Here’s what happened in crypto today

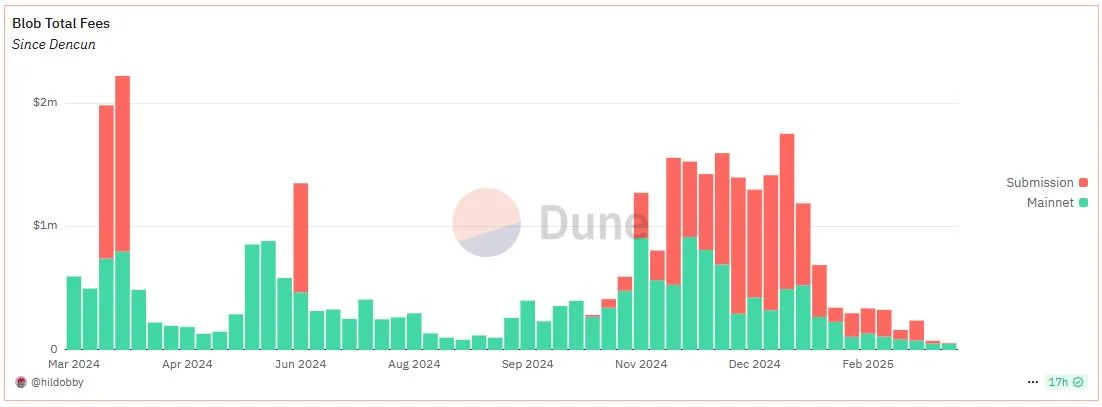

Today in crypto, Ethereum's revenue from blob storage sinks to its lowest level of 2025, Binance halts select Tether (USDt) spot trading pairs in the European Economic Area, and a new privacy tool launches on Ethereum, promising private transactions while filtering out malicious actors.Ethereum's weekly blob fees hit 2025 lowsThe Ethereum network’s main source of income from layer-2 (L2) scaling chains — “blob fees” — has sunk to the lowest weekly levels so far this year, according to data from Etherscan. In the week ending March 30, Ethereum earned only 3.18 Ether (ETH) from blob fees, according to Etherscan, or approximately $6,000 US dollars as of April 1. This figure marks a 73% drop from the prior week and a more than 95% decline from the week ending March 16, when Ethereum’s income from blob fees exceeded 84 ETH, Etherscan said in an X post. In March 2024, Ethereum’s Dencun upgrade migrated L2 transaction data to temporary offchain stores called “blobs.” The upgrade cut costs for users but also reduced overall fee revenue for Ethereum — initially by as much as 95%, according to data from asset manager VanEck.Since then, growth in blob fees has been unsteady. Ethereum’s weekly blob fee income peaked at nearly $1 million in November before declining sharply in recent weeks, according to data from Dune Analytics. Binance ends Tether USDT trading in Europe to comply with MiCA rulesBinance has discontinued spot trading pairs with Tether’s USDt in the EEA to comply with MiCA.Cryptocurrency exchange Binance has delisted spot trading pairs with several non-MiCA-compliant tokens in the EEA in line with a plan disclosed in early March, Cointelegraph has learned.While spot trading pairs in tokens such as USDt (USDT) are now delisted on Binance, users in the EEA can still custody the affected tokens and trade them in perpetual contracts.According to a previous announcement by Binance, the spot trading pairs for non-MiCA-compliant tokens were to be delisted by March 31, which is in line with a local requirement to delist such tokens by the end of the first quarter of 2025.Binance is not the only crypto exchange delisting non-MiCA-compliant tokens for spot trading in the EEA.Other exchanges, such as Kraken, have delisted spot trading pairs in tokens such as USDT in the EEA after announcing plans in February.According to a notice on the Kraken website, the exchange restricted USDT for sell-only mode in the EEA on March 24. At the time of writing, the platform doesn’t allow its EEA users to buy the affected tokens.Among other non-MiCA-compliant tokens, Binance has also delisted spot trading pairs for Dai (DAI), First Digital USD (FDUSD), TrueUSD (TUSD), Pax Dollar (USDP), Anchored Euro (AEUR), TerraUSD (UST), TerraClassicUSD (USTC) and PAX Gold (PAXG).Privacy Pools launch on Ethereum, with Vitalik demoing the featureA new semi-permissionless privacy tool, Privacy Pools, has launched on Ethereum, allowing users to transact privately while proving their funds aren’t linked to illicit activities.The privacy tool, launched by Ethereum builders 0xbow.io on March 31, earned support from the likes of Ethereum co-founder Vitalik Buterin, who not only backed the privacy project but made one of the first deposits on the platform. 0xbow.io said that it implements “Association Sets” to batch transactions into the anonymous Privacy Pools and that a screening test is conducted to ensure that those transactions aren’t linked to illicit actors, such as hackers, phishers and scammers.