Is XRP price around $2 an opportunity or the bull market's end? Analysts weigh in

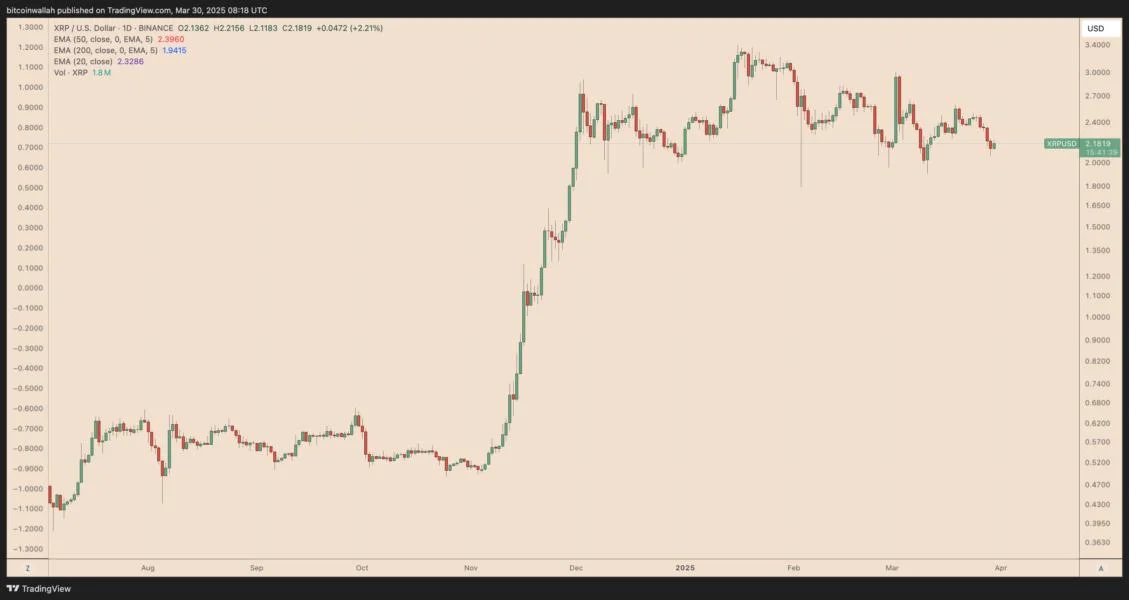

XRP has dropped nearly 40% to around $2.19, two months after hitting a multi-year high of $3.40. The cryptocurrency is tracking a broader market sell-off driven by President Donald Trump’s trade war despite bullish news like the SEC dropping its case against Ripple.However, XRP is still up 350% from its November 2024 low of $0.50, suggesting a consolidation phase after a strong rally. This sideways action has sparked discussions over whether it’s the end of the bull run or a prime buying opportunity.No buying opportunity until XRP falls further XRP has been consolidating between $1.77 (support) and $3.21 (resistance) since January, with repeated rejections near the top of the range and fading bullish momentum.According to analyst CrediBULL Crypto, XRP’s recent bounce attempt stalled below $2.20, reinforcing bearish control. He now expects the price to revisit the range lows around $1.77 for a potential long entry. The rectangle-shaped green support area on the chart extends as low as $1.50, signaling a high-demand zone where bulls could step in.A short-term marketwide bounce—led primarily by Bitcoin —could trigger a temporary recovery, argues CrediBULL, emphasizing that only a clean breakout above $3.21 would confirm a bullish trend reversal. Until then, XRP remains in a sideways structure, with CrediBULL’s strategy focused on watching for reactions at the $1.77 support level before committing to a long position.XRP bull flag may lead to 450% price rallyCrediBULL highlighted XRP’s sideways range between $1.77 and $3.21 as a consolidation zone, waiting for a clear breakout to confirm the next trend. Interestingly, that very range may be forming a bull flag, according to analyst Stellar Babe. A bull flag forms when the price consolidates inside a parallel channel after undergoing a strong uptrend. It resolves when the price breaks above the upper trendline and rises by as much as the previous uptrend’s height.Stellar Babe’s analysis notes that If XRP breaks above the flag’s upper boundary range at $3.21. Its projected target, based on the height of the flagpole, is around $12, up around 450% from current prices.XRP’s five-year channel hints at rally to $6.50XRP is currently consolidating within a long-term bullish structure, according to a recent analysis by InvestingScoope. The chart shows XRP trading inside a five-year ascending channel, with the current move resembling the March 2020 to April 2021 rally based on price behavior and momentum indicators.Despite the pullback, the broader bullish cycle stays intact as long as XRP holds above the 50-week moving average (1W MA50). InvestingScoope notes that this phase mirrors March 2021, which preceded a strong breakout. If the pattern continues, XRP price could be preparing for its next leg up with a potential target of $6.50 in the months ahead.This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.