JPMorgan says crypto inflows have surged to $60 billion year to date amid regulatory push

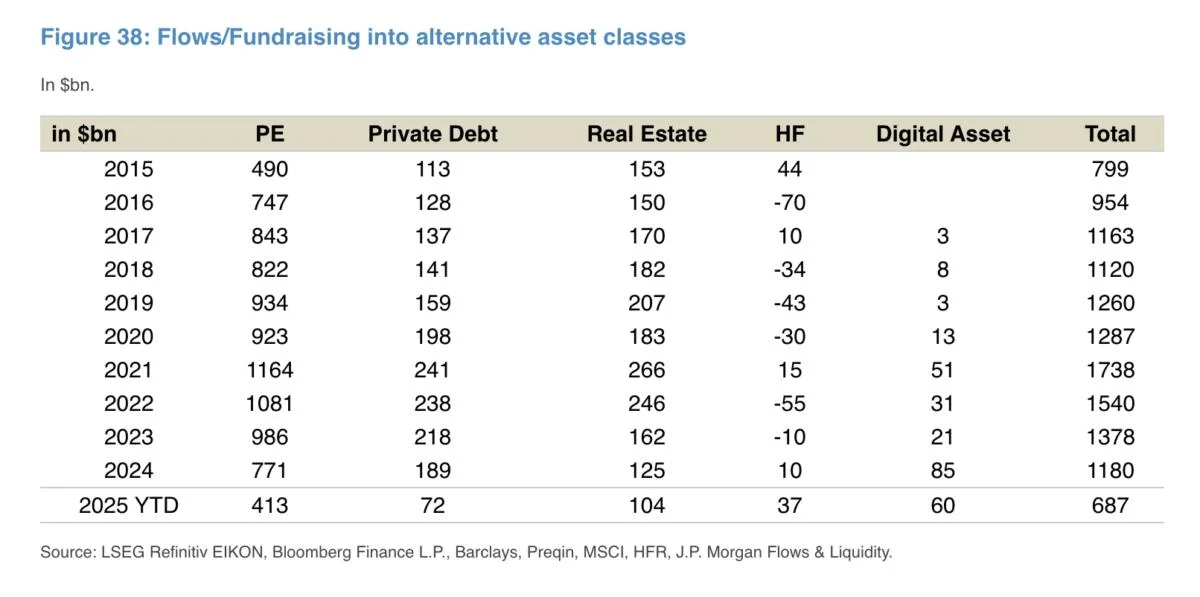

Capital inflows into digital assets have reached $60 billion year to date, driven by a mix of crypto fund flows, CME futures activity, and venture capital fundraising, according to estimates by JPMorgan analysts. Inflows are up nearly 50% since the end of May and are on track to comfortably surpass last year’s record total, the analysts said.The analysts, led by managing director Nikolaos Panigirtzoglou, cite a more favorable U.S. regulatory environment as a key catalyst. The GENIUS Act, recently passed by Congress, provides long-awaited clarity for stablecoins and effectively sets a global standard, the analysts wrote. With most stablecoins denominated in U.S. dollars, other countries are stepping up efforts to compete. China, for example, is advancing its digital yuan rollout, and a yuan stablecoin is in the works in Hong Kong, the analysts said.Another U.S. legislative effort — the CLARITY Act — is progressing through Congress and aims to classify digital assets as either securities or commodities. According to the analysts, the bill could make the U.S. a more attractive destination for crypto-native firms, especially compared to the European Union's Markets in Crypto-Assets (MiCA) regulation.The improving policy backdrop is already driving activity across both private and public crypto markets. On the venture side, crypto VC funding has increased, they said. Public markets have also seen renewed momentum, with the analysts highlighting Circle’s recent successful IPO and a surge in new filings with the U.S. Securities and Exchange Commission. The analysts note that companies may be seeking valuation premiums, pointing to Strategy’s (formerly MicroStrategy) stock price, which continues to trade at a significant premium to the value of its bitcoin holdings.Investor interest in altcoins is rising as well. Ethereum has been a major beneficiary, the analysts said, due to its dominance in decentralized finance (DeFi) and smart contracts — and its growing inclusion in corporate treasuries alongside bitcoin. They also pointed to increased interest from asset managers in launching crypto ETFs based on altcoins and featuring staking components.Within the broader alternatives space, digital assets and hedge funds are seeing accelerated inflows this year, the analysts noted — in sharp contrast to the weaker fundraising environment for private equity and private credit.Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.