Here’s what happened in crypto today

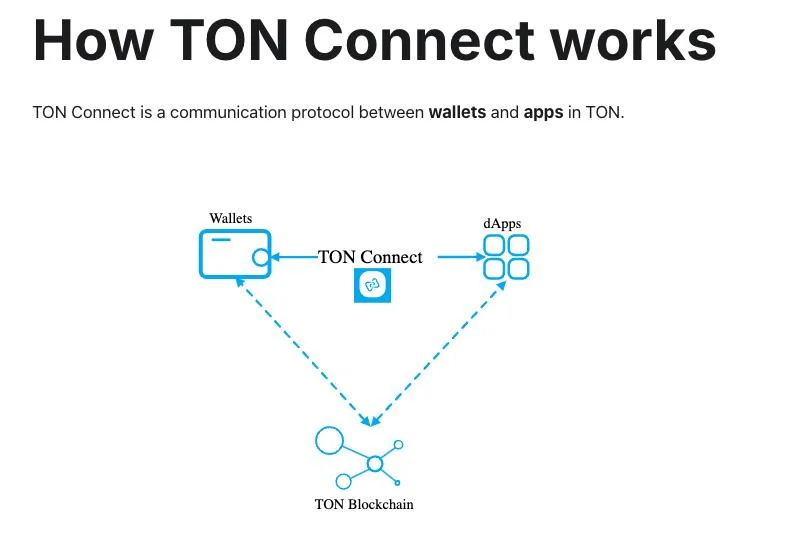

Today in crypto, Telegram now requires third-party crypto wallets to use TON Connect, restricting Mini Apps to the TON blockchain and prompting concerns about decentralization and exclusivity, Michael Saylor’s recently rebranded “Strategy” reported a $670 million net loss in the fourth quarter of 2024 amid an aggressive Bitcoin stacking spree, and BlackRock is launching a European Bitcoin ETF.Telegram mandates TON Connect for all crypto wallets, sparking backlashCryptocurrency wallets on Telegram may have to make some changes following the messenger’s exclusive partnership with The Open Network (TON) Foundation.Telegram’s third-party crypto wallets must now use TON Connect as their exclusive wallet connection protocol, a spokesperson for the TON Foundation told Cointelegraph.The new requirement is part of Telegram’s partnership with the TON Foundation, which made TON the only supported blockchain network for its messenger services.The foundation’s representative said that existing Mini Apps operating on other blockchains must transition to TON by Feb. 21, including bridging existing assets, migrating smart contracts and exclusively utilizing TON Connect.Wallet in Telegram — a third-party crypto wallet offered as a default Telegram’s wallet service — will not be affected by the new requirements.“The Wallet in Telegram is unaffected because it’s TON-based and only supports TON Connect for decentralized application interactions,” a spokesperson for the TON foundation said, adding:“After the migration period ends, third-party wallets that haven’t adopted TON Connect won’t be supported.”MicroStrategy, now “Strategy,” records $670 million net loss in Q4Bitcoin stacking firm Strategy — which has just rebranded from MicroStrategy — reported a net loss of $670.8 million for the fourth quarter as the firm stacked an additional 218,887 Bitcoin.On Feb. 5, Strategy reported $120.7 million in revenue in the fourth quarter, marking a 3% year-on-year fall that missed analyst estimates by about $2 million.The firm’s expenses for Q4 rose nearly 700% year-on-year to $1.1 billion as it started executing its $42 billion “21/21 Plan” aimed at buying more Bitcoin (BTC). Strategy said it has already completed $20 billion of that $42 billion capital plan, fueling its Bitcoin buying spree largely through senior convertible notes and debt.The company’s Bitcoin holdings now sit at 471,107 Bitcoin, worth over $45 billion, the largest of any corporation in the world.BlackRock to launch Bitcoin ETP in Europe — ReportBlackRock, the world’s largest asset manager, is preparing to launch a Bitcoin (BTC) exchange-traded product (ETP) in Europe, according to a Feb. 5 report by Bloomberg. The move comes after BlackRock’s US spot Bitcoin exchange-traded fund (ETF), iShares Bitcoin Trust (IBIT), drew upward of $57 billion in net assets after launching in January 2024. BlackRock’s IBIT fund is America’s most popular spot Bitcoin ETF.BlackRock’s European Bitcoin ETP will reportedly be domiciled in Switzerland. The asset manager plans to start marketing the fund as soon as this month, Bloomberg said, citing people familiar with the matter. BlackRock is a top ETF issuer, with $4.4 trillion in assets under management (AUM) across its suite of ETPs. This would be BlackRock’s first Bitcoin ETP outside of North America, Bloomberg said.