Low volatility, momentum make an early move

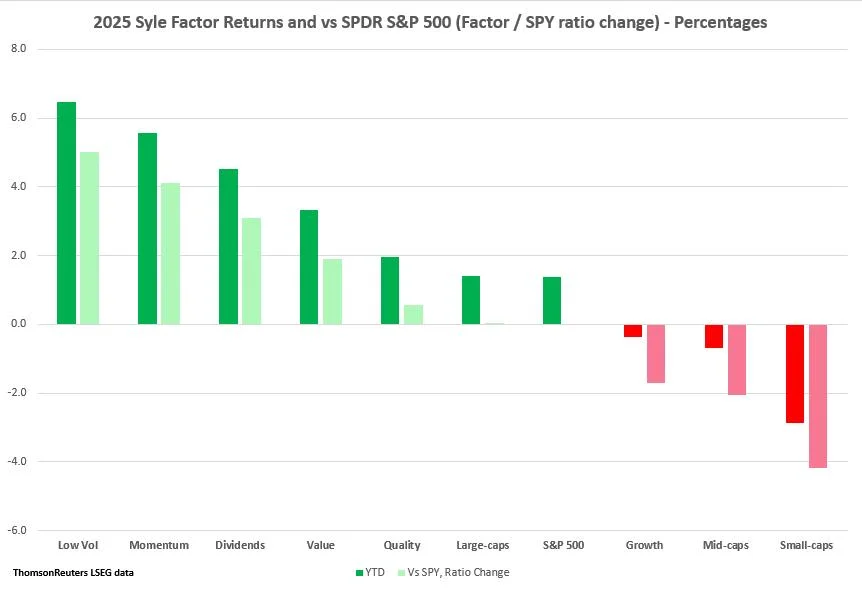

LOW VOLATILITY, MOMENTUM MAKE AN EARLY MOVE When it comes to major style factors that have historically driven portfolio returns, low volatility is leading the pack early in 2025.Major investing style factors include stocks discounted to their fundamentals (value), financially-sound companies (quality), size (small caps), stable, lower-risk stocks (low volatility), and stocks exhibiting upward price trends (momentum).To this, let's add in as separate factors mid- and large-caps, high-growth companies (growth), and those stocks that provide income (dividends).As of the end of February, the SPDR S&P 500 ETF Trust is up 1.4% year-to-date (YTD).Here is a graphic showing the YTD factor percentage changes as well as how they have performed vs the SPY (factor/SPY ratio change):February saw some significant shifts as both low volatility and momentum charged ahead of dividends , which had been the early 2025 leader.Perhaps not surprisingly, given uncertainties surrounding tariffs and interest rates, low volatility, which is defensive and seen as an attractive alternative for risk adverse investors, is showing a 6.5% advance. A little over a third of the SPLV's exposure at the end of January was in utilities and consumer non-cyclicals.That said, momentum, which is generally considered aggressive, is now up 5.6%. This even as tech , which carried a 27% weight in the MTUM as of the end of January, has stumbled so far this year. However, MTUM has clearly been underpinned by a large commitment to financials (22% weight as of the end of January). Financials are among the top performing S&P 500 sectors this year as big banks (.SPXBK) have been a solid outperformer.Dividends are posting a 4.5% YTD gain, value is up 3.3%, and quality has risen 2%. With this, these groups are lagging the style factor leaders, but are still outpacing the SPY. Large caps , up 1.4%, are flat when compared to the SPY.Among the underperformers are last year's winner - growth , which is off 0.4% YTD, mid caps which are losing 0.7%, and small caps which are down 2.9%.It's still early in the 2025 race of course, but traders will be keeping a close eye on all these factors as they jockey for position throughout the year.(Terence Gabriel) *****FOR MONDAY'S EARLIER LIVE MARKETS POSTS:EUROPEAN DEFENCE SECTOR: MORE GAINS ON THE HORIZON? - CLICK HERECHINA STOCKS, WHAT'S NEXT AFTER 40% RALLY? - CLICK HERECRYPTOCURRENCIES HAVE THEIR "TRUMP PUT" - CLICK HEREDEFENCE NAMES SURGE, BROADER MARKET MIXED - CLICK HEREEUROPE BEFORE THE BELL: FUTURES HIGHER, MARKETS SET FOR DEFENCE BOOST - CLICK HERETRUMP FLAGS CRYPTO RESERVE, MUM ON FUNDING - CLICK HERE