Here’s what happened in crypto today

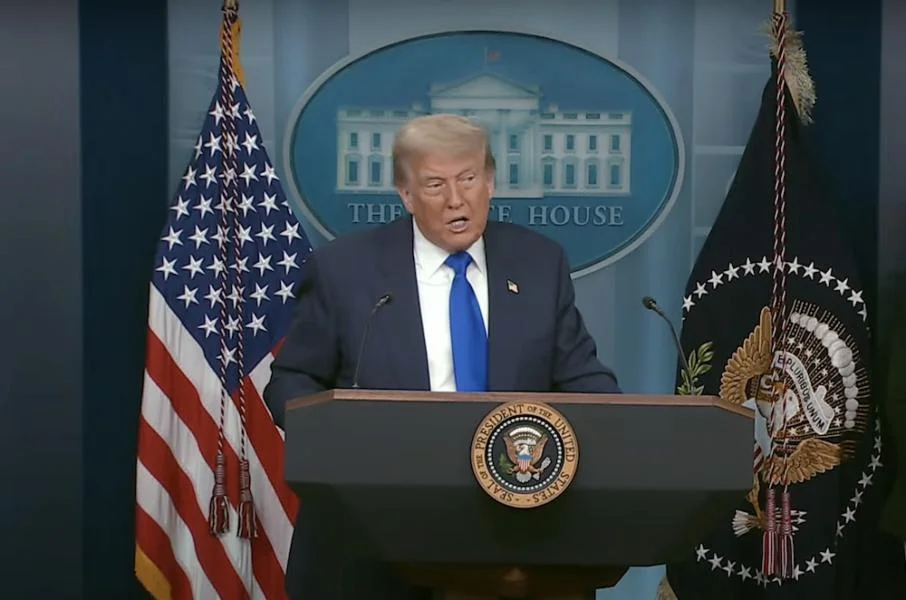

Today in crypto, US President Donald Trump sidestepped questions on divesting from crypto ventures amid political pressure over digital asset bills. Across Protocol founders were accused of redirecting $23 million in tokens and infrastructure attacks flagged behind most of the $2.1 billion stolen in crypto this year.Trump sidesteps question on crypto divesting to pass key billsUS President Donald Trump didn’t answer a reporter’s question on whether he would divest from his family’s crypto ventures in order to ensure passage of key cryptocurrency legislation, saying only that if the US didn’t have crypto, China or other countries would."Many Democrats have said that they are not going to support crypto bills in Congress only because of you and your family's personal crypto ventures," a reporter said to Trump during a press briefing at the White House on Friday.Asked whether he would consider divesting from his crypto ventures to ease political pressure on digital asset bills on Congress, Trump responded:"I became a fan of crypto, and to me, it's an industry. I view it as an industry and I am president. And if we did not have it, China would, or somebody else would, but most likely China would love to, and we have dominated that industry.We have created a very powerful industry, and that is much more important than anything that we invest in," Trump said.Across Protocol DAO under fire over $23 million fund misuse claimsThe founders of the crosschain bridge Across Protocol have been accused of siphoning $23 million of funds to their own for-profit company.In a Friday X thread, Ogle — the pseudonymous founder of layer-1 project Glue and onchain sleuth — accused some founders of Across Protocol of covertly manipulating decentralized autonomous organization (DAO) votes to fund their for-profit company, Risk Labs. Ogle accused the project of being among the “DAOs that are DAOs in name only.”Hart Lambur, who founded both Risk Labs and Across, denied the claims in a separate post. He said that Risk Labs is a Cayman Islands-based nonprofit with no shareholders. He shared a certificate of incorporation and claimed that the company operates under fiduciary obligations.“If the funds are misused, you can sue the directors (me!),” he said.Talking to Cointelegraph, Lambur also shared the company’s certificate of incorporation. The document describes the firm as a “foundation company.” Cointelegraph was able to independently verify the company’s registration with Cayman Island’s online general registry.Still, law firm Harneys explained in its Cayman Islands foundation company guide that such firms can have any purpose, “whether commercial, charitable/philanthropic or private.”Crypto seed phrase, front-end hacks drive record losses in 2025Infrastructure attacks such as private wallet key exploits and crypto protocol front-end compromises accounted for 80% of the $2.1 billion worth of crypto lost to attacks in the first half of 2025, TRM Labs said in a report on Thursday.Protocol exploits were another majorly successful attack vector, with compromises such as flash loan and re-entrancy attacks accounting for 12% of crypto losses in the first half of the year. The losses in the first half of 2025 have surpassed the previous record set in 2022 by roughly 10% and nearly equal the total losses from all of 2024, which TRM Labs said “highlights an increasingly concentrated threat to digital assets.” The $1.5 billion hack of Bybit in February, an attack linked to North Korea, made up nearly 70% of the total losses so far in 2025, with TRM Labs calling for “multifaceted collaboration” between global law enforcement, financial intelligence units and blockchain intelligence firms.