Here’s what happened in crypto today

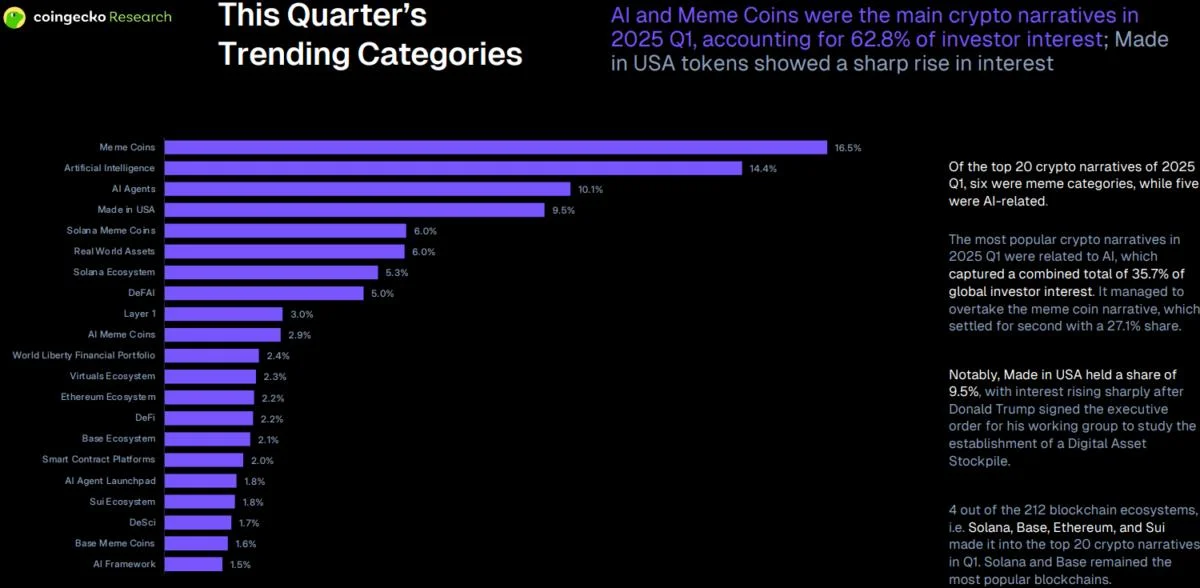

Today in crypto, a new report from CoinGecko revealed crypto investor interest has yet to rotate into new narratives as memecoins and artificial intelligence continued to occupy mindshare during the first quarter of 2025, Coinbase has distanced its blockchain network Base from a token it was highly criticized for sharing, and a US appeals court paused the SEC’s case against Ripple amid settlement talks.AI tokens, memecoins dominate crypto narratives in Q1 2025: CoinGeckoThe cryptocurrency market is recycling old narratives, with few new trends emerging to replace the leading themes in the first quarter of 2025.Artificial intelligence tokens and memecoins were the dominant crypto narratives in the first quarter of 2025, accounting for 62.8% of investor interest, according to a quarterly research report by CoinGecko. AI tokens captured 35.7% of global investor interest, overtaking the 27.1% share of memecoins, which remained in second place.Out of the top 20 crypto narratives of the quarter, six were memecoin categories while five were AI-related.“Seems like we have yet to see another new narrative emerge and we are still following past quarters’ trends,” said Bobby Ong, the co-founder and chief operating officer of CoinGecko, in an April 17 X post. “I guess we are all tired from the same old trends repeating themselves.”Interest in memecoins saw a sharp increase ahead of US President Donald Trump’s inauguration on Jan. 20 after his team launched the Official Trump (TRUMP) memecoin on Jan. 18 and the Official Melania (MELANIA) token on Jan. 19 on the Solana network.However, some industry watchers are concerned that memecoins are draining capital from utility tokens, such as Solana (SOL), limiting their price potential.Coinbase distances Base from highly criticized memecoin that dumped $15 millionCrypto exchange Coinbase has distanced its blockchain network Base from a memecoin it shared on X on April 16 that saw massive backlash after the token rapidly gained, then dropped in value.Base shared an image on X with its marketing tagline, “Base is for everyone,” alongside a link to a token of the same name on Zora, a social network where users can make posts into crypto tokens.The token hit a peak market capitalization of $17.1 million just over an hour after it was created before it then dropped by nearly 90% in the next 20 minutes to $1.9 million before making a recovery.A Coinbase spokeswoman distanced Base from the token, telling Cointelegraph that “Base did not launch a token. This is not an official Base token, and Base did not sell this token.”“Base posted on Zora, which automatically tokenizes content,” the spokeswoman said.Hundreds of X posts criticized Base over the token, while others argued Base just poorly executed a plan to try to redefine memecoins.Base creator Jesse Pollack also defended Base's creation of the token, saying on X that “someone has to normalize putting all of our content onchain. I'm not afraid for it to be us.”Court grants 60-day pause of SEC, Ripple appeals caseAn appellate court has granted a joint request from Ripple Labs and the Securities and Exchange Commission (SEC) to pause an appeal in a 2020 SEC case against Ripple amid settlement negotiations.In an April 16 filing in the US Court of Appeals for the Second Circuit, the court approved a joint SEC-Ripple motion to hold the appeal in abeyance — temporarily pausing the case — for 60 days. As part of the order, the SEC is expected to file a status report by June 15.The SEC’s case against Ripple and its executives, filed in December 2020, was expected to begin winding down after Ripple CEO Brad Garlinghouse announced on March 19 that the commission would be dropping its appeal against the blockchain firm. A federal court found Ripple liable for $125 million in an August ruling, resulting in both the SEC and blockchain firm filing an appeal and cross-appeal, respectively.However, once US President Donald Trump took office and leadership of the SEC moved from former chair Gary Gensler to acting chair Mark Uyeda, the commission began dropping multiple enforcement cases against crypto firms in a seeming political shift. Ripple pledged $5 million in XRP to Trump’s inauguration fund, and Garlinghouse and chief legal officer Stuart Alderoty attended events supporting the US president.April 16 order approving a motion to hold an appeal in abeyance. Source: PACER