Kentucky joins growing list of US states to introduce Bitcoin reserve bill

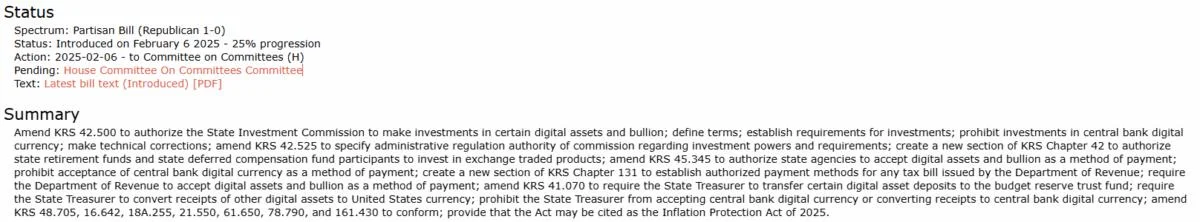

Kentucky has become the 16th US state to introduce legislation aimed at establishing a Bitcoin reserve, highlighting the growing adoption of digital assets at the state level.The bill, KY HB376, was introduced by Kentucky State Representative Theodore Joseph Roberts on Feb. 6. If passed, it would authorize the State Investment Commission to allocate up to 10% of excess state reserves into digital assets, including Bitcoin (BTC). It states:“The total amount of excess cash invested under subsection (9)(k), (l), and (m) of this section shall not, at the time of the investment is made, exceed ten percent (10%) of the total amount of excess cash invested under subsection (9) of this section.”While the bill doesn’t mention particular cryptocurrencies, its criteria refer to digital assets other than stablecoins with a market capitalization of over $750 billion, which is averaged over the previous calendar year.Bitcoin is the only cryptocurrency to fall under this criteria with its $1.9 trillion market capitalization. In comparison, Ether’s $330 billion market cap would need to grow over twofold to qualify for the potential reserve.Kentucky became the 16th state in the US to introduce legislation for a Bitcoin reserve, following Arizona, Alabama, Florida, Massachusets, Missouri, New Hampshire, North Dakota, South Dakota, Ohio, Oklahoma, Pennsylvania, Texas, Utah, Kansas and Wyoming. Kentucky’s move may set a precedent for a federal Bitcoin reserveAs the 16th state to consider such regulation, Kentucky’s move may set a precedent for a federal-level strategic Bitcoin reserve, according to Anndy Lian, author and intergovernmental blockchain expert.“If Kentucky moves forward, it creates a roadmap for others to follow,” Lian told Cointelegraph, adding:“The SEC, the Fed, and even Congress will have to grapple with how to classify Bitcoin in public reserves — is it a commodity? A security? Something entirely new? This could accelerate regulatory clarity, but it also risks creating a patchwork of state-level rules that complicate national policy. “Let’s not forget the consumer protection angle: if Bitcoin’s volatility tanks, taxpayers could be on the hook, which raises serious governance questions,” he added.Despite the volatility-related concerns, Kentucky’s bill is a “massive vote of confidence in Bitcoin,” which could inspire more adoption, Lian said, adding:“It could drive institutional interest through the roof, pushing other states and even countries to consider similar moves. But adoption isn’t just about price; it’s about infrastructure. Kentucky will need robust custody solutions, cybersecurity measures, and a clear exit strategy if things go south.”Kentucky’s bill comes a week after the state of Illinois announced plans for a Bitcoin reserve bill that proposed a minimum BTC holding strategy of five years.Magazine: BTC above $150K is ‘speculative fever,’ SAB 121 canceled, and more: Hodlers Digest, Jan. 19 – 25