Here’s what happened in crypto today

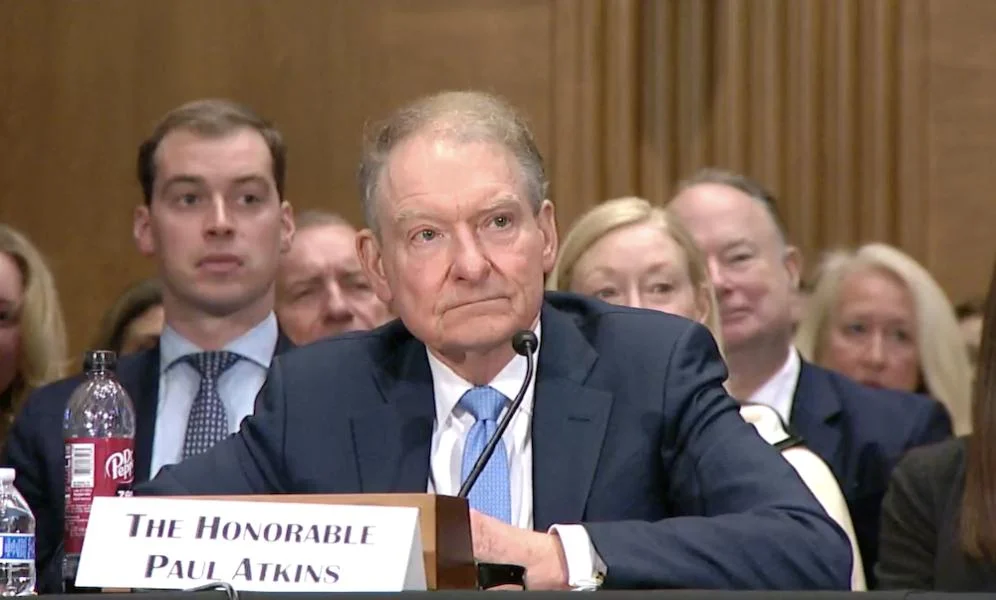

Today in crypto, the Securities and Exchange Commission nominee Paul Atkins faced a Senate confirmation hearing, while a new survey showed that fewer than 1 in 5 European banks currently offer crypto services — despite rising investor demand. Meanwhile, the US Senate voted to repeal the DeFi broker rule.Prospective SEC chair pressed on sale of FTX-tied firmLawmakers in the US Senate Banking Committee questioned prospective Securities and Exchange Commission (SEC) member Paul Atkins on his ties to the crypto industry and how he might regulate digital assets if confirmed.Questioning Atkins at his nomination hearing on March 27, Massachusetts Senator Elizabeth Warren, the committee’s ranking member, said the former SEC commissioner had had “staggeringly bad judgment” in his role leading up to the 2008 financial crisis — Atkins served at the agency from 2002 to 2008. Sen. Warren also asked Atkins to disclose the buyers of his consulting firm Patomak Global Partners — which advised crypto exchange FTX before its collapse in 2022 — for transparency about potential conflicts of interest with the digital asset industry.“Your clients pay you north of $1,200 an hour for advice on how to influence regulators like the SEC, and if you’re confirmed, you will be in a prime spot to deliver for all those clients who’ve been paying you millions of dollars for years,” said Sen. Warren, suggesting Atkins’ judgment “will be influenced by more than an objective assessment of the data.”The Massachusetts senator sent a letter to Donald Trump’s SEC pick on March 23, calling on him to be prepared to answer questions related to his potential role at the agency based on his ties to the crypto industry through Patomak. At the March 27 hearing, Sen. Warren asked Atkins to disclose the consulting firm’s potential buyers — he said he planned to sell the company if confirmed — who might be “buying access to the future chair of the SEC.” Atkins said he would “abide by the process” but did not directly answer Sen. Warren’s question. She suggested that the sale of Patomak could be a “pre-bribe” for the former SEC commissioner’s services.Most EU banks fail to meet rising crypto investor demand — SurveyEuropean banks and financial institutions may be underestimating the demand for cryptocurrency services, with fewer than one in five offering digital asset products, according to a new survey by crypto investment platform Bitpanda.The study surveyed 10,000 retail and business investors across 13 European countries and found that more than 40% of business investors already hold cryptocurrencies, with another 18% planning to invest in the near future.Yet, only 19% of surveyed financial institutions said their clients showed strong demand for crypto products, suggesting a 30% gap between actual investor adoption and perceived interest.Moreover, only 19% of surveyed European financial institutions are offering crypto services, while over 80% of institutions acknowledge crypto’s growing importance.Still, some European banks are recognizing the growing demand for digital assets, with 18% of surveyed financial institutions planning to expand their crypto service offering, particularly offerings related to crypto transfers.Senate sends resolution killing IRS DeFi broker rule to TrumpThe US Senate passed a resolution on March 26 to revoke a Biden-era rule that would have required decentralized finance (DeFi) protocols to report to the Internal Revenue Service, which will now head to President Donald Trump, who has supported killing the rule.The Senate voted 70-28 to pass the motion to repeal the so-called IRS DeFi broker rule that aimed to require DeFi platforms, such as decentralized exchanges, to file their gross proceeds from crypto sales and include information on those involved in the transactions.The White House’s AI and crypto czar, David Sacks, has previously said Trump supports killing the rule.Critics of the rule said it would lump decentralized platforms with too onerous rules, which would hamper crypto innovation, while those who opposed the resolution said it would create a tax evasion loophole.The Senate was widely expected to pass the resolution as it originally passed a version of it in early March. The House made a copycat due to Constitutional budget rules, which it passed on March 11.