Here’s what happened in crypto today

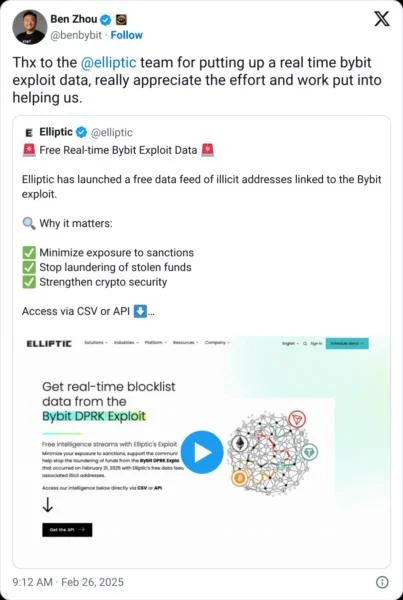

Today in crypto, Bybit and blockchain analytics firms have ramped up efforts to track and recover stolen funds, identifying more than 11,000 wallets linked to North Korean hackers, US spot Bitcoin ETFs notched new record outflows, and the US Securities and Exchange Commission has reportedly dropped its investigation into Uniswap.Bybit hack investigators tie over 11,000 wallets to North Korean hackersNorth Korean hackers behind the $1.4 billion Bybit hack control more than 11,000 cryptocurrency wallets used to launder stolen funds, according to blockchain analytics firm Elliptic. On Feb. 25, four days after the Bybit exploit, company co-founder and CEO Ben Zhou declared “war” on the Lazarus Group, the North Korea-linked hacking collective identified as the primary suspect. As part of the initiative to recover stolen assets, Bybit introduced a blacklist wallet application programming interface (API) and offered a bounty for tracing the funds.At the same time, blockchain analytics firm Elliptic released a freely accessible data feed containing a list of wallet addresses attributed to North Korean hackers. The initiative aims to help community members minimize exposure to sanctions and prevent money laundering of stolen assets.“Addresses associated with the Bybit exploit were identified and available to screen within just 30 minutes of the announcement, protecting customers without the need for them to conduct repetitive manual checks,” Elliptic said.US spot Bitcoin ETFs see largest-ever daily outflow of $938MThe 11 US spot Bitcoin exchange-traded funds (ETFs) saw their largest-ever daily net outflow on Feb. 25 of $937.9 million as Bitcoin continued to trade below $90,000.The record outflows from the ETFs came as Bitcoin (BTC) dropped by 3.4% over the last day, plunging to a 24-hour low of $86,140 from an intraday high of over $92,000.The Fidelity Wise Origin Bitcoin Fund (FBTC) led the day’s losses with a new record $344.7 million in outflows, while BlackRock’s iShares Bitcoin Trust (IBIT) followed up with an outflow of $164.4 million.Grayscale’s two funds saw joint net outflows $151.9 million, split between $66.1 million from its Grayscale Bitcoin Trust (GBTC) and $85.8 million from its Bitcoin Mini Trust ETF (BTC).Around $2.4 billion has exited the 11 ETFs so far this month, which has seen just four days of net inflows over the same period.SEC backs off: Uniswap announces end of investigationUniswap Labs, the developer behind the Uniswap decentralized exchange, reported that the US Securities and Exchange Commission (SEC) has dropped its probe into the firm.According to a Feb. 25 X post, the SEC concluded its investigation into Uniswap and has no plans to pursue enforcement action against the firm. The report followed Uniswap’s announcement that it received a Wells notice from the SEC in April 2024 while the commission was under the leadership of then-Chair Gary Gensler. “This is a huge win for DeFi and reaffirms what we’ve always known – that the technology we build is on the right side of the law, and our work is on the right side of history,” said Uniswap.At the time of publication, the SEC had not made any official announcement regarding Uniswap. However, Coinbase made a similar claim on Feb. 21 that the commission would be closing its case against the crypto exchange roughly two years after being launched. The regulator’s Enforcement Division will also be closing investigations into Robinhood Crypto and OpenSea.