Here’s what happened in crypto today

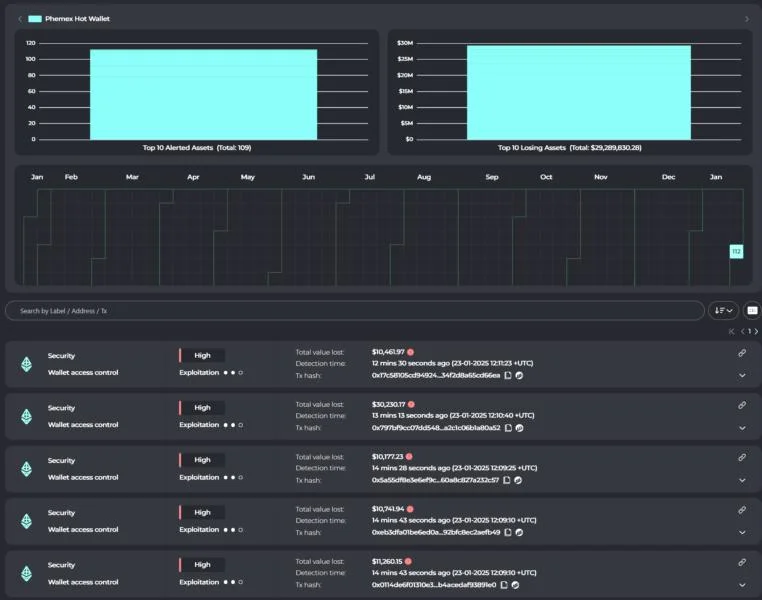

Today in crypto, Phemex, a cryptocurrency exchange, has halted withdrawals after reports emerged of millions of dollars in outflows from its hot wallets, US House Democrats want a government oversight committee to probe President Donald Trump over his crypto ventures, and the Chicago Mercantile Exchange (CME) briefly listed a page for upcoming derivative products tied to cryptocurrencies.Phemex halts withdrawals amid $29 million of “suspicious” outflowsPhemex crypto exchange has halted withdrawals after being alerted to nearly $30 million worth of “suspicious” outflows, which raised alarms among blockchain security firms.Phemex saw over $29 million worth of crypto transfers across multiple blockchains including BNB , Polygon , Arbitrum (ARB) and Base (BASE), according to onchain security firm Cyvers.The outflows point to “suspicious transactions” involving the Phemex hot wallets, Cyvers stated in a Jan. 23 X post:“Over $29 million worth of digital assets have been transferred by suspicious addresses. These addresses have already begun swapping assets to $ETH.”Cyvers’ co-founder and chief technology officer, Meir Dolev, highlighted that 125 suspicious transactions were recorded across 11 blockchains, with some assets already swapped to bypass freezing measures.“Some of the tokens and stablecoins already have been swapped to avoid freezing.”In response, Phemex announced on Jan. 23 that it had temporarily suspended withdrawals to conduct a comprehensive security inspection and enhance its wallet services:“To ensure security, withdrawals have been temporarily suspended while we conduct an emergency inspection and strengthen wallet services.”House Democrats want Trump ethics probe over cryptoDemocrat Representative Gerald Connolly called on the US House Committee on Oversight and Government Reform’s Republican chair, James Comer, to investigate whether President Donald Trump’s crypto ventures conflict with his presidential duties.Connolly said Trump might already be cashing in profits from his World Liberty Financial (WLF) platform and the Official Trump (TRUMP) memecoin, potentially breaching ethical standards and creating national security risks.He added World Liberty was “particularly troubling” due to its largest investor being Tron founder Justin Sun who the Securities and Exchange Commission charged with securities fraud.Financial “entanglements” like this one raise “serious national security concerns” about the potential for foreign influence on US policy, Connolly added.“Allowing such practices to persist unchecked would signal to the American people that the Oversight Committee is unwilling or unable to enforce the standards it claims to uphold,” he said.CME website hints at XRP, SOL futures debut in FebruaryThe CME website hinted at the introduction of SOL (SOL) and XRP (XRP) futures contracts that could debut as early as Feb. 10, pending regulatory review.According to the website — which later removed the page — contracts for both assets will be available in standard and micro sizes, with the standard SOL contract having a 500 SOL lot size and the micro-contract accounting for 25 SOL.Standard-size XRP futures contracts will feature lot sizes of 50,000 XRP, with the micro futures contracts featuring a 2,500 XRP lot size. All contracts for XRP and SOL will settle in US dollars.