Here’s what happened in crypto today

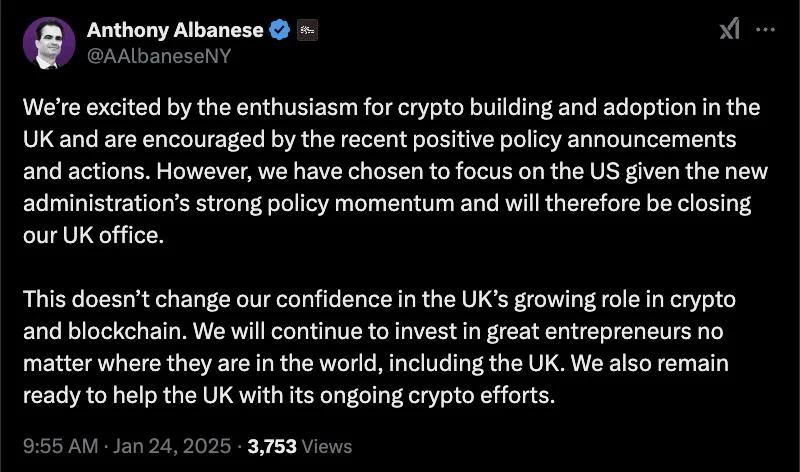

Today in crypto, venture capital firm Andreessen Horowitz plans to leave the United Kingdom, MicroStrategy may have to pay taxes on its unrealized Bitcoin gains, and the US Securities and Exchange Commission has rescinded the controversial crypto accounting rule SAB 121.Andreessen Horowitz to close UK office to focus on US crypto effortsVenture capital firm Andreessen Horowitz will be pulling back its operations in the UK in response to US President Donald Trump’s “strong policy momentum” on crypto.In a Jan. 24 X post, Anthony Albanese, chief operating officer of Andreessen Horowitz’s crypto arm, said the firm had been encouraged by “enthusiasm for crypto building and adoption” in the UK but still planned to close its office. According to Albanese, the venture capital company intended to focus its efforts on the US market based on Trump’s actions during his first week in office.“This doesn’t change our confidence in the UK’s growing role in crypto and blockchain,” said the a16z Crypto chief operating officer. “We will continue to invest in great entrepreneurs no matter where they are in the world, including the UK. We also remain ready to help the UK with its ongoing crypto efforts.”The venture capital firm opened its London crypto office in 2023, saying at the time the country was a “predictable business environment.”MicroStrategy may owe taxes on $19 billion unrealized Bitcoin gainsDespite never selling any Bitcoin, MicroStrategy may have to pay taxes on its unrealized gains.Michael Saylor’s MicroStrategy, the largest corporate Bitcoin holder, may have to pay federal income taxes on its unrealized gains, according to the Inflation Reduction Act of 2022.The act established a “corporate alternative minimum tax” under which MicroStrategy would qualify for a 15% tax rate based on the adjusted version of the company’s earnings, according to Jan. 24 report in The Wall Street Journal.Still, the US Internal Revenue Service (IRS) may create an exemption for BTC under President Donald Trump’s more crypto-friendly administration.MicroStrategy’s holdings have surpassed 450,000 BTC, worth more than $48 billion, after the company bought $243 million of BTC on Jan. 13. According to MicroStrategy’s portfolio tracker, the company’s Bitcoin holdings have an unrealized gain of over $19.3 billion.SEC revokes SAB 121 crypto accounting ruleThe Securities and Exchange Commission on Jan. 23 canceled the controversial Staff Accounting Bulletin 121, or SAB 121, a rule that mandated financial firms holding crypto on behalf of customers must record them as liabilities on their balance sheets.A new bulletin, SAB 122, said it “rescinds the interpretive guidance” of SAB 121 — a rule published in March 2022 that the crypto industry has long sought to have repealed.“Bye, bye SAB 121!” SEC Commissioner and the agency’s crypto task force lead Hester Peirce wrote in a Jan. 23 X post. “It’s not been fun.”Bye, bye SAB 121! It's not been fun: https://t.co/cIwUc0isUE | Staff Accounting Bulletin No. 122The crypto industry had long pushed back on the rule, saying it would make holding crypto administratively more difficult for financial firms to hold.It marks the first significant move by the SEC under President Donald Trump, which is led by his pick, Mark Uyeda, currently the agency’s acting chair.A bill to repeal SAB 121 initially received bipartisan support in Congress but Joe Biden vetoed it in June last year. A House vote five weeks later to override the veto fell short, which left the rule in place.