Here’s what happened in crypto today

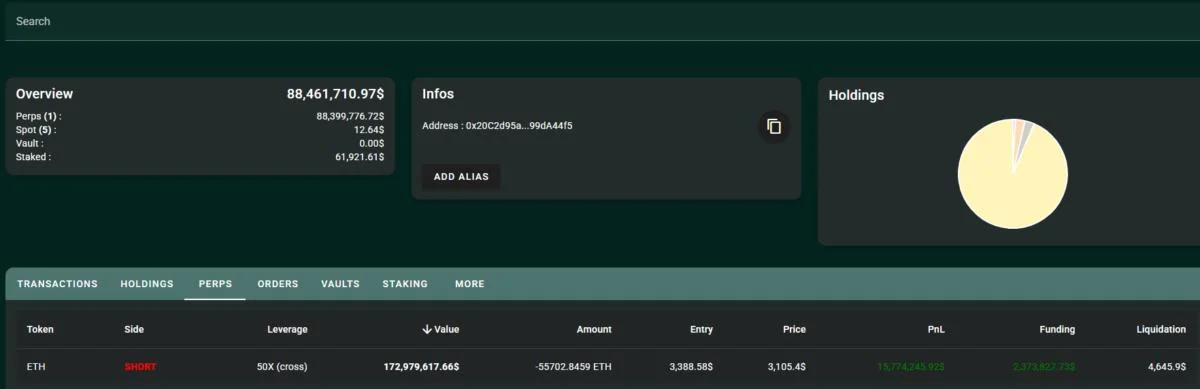

Today in crypto, a savvy cryptocurrency trader has made nearly $16 million by capitalizing on Ether’s recent price decline, Bitcoin fell below $100,000 following US President Donald Trump imposing stringent import tariffs, and El Salvador acquired two additional BTC.Ethereum trader earns $16 million as ETH price falls to $3,000A savvy cryptocurrency trader has made nearly $16 million by capitalizing on Ether’s price decline.The trader generated $15.7 million worth of unrealized profit on a leveraged Ether short position, which involves “borrowing” the underlying cryptocurrency from a broker, selling it at the current price and then repurchasing it once the price falls — a strategy used by traders to bet on the price decline of an asset.The trader opened the 50x leveraged short position when ETH traded at $3,388, with a liquidation threshold of $4,645, Hypurrscan data shows.The trader earned an additional $2.3 million worth of funding fees on their leveraged position.While leveraged trading can potentially increase returns, it can significantly amplify downside risks and lead to the loss of the initial investment.In January 2024, a pseudonymous trader lost over $161,000 worth of funds in a single trade after being liquidated on a leveraged position, illustrating the risks of leveraged trading.Bitcoin falls below $100,000 following Donald Trump imposing import tariffsBitcoin has dropped below $100,000 for the first time in six days following US President Donald Trump signing an executive order to impose import tariffs on goods from China, Canada, and Mexico.The imposed tariffs have already triggered retaliation from the three countries, and the crypto industry is divided on how this will affect the broader market.According to a Feb. 1 statement from the White House, “Trump is implementing a 25% additional tariff on imports from Canada and Mexico and a 10% additional tariff on imports from China. Energy resources from Canada will have a lower 10% tariff.”The statement said that “Trump is taking bold action to hold Mexico, Canada, and China accountable to their promises of halting illegal immigration and stopping poisonous fentanyl and other drugs from flowing into our country.”Tariffs could raise inflation, leading to higher interest rates, which typically causes investors to move away from riskier assets like crypto and toward more traditional assets like bonds and term deposits.El Salvador continues accumulating BTC dispute IMF dealEl Salvador acquired two additional Bitcoin (BTC) on Feb. 1, as the government’s National Bitcoin Office accelerates its pace of BTC accumulation.According to El Salvador’s national Bitcoin tracker, the country has a total of over 6,055 BTC, valued at over $612 million, at the time of this writing.The country recently walked back its Bitcoin legal tender law, which required businesses to accept Bitcoin as a form of payment.As part of the IMF deal, the country also agreed to scale back public sector involvement in the Bitcoin industry and privatize the Chivo wallet.Despite the IMF deal, El Salvador has continued accumulating Bitcoin for its national reserve.