Here’s what happened in crypto today

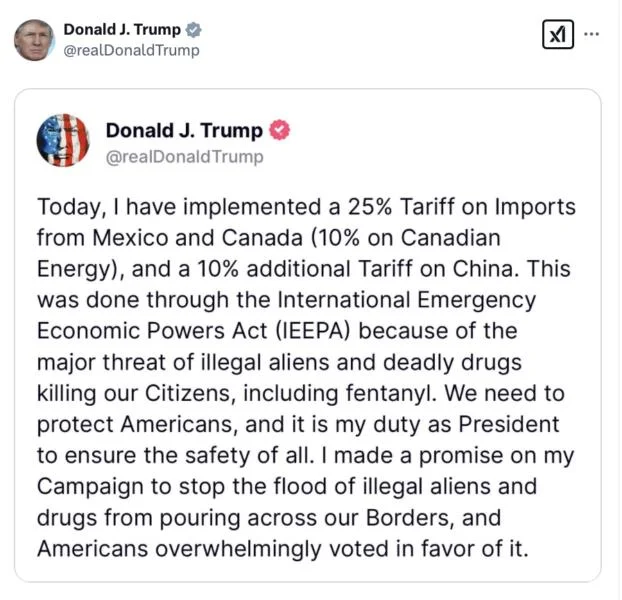

Today in crypto, Bitcoin falls below $100,000 following Donald Trump imposing stringent import tariffs, El Salvador acquires two additional BTC, Kraken announced that it will delist Tether’s USDt and four other stablecoins in Europe to comply with the Markets in Crypto-Assets Regulation (MiCA).Bitcoin falls below $100K following Donald Trump imposing import tariffsBitcoin has dropped below $100,000 for the first time in six days following US President Donald Trump signing an executive order to impose import tariffs on goods from China, Canada, and Mexico.The imposed tariffs have already triggered retaliation from the three countries, and the crypto industry is divided on how this will affect the broader market.According to a Feb. 1 statement from the White House, “Trump is implementing a 25% additional tariff on imports from Canada and Mexico and a 10% additional tariff on imports from China. Energy resources from Canada will have a lower 10% tariff.”The statement said that “Trump is taking bold action to hold Mexico, Canada, and China accountable to their promises of halting illegal immigration and stopping poisonous fentanyl and other drugs from flowing into our country.”Tariffs could raise inflation, leading to higher interest rates, which typically causes investors to move away from riskier assets like crypto and toward more traditional assets like bonds and term deposits.El Salvador continues accumulating BTC dispute IMF dealEl Salvador acquired two additional Bitcoin on Feb. 1, as the government's National Bitcoin Office accelerates its pace of BTC accumulation.According to El Salvador's national Bitcoin tracker, the country has a total of over 6,055 BTC, valued at over $612 million, at the time of this writing.The country recently walked back its Bitcoin legal tender law, which required businesses to accept Bitcoin as a form of payment.As part of the IMF deal, the country also agreed to scale back public sector involvement in the Bitcoin industry and privatize the Chivo wallet.Despite the IMF deal, El Salvador has continued accumulating Bitcoin for its national reserve.Kraken to delist USDT and four other stablecoins in EuropeCryptocurrency exchange Kraken is moving to comply with European crypto regulations by preparing to delist five stablecoins, including Tether’s USDt.Kraken will fully delist USDt (USDT) on March 31 to comply with the European Union’s Markets in Crypto-Assets Regulation (MiCA), according to an official announcement by the exchange.Alongside USDT, the exchange will gradually remove support for PayPal USD (PYUSD), Tether EURt (EURT), TrueUSD (TUSD), and TerraClassicUSD (UST) in the European market.“These changes ultimately ensure Kraken remains compliant and is able to provide its exceptional trading experience to European clients for the long term,” the company said.In line with the provisions set by the European Securities and Markets Authority (ESMA) to ensure a smooth and orderly delisting process, Kraken will drop USDT support in stages.First, Kraken will set margin pairs involving the affected assets to “reduce-only” mode for clients in the European Economic Area (EEA) on Feb. 13. Following this restriction, EEA users will be only able to reduce or fully close out existing margin positions.By Feb. 27, Kraken will put the affected tokens in “sell-only” mode, restricting EEA clients from generating deposit addresses for tokens like USDT but still supporting trading.On March 24, Kraken will halt all spot trading for the affected assets, closing all open orders and exchanges into other coins or fiat currencies.