Here’s what happened in crypto today

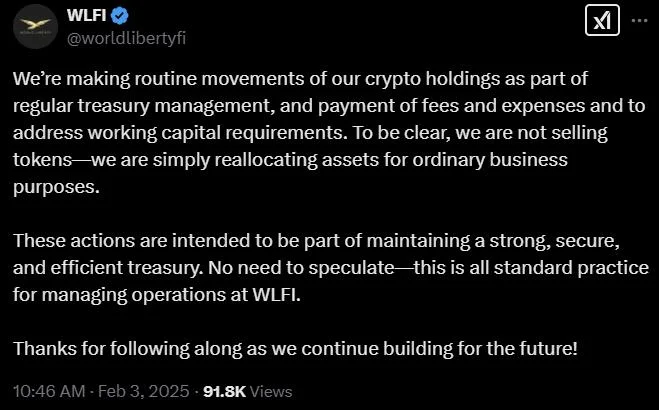

Today in crypto, World Liberty Financial denies token swap allegations, while Bybit’s CEO estimates $10 billion in liquidations as the market plunges. Several top altcoins, including Ether, saw double-digit losses, amid fallout from Trump’s first round of tariffs.Trump-backed World Liberty Financial denies token salesWorld Liberty Financial claims it hasn’t sold any of its WLFI tokens amid rumors that the decentralized finance (DeFi) project was pursuing token swaps with various blockchain projects whose tokens it acquired in recent months.According to a Feb. 3 social media post, World Liberty said it routinely shuffles its crypto holdings as part of its treasury management strategy.“To be clear, we are not selling tokens — we are simply reallocating assets for ordinary business purposes,” the post said.World Liberty Financial, which is linked to the family of US President Donald Trump, issued the statement less than two hours after Blockworks reported that the company was pursuing token swaps with various crypto projects.Citing anonymous sources, the report claims that World Liberty was looking to sell at least $10 million worth of yet-to-be-launched WLFI tokens in exchange for buying the same amount of that project’s native cryptocurrency. The sale would come with a 10% fee, the report said.Crypto market liquidations likely reached $10 billion — Bybit CEOThe recent crypto market correction may have liquidated up to $10 billion worth of capital, eclipsing previous estimates, according to Bybit’s CEO.More than $2.24 billion was liquidated from the crypto markets in 24 hours on Feb. 3, according to CoinGlass data.Bybit co-founder and CEO Ben Zhou, however, said the real figure may be five times larger.“Bybit’s 24hr liquidation alone was $2.1 billion,” Zhou wrote in a Feb. 3 X post.“I am afraid that today’s real total liquidation is a lot more than $2 billion, by my estimation, it should be at least around $8 billion -10 billion,” he said.The multibillion-dollar crypto liquidation event occurred amid growing macroeconomic concerns over a potential global trade war days after President Donald Trump signed an executive order to impose import tariffs on goods from China, Canada and Mexico, according to a Feb. 1 statement from the White House.Ether, altcoins dive double digits as Trump tariffs take further tollEther and top altcoins including Cardano fell double digits in an hour as the market continued to reel from US President Donald Trump’s first round of tariffs against imports from China, Canada and Mexico.Ether (ETH), the second largest cryptocurrency by market capitalization, fell 16% in a single hour to $2,368 on Feb. 3 at 2:11 am UTC.Avalanche (AVAX), XRP (XRP), Chainlink (LINK), Dogecoin (DOGE) and other top altcoins have fallen over 20% in the last 24 hours, contributing to an 11.4% drop in the crypto market cap to $3.17 trillion, CoinGecko data shows.10x Research founder Markus Thielen told Cointelegraph: “The sharp drop in altcoins reflects a wave of stop-loss triggers combined with a buyer’s strike from retail investors.”Thielen said trading volumes had been falling over the last few weeks, “signaling a waning appetite and lack of conviction from investors.”