Here’s what happened in crypto today

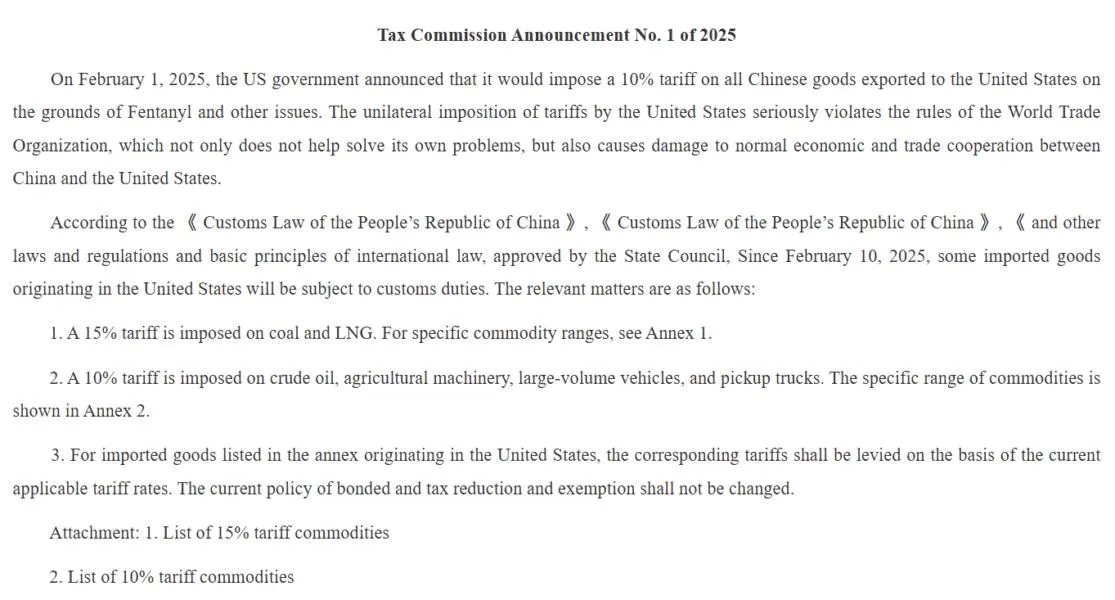

Today in crypto, despite Bitcoin, Ether and other altcoins rebounding after news that US President Donald Trump has put a 30-day pause on tariffs, some analysts have suggested BTC could still face a correction below $90,000 following escalating US-China tensions, and, World Liberty Financial denies token swap allegations.Bitcoin risks correction below $90,000 on US-China trade war concernsBitcoin risks a deeper correction as fears of a potential global trade war escalated following import tariffs announced by US President Donald Trump and China’s Ministry of Finance.The Ministry of Finance of the People’s Republic of China announced new import tariffs of up to 15% on some US imports effective Feb. 10, according to official documents published on Feb. 4.China’s decision came in response to Trump’s Feb. 1 executive order imposing import tariffs on goods from China, Canada and Mexico.After a brief recovery, Bitcoin fell below the $100,000 mark on Feb. 4, pressured by growing fears of a potential trade war ignited by Trump’s tariffs.Despite finding its daily bottom and reversing from $96,200, Bitcoin’s price risks a correction below $90,000 on growing global trade and inflationary concerns.Ryan Lee, chief analyst at Bitget Research, said China’s tariff decision could introduce additional volatility to risk assets such as Bitcoin.“Escalating tensions may weaken traditional markets, prompting investors to seek Bitcoin as a hedge against inflation and currency devaluation. However, a broader market sell-off driven by economic uncertainty could also trigger short-term corrections, potentially pushing Bitcoin below $90,000,” Lee told Cointelegraph.Crypto markets rebound as Trump puts Canada, Mexico tariffs on holdCrypto markets sharply rebounded after US President Donald Trump agreed to temporarily hold off on proposed tariffs aimed at Canada and Mexico as negotiations with the countries continue.In a Feb. 3 statement on X, Canadian Prime minster Justin Trudeau said that after a phone call with Trump, the 25% tariffs would be paused for at least 30 days and the two countries would work together. Mexico’s tariffs have also been paused for a month. Mexico President Claudia Sheinbaum said in a Feb. 3 statement to X that the two leaders had “reached a series of agreements,” with a similar promise of reinforcing the land border shared between the two countries. Cryptocurrency prices had plummeted just a day earlier, on Feb. 3, after Trump announced potential tariffs on goods from China, Mexico and Canada. Some estimates suggested up to $10 billion of worth capital was liquidated from the markets. Following the string of announcements by world leaders, the crypto market has been steadily climbing. Bitcoin (BTC) has increased has crossed over the 100,000 threshold to $101,731, according to CoinMarketCap. CoinMarketCap shows Ether (ETH) has also performed better compared to Feb. 2. The second-largest cryptocurrency by market cap reached a low of $2,451, but it has since climbed back to $2,880. Trump-backed World Liberty Financial denies token salesWorld Liberty Financial claims it hasn’t sold any of its WLFI tokens amid rumors that the decentralized finance (DeFi) project was pursuing token swaps with various blockchain projects whose tokens it acquired in recent months.According to a Feb. 3 social media post, World Liberty said it routinely shuffles its crypto holdings as part of its treasury management strategy.“To be clear, we are not selling tokens — we are simply reallocating assets for ordinary business purposes,” the post said.World Liberty Financial, which is linked to the family of US President Donald Trump, issued the statement less than two hours after Blockworks reported that the company was pursuing token swaps with various crypto projects.Citing anonymous sources, the report claims that World Liberty was looking to sell at least $10 million worth of yet-to-be-launched WLFI tokens in exchange for buying the same amount of that project’s native cryptocurrency. The sale would come with a 10% fee, the report said.