Here’s what happened in crypto today

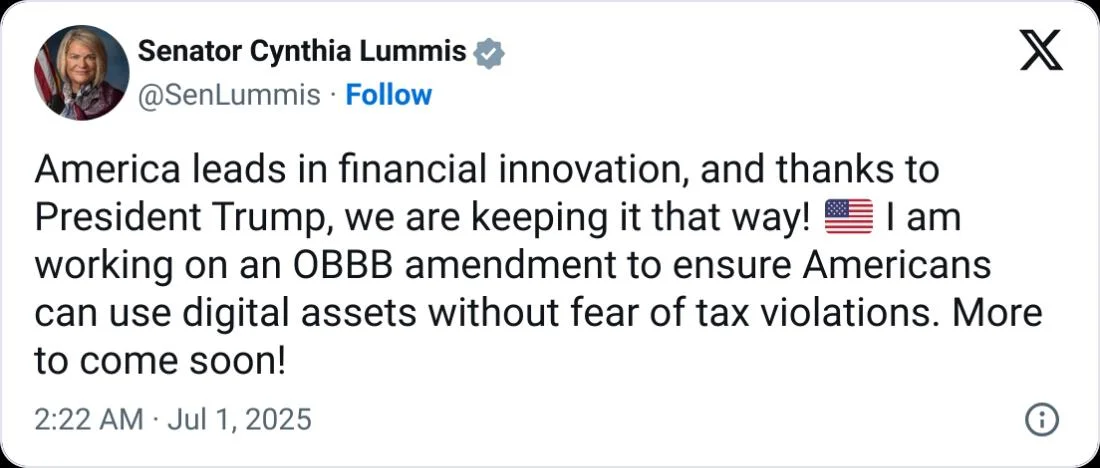

Today in crypto, German banking giant Deutsche Bank reportedly plans to launch a crypto custody service in 2026 with Bitpanda and Taurus, US Senators looked to squeeze crypto amendments into the “big beautiful bill,” and the US is set to debut its first exchange-traded fund (ETF) offering crypto staking.Deutsche Bank to launch crypto custody accounts in 2026: ReportGermany’s biggest bank, Deutsche Bank, is reportedly planning to allow its clients to store cryptocurrencies like Bitcoin (BTC) next year.Deutsche Bank plans to launch a digital assets custody service in 2026 in collaboration with the technology unit of Austria-based Bitpanda crypto exchange, Bloomberg reported on Tuesday.The crypto custody service’s development will also involve Deutsche Bank-backed Swiss technology provider Taurus, according to Bloomberg, citing sources familiar with the matter.If confirmed, Deutsche Bank’s latest plans would mark the bank’s latest attempt to enter the crypto storage market, since it revealed such ambitions in 2020.Deutsche Bank has signaled increasing interest in cryptocurrency in recent yearsIn early June, Deutsche Bank’s head of digital assets, Sabih Behzad, said the bank was considering entering the stablecoin market, including issuing its own stablecoin or joining stablecoin projects.“We can certainly see the momentum of stablecoins along with a regulatory supportive environment, especially in the US,” Behzad said, adding:“Banks have a wide variety of options available to engage in the stablecoin industry — everything from acting as a reserve manager, through to issuing their own stablecoin, either alone or in a consortium.”Additionally, Deutsche Bank is also reportedly assessing whether to develop its own tokenized deposit solution for use in payments.Senators jam in crypto changes to “big beautiful bill”US Senators were in a marathon vote-a-rama all Monday and into Tuesday on Donald Trump’s sweeping tax and spending One Big Beautiful Bill Act as they looked to tack on amendments, one of which would change crypto taxes.Republican Senator Cynthia Lummis said she put forward an amendment aimed at ending the “unfair tax treatment” of crypto that would, among other things, waive taxes on crypto transactions under $300 and stipulate that crypto earned from airdrops, mining and staking not be taxable until sold.Earlier on Monday, the Senate shot down a Democrat-backed amendment that would have prohibited government officials, including the president, and their families from offering or promoting cryptocurrencies and other digital assets.Lummis, who opposed the amendment, claimed it “would inflict serious harm on American innovation and competitiveness” as it went “too far” with restricting the family of government officials and could send a message that “America is closed for business.”Meanwhile, Trump’s former cost-cutting czar, Elon Musk, has said he’ll work to unseat all members of Congress who voted for the bill and would create a new political party if it passes, saying the US needs “an alternative to the Democrat-Republican uniparty.”First US staking ETF to launch Wednesday, giving investors exposure to SolanaThe first US staked cryptocurrency exchange-traded fund (ETF) will launch on Wednesday, allowing investors to hold Solana (SOLANA) and earn yield through staking.Two days after Cointelegraph reported that the REX-Osprey Solana and Staking ETF could launch imminently, issuer REX Shares confirmed on Monday that the fund is set to debut.As the name suggests, the REX-Osprey fund will give investors direct exposure to spot SOL along with staking income, potentially paving the way for broader institutional adoption of crypto.The launch follows REX’s updated prospectus and positive feedback from the US Securities and Exchange Commission (SEC) regarding its unique C-Corp business structure — an arrangement the regulator had previously argued conflicted with the so-called ETF rule.The SEC ruled in May that staking does not violate securities laws, but still decided to punt its decision on staked ETFs and other altcoin funds.