Here’s what happened in crypto today

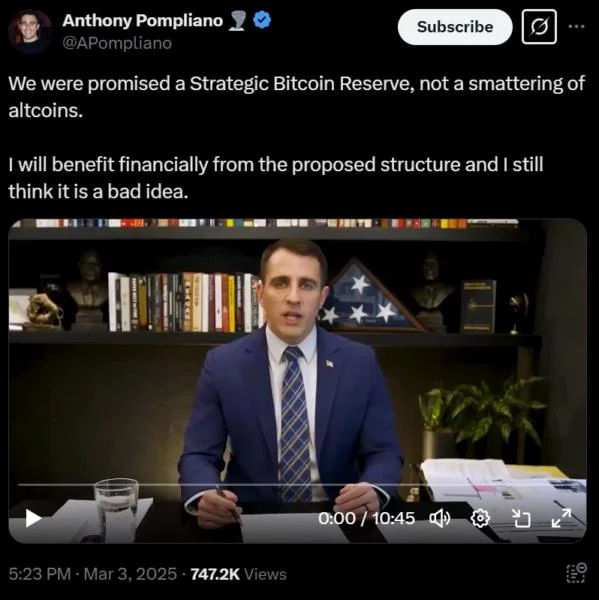

Today in crypto, US President Donald Trump is expected to unveil plans for a strategic Bitcoin reserve on March 7, and the Senate voted to block the new DeFi broker rule. Meanwhile, the European Securities and Markets Authority (ESMA) confirmed to Cointelegraph that its digital assets regulation does not ban holding or transferring non-compliant stablecoins. Trump’s commerce secretary hints at Bitcoin-only strategic reserveUS Commerce Secretary Howard Lutnick has confirmed that the Trump administration will unveil plans for a strategic Bitcoin reserve at the upcoming White House Crypto Summit on March 7.In an interview with The Pavlovic Today, Lutnick clarified that Bitcoin (BTC) will likely have a special status in the country’s national cryptocurrency reserve, which will include Ether (ETH), Solana (SOL), Cardano (ADA) and XRP (XRP).“The president definitely thinks that there’s a Bitcoin strategic reserve,” Secretary Lutnick said. “Now, there will be the question of, how do we handle the other cryptocurrencies. And I think the model is going to be announced on Friday when we do that.”President Donald Trump has faced criticism since announcing on social media that the country’s crypto reserve would include assets other than Bitcoin. Critics say centralized altcoins should not be included alongside Bitcoin, which is the only decentralized commodity that can be used as a long-term store of wealth. Even notorious Bitcoin critic Peter Schiff, who refused to invest in the digital asset when it was valued at less than $100, said he understands the rationale behind a BTC-only reserve but not one that includes altcoins.In response, Lutnick reiterated Trump’s interest in a Bitcoin-only stockpile without dismissing the other assets in the proposed basket.“So Bitcoin is one thing, and then the other currencies, the other crypto tokens, I think, will be treated differently — positively, but differently,” said Lutnick.Tether USDt custody and transfers ‘not restricted’ under MiCA — ESMAThe European Securities and Markets Authority (ESMA) has added new comments on the status of stablecoins that do not comply with the Markets in Crypto-Assets Regulation (MiCA), adding to the ongoing uncertainty around their classification and use. On March 3, Binance announced plans to delist nine non-MiCA-compliant stablecoins, including Tether’s UDSt (USDT), for users in the European Economic Area (EEA).Despite removing the affected tokens for trading, Binance said it will support deposits and withdrawals of non-MiCA-compliant stablecoins after the delisting on March 31.According to ESMA, a key regulatory body overseeing MiCA compliance in Europe, providing custody and transfer services for non-compliant stablecoins does not violate the new European cryptocurrency laws.“Under MiCA, custody and transfer services do not in themselves constitute an ‘offering to the public’ or ‘seeking admission to trading’ of non-compliant asset-reference tokens or e-money tokens,” a spokesperson for the ESMA told Cointelegraph on March 4.“These services are therefore not explicitly prohibited under Titles III and IV of MiCA,” the representative added.Although the ESMA acknowledged that deposits and withdrawals of non-MiCA-compliant stablecoins are not prohibited, it stressed that European crypto asset services providers (CASPs) should “prioritize restricting services that facilitate the acquisition” of such assets, citing its guidance issued on Jan. 17, 2025.US Senate votes to kill IRS DeFi broker ruleThe US Senate on March 4 passed a resolution to repeal a rule that would require decentralized finance (DeFi) protocols to report to the Internal Revenue Service (IRS) with a 70 to 27 vote.The Biden-era rule looks to expand existing IRS reporting requirements to include decentralized exchanges and require brokers to disclose gross proceeds from crypto sales, including information regarding taxpayers involved in the transactions.The resolution now moves to the House, where it will need to be passed before being sent to President Donald Trump. The White House’s AI and crypto czar, David Sacks, has said Trump supports killing the rule.Eli Cohen, general counsel of the RWA tokenizing platform Centrifuge, said in a statement to Cointelegraph that the rule never made “any sense and was unworkable in practice.”