Here’s what happened in crypto today

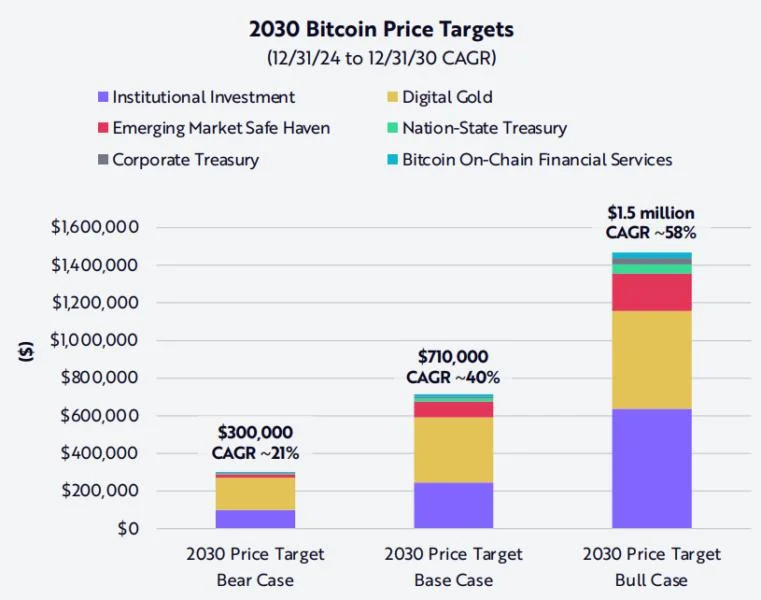

Today in crypto, the co-founders of HashFlare pleaded guilty to wire fraud in the US; ARK Invest's Cathie Wood predicted Bitcoin may reach $1.5 million by 2030 and Franklin Templeton filed for a “Franklin Solana Trust” in Delaware. HashFlare co-founders plead guilty to wire fraud in USThe co-founders of crypto mining service HashFlare agreed to plead guilty to one count of conspiracy to commit wire fraud as part of a deal with US authorities.In Feb. 12 hearings in the US District Court for the Western District of Washington, Sergei Potapenko and Ivan Turogin pleaded guilty to one felony count out of the 18 charges they had been facing from US prosecutors.The Estonian nationals were responsible for running HashFlare, which defrauded users out of more than $550 million between 2015 and 2019, and raising $25 million from investors in 2017, claiming they would establish a digital bank called Polybius — but the company was never created.Speaking to Cointelegraph after the hearings, Reed Smith partner and defense counsel Mark Bini said both defendants had “agreed to forfeit their interests in assets that the government froze in 2022” and to provide assistance “so that there will be zero financial harm to anyone.” According to the attorney, Potapenko, Turogin and HashFlare returned $350 million in crypto payments to users between 2015 and 2022.Bitcoin price could reach $1.5 million by 2030 — Cathie WoodBitcoin’s chances of reaching $1.5 million are improving as institutional investors increase their exposure to digital assets, according to ARK Invest CEO Cathie Wood.Bitcoin has been trading under the key $100,000 level since Feb. 4, after investor sentiment was pressured by global trade war concerns following new import tariffs announced by the US and China.Despite the temporary market slump, Bitcoin’s odds of surpassing $1.5 million a coin have increased, according to Wood. “Many people know us for our [Bitcoin] bull case, $1.5 million,” said Wood during a video published on Feb. 11, adding:“We actually think the odds have gone up that our bull case will be the right number, because of what is becoming the institutionalization of this new asset class.”“Many institutional investors are now looking at Bitcoin and thinking they need to add it to their asset allocation because its return and risk profile looks so much different than all the other assets in their portfolios,” Wood added.A potential rally to $1.5 million would assume that Bitcoin realizes an average compound annual growth rate (CAGR) of 58% during the next five years.Franklin Templeton lines up for Solana ETF with Delaware trustAsset manager Franklin Templeton on Feb. 10 registered a trust in Delaware called the “Franklin Solana Trust” — a sign it could soon look to launch a spot Solana (SOL) exchange-traded fund (ETF) in the US.A filing to Delaware’s corporate regulator shows the CSC Delaware Trust Company formed the trust, a firm that has registered crypto trust products for other asset managers like Bitwise.Franklin will need to file what’s known as a Form 19b-4 and a Form S-1 for the proposed ETF with the Securities and Exchange Commission before it launches for trading.If it does, it’ll join Grayscale, Bitwise, VanEck, 21Shares and Canary Capital in vying for a spot SOL fund to track what is currently the fifth-largest cryptocurrency by value.