Here’s what happened in crypto today

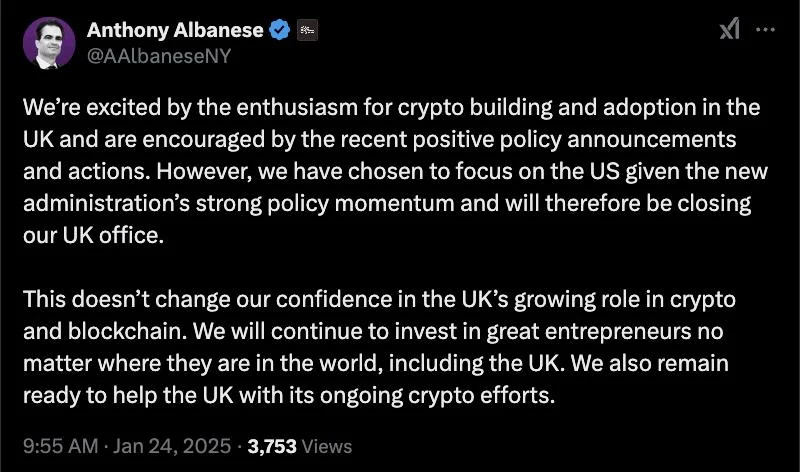

Today in crypto, Solana-based decentralized exchange aggregator Jupiter announced a majority stake in Moonshot, Nasdaq proposes a rule change for BlackRock’s spot Bitcoin ETF, and venture capital firm Andreessen Horowitz plans to leave the United Kingdom.Solana-based DEX Jupiter acquires majority stake in MoonshotSolana-based decentralized exchange (DEX) aggregator Jupiter announced the acquisition of a majority stake in Moonshot, an app that allows users to buy memecoins using Apple Pay.Meow, Jupiter’s pseudonymous founder on Jan. 25 shared the news on X:“For the first announcement of Catstanbul, I'm thrilled to share that Jupiter Exchange has acquired a majority stake in Moonshot. The team is amongst the smartest, most driven group of people I have ever met.”Moonshot’s popularity surged, especially following the launch of Donald Trump’s Official Trump (TRUMP) memecoin on Jan. 18. On Jan. 1, the Moonshot app was ranked 309th in the US App Store’s finance category. However, just a day after TRUMP’s memecoin launch, Moonshot climbed to the top spot.During TRUMP memecoin’s debut, Moonshot saw nearly $400 million in trading volume. By Jan. 20, Moonshot recorded 1 million daily active users. Launched in July 2024, Moonshot is a self-custodial app powered by TurnkeyHQ.Jupiter also announced the acquisition of SonarWatch, a portfolio-tracking tool that is being integrated into Jupiter’s platform.Nasdaq seeks amendment to BlackRock’s Bitcoin ETF for in-kind redemptionsNasdaq has submitted a filing on behalf of asset manager BlackRock, seeking a rule change to permit in-kind creation and redemption for its spot Bitcoin exchange-traded fund (ETF).Bloomberg ETF analyst James Seyffart said in a Jan. 24 X post that BlackRock “should have been allowed to do this from the get-go” when the BlackRock iShares Bitcoin Trust (IBIT) launched alongside the other ten US spot Bitcoin ETFs in January 2024.On the same day as the filing, six more crypto ETF applications were filed in the US.Nasdaq proposed “to allow for in-kind transfers of the Trust’s Bitcoin,” as per a Jan. 24 filing with the US Securities and Exchange Commission (SEC).The filing stated that Authorized Participants — institutions that facilitate the creation and redemption of fund shares — would be able to use either cash or Bitcoin to create shares or receive cash or Bitcoin when redeeming shares.Andreessen Horowitz to close UK office to focus on US crypto effortsVenture capital firm Andreessen Horowitz will be pulling back its operations in the UK in response to US President Donald Trump’s “strong policy momentum” on crypto.In a Jan. 24 X post, Anthony Albanese, chief operating officer of Andreessen Horowitz’s crypto arm, said the firm had been encouraged by “enthusiasm for crypto building and adoption” in the UK but still planned to close its office. According to Albanese, the venture capital company intended to focus its efforts on the US market based on Trump’s actions during his first week in office.“This doesn’t change our confidence in the UK’s growing role in crypto and blockchain,” said the a16z Crypto chief operating officer. “We will continue to invest in great entrepreneurs no matter where they are in the world, including the UK. We also remain ready to help the UK with its ongoing crypto efforts.”The venture capital firm opened its London crypto office in 2023, saying at the time the country was a “predictable business environment.”