanet's plans to buy other businesses, he stressed.On Monday, Metaplanet announced it had purchased an additional 2,205 BTC for $238.7 million, bringing its total holdings to 15,555 BTC ($1.7 billion). The firm is currently the fifth-largest of around 135 publicly listed corporate holders of bitcoin behind Strategy, MARA, the upcoming Tether-backed Twenty One, and Riot Platforms. Last month, Metaplanet set the audacious goal of joining the bitcoin 1% club, targeting 210,000 BTC ($23 billion) by the end of 2027.From the 'bitcoin gold rush' to phase two financialization"We think of it as a bitcoin gold rush," Gerovich said, in what he describes as a four to six-year initial bitcoin accumulation phase. "We need to accumulate as much bitcoin as we can . . . to get to a point where we've reached escape velocity, and it just makes it very difficult for others to catch up."The firm can then enter "phase two," Gerovich continued when he envisions bitcoin, like securities or government bonds, can be deposited with banks to provide very attractive financing against the asset without selling it. "We'll get cash that we can use to buy profitable businesses, cash-flowing businesses."Ideally, the target companies would be aligned with Metaplanet's current strategy, so "maybe it is acquiring a digital bank in Japan and providing digital banking services that are superior to the services which retail now is getting," he added.While some investors continue to air reservations about the firm's premium to NAV valuation and the increasingly numerous corporate bitcoin acquisition programs in general, Gerovich dismisses the criticism. "I encourage people to short our stock if they don't believe in the story," he said.The former Goldman Sachs banker has grown Metaplanet's market capitalization past ¥1 trillion ($6.8 billion), despite minimal revenue, with shares up 60 times since the company's pivot to a bitcoin treasury in April 2024 and 318% year-to-date.Metaplanet price chart. Image: The Block/TradingView.Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.