Here’s what happened in crypto today

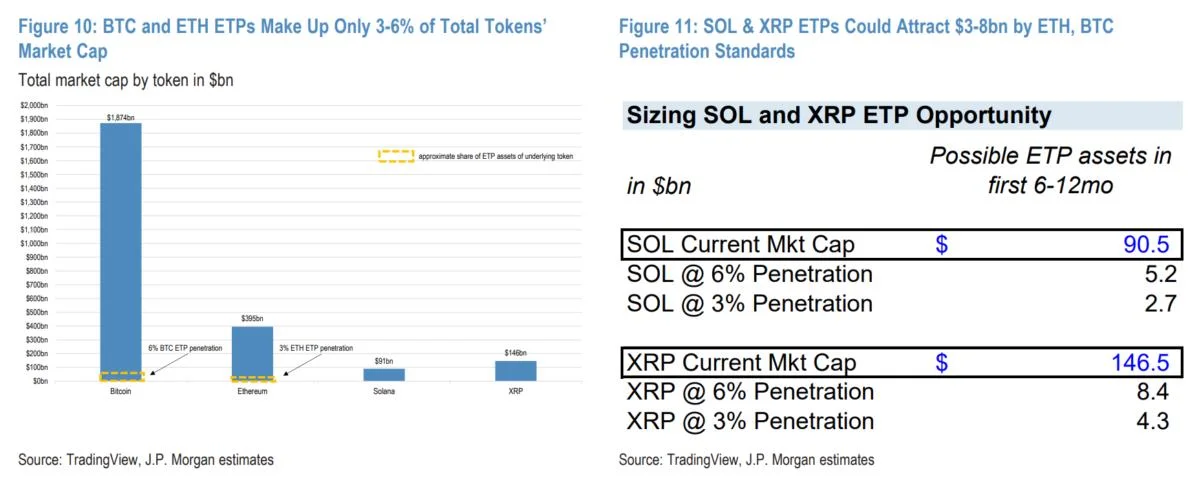

Today in crypto, outgoing Securities and Exchange Commission Chair Gary Gensler downplayed the influence of crypto interest groups on the 2024 US presidential election, despite funds raised from the crypto sector.Global banking giant JPMorgan has projected that the approval of spot Solana and XRP exchange-traded funds (ETFs) could draw billions of dollars in new investments. Meanwhile, US Senator Elizabeth Warren has raised concerns about President-elect Donald Trump’s Treasury Secretary nominee, Scott Bessent, questioning his strategy for combating money laundering in the crypto sector.Gary Gensler says the presidential election wasn’t about crypto moneyUS SEC Chair Gary Gensler, scheduled to leave the regulatory body in six days, said the outcome of the 2024 presidential election didn’t come down to money from crypto interest groups.In a Jan. 14 interview with CNBC‘s Andrew Ross Sorkin on Squawk Box, Gensler said he thought it was unlikely that crypto-focused voters and money from digital asset interest groups swung the US election for President-elect Donald Trump.“I think this election, though as you point out, there was money raised from the crypto field, I don’t think that’s what this election was about,” said Gensler. He continued:“This field, the crypto field, a highly speculative field, has not been compliant with various laws, whether it’s any money laundering laws, sanctions laws, or in our case, securities laws.”Under Gensler, the SEC filed several enforcement actions against US-based crypto firms, including Coinbase, Ripple Labs, and Binance. Solana, XRP ETFs may attract billions in new investment — JPMorganEmerging cryptocurrency-based exchange-traded products (ETPs) may attract significant new investment if approved, according to banking giant JPMorgan.More investors are betting on the approval of the first spot Solana and spot XRP exchange-traded funds (ETFs) with expectations of a more innovation-friendly regulatory regime in the US after President-elect Donald Trump’s inauguration on Jan. 20.In a Jan. 13 report shared with Cointelegraph, JPMorgan projected that SOL and XRP ETPs may eclipse the performance of spot Ether (ETH) ETFs in their first six months of trading.“When applying these so-called “adoption rates” to SOL and XRP, we see SOL attracting roughly $3 billion-$6 billion of net assets and XRP gathering $4 billion-$8 billion in net new assets,” the report stated.The prediction comes shortly after the first anniversary of the US spot Bitcoin (BTC) ETFs, which nearly surpassed $110 billion in cumulative holdings on Jan. 2, Cointelegraph reported.New crypto-based ETFs could propel the underlying altcoins to new all-time highs. For Bitcoin, the ETFs accounted for about 75% of new investment when Bitcoin recaptured the $50,000 mark on Feb. 15, less than a month after spot BTC ETFs debuted on Jan. 11.Senator Warren urges Trump’s Treasury pick to consider stricter crypto regsUS Senator Elizabeth Warren has penned an open letter to US President-elect Donald Trump’s pick to lead the US Treasury — Scott Bessent, asking if the Treasury Department should have more power to sanction the crypto sector.“Should AML/CFT and sanctions programs include risk-based provisions reasonably designed to prevent money laundering or terrorist financing involving digital assets,” wrote Warren.“Bad actors are also increasingly turning to cryptocurrency to enable money laundering, sanctions evasion, and to finance major national security threats, such as Russia’s invasion of Ukraine, North Korea’s nuclear program, China’s sale of weapons parts to sanctioned nations, and ransomware attacks,” Warren said. She also asked Bessent whether the department’s powers regarding Anti-Money Laundering and Counter-Terrorism Financing should include a secondary sanctions tool that would allow it to “sever fintech and crypto operators from US relationships,” among many other questions.