Here’s what happened in crypto today

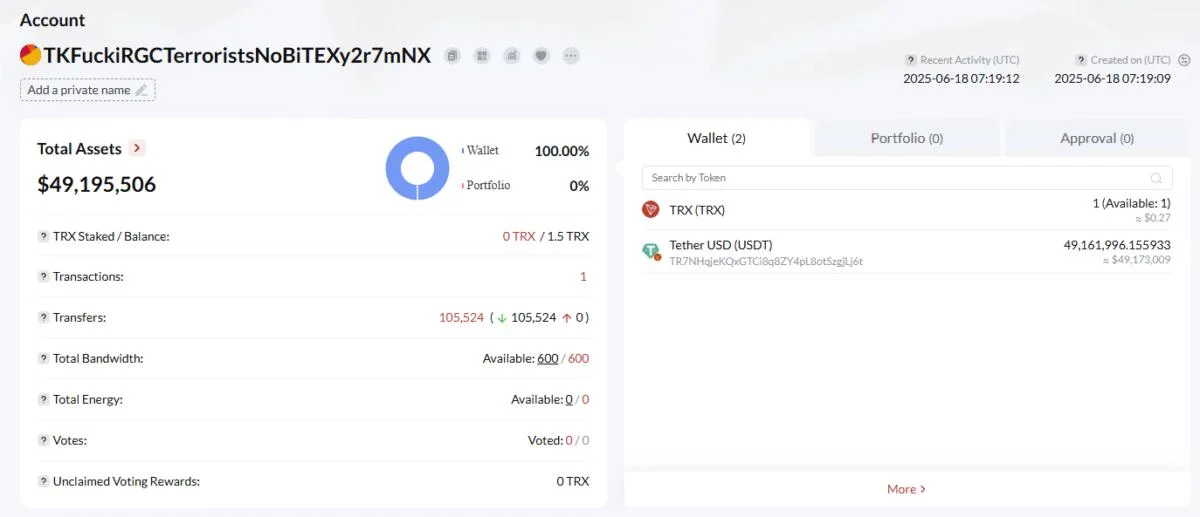

Today in crypto, Iranian crypto exchange Nobitex was hacked by an Israeli-linked group, multiple public companies raised hundreds of millions of dollars to buy crypto, and the US Senate passed the GENIUS Act stablecoin bill.Iranian exchange Nobitex hacked for over $81 million by Israel-linked hackersIran-based cryptocurrency exchange Nobitex has been hacked for more than $81 million of digital assets, according to onchain investigator ZachXBT.The attack, disclosed in a Wednesday Telegram post, drained at least $81.7 million in assets across the Tron network and Ethereum Virtual Machine (EVM)-compatible blockchains.ZachXBT spotted attackers using a “vanity address” to exploit the protocol, which resulted in “suspicious outflows” from multiple Nobitex-linked wallets.A vanity address refers to a public wallet address with a specific, user-defined sequence of characters. The first $49 million was stolen through the address “TKFuckiRGCTerroristsNoBiTEXy2r7mNX.” The second address used was “0xffFFfFFffFFffFfFffFFfFfFfFFFFfFfFFFFDead,” according to Tronscan.A pro-Israel hacker group calling itself “Gonjeshke Darande” has claimed responsibility for the Nobitex hack.Nobitex confirmed that a portion of its hot wallets saw signs of “unauthorized access” and was immediately “suspended” upon detection.“Users’ assets are completely secure according to cold storage standards, and the above incident only affected a portion of the assets in hot wallets,” Nobitex said in an X post, adding that “all damages will be compensated through the insurance fund and Nobitex resources.”The Nobitex exploit “appears to stem from a critical failure in access controls, allowing attackers to infiltrate internal systems and drain hot wallets across multiple blockchains,” according to Hakan Unal, senior security operations lead at blockchain security firm Cyvers.“Yet, surprisingly, the stolen funds remain unmoved,” Unal said.The breach adds to a growing list of crypto industry hacks in 2025. More than $2.1 billion in digital assets have been stolen so far this year, according to blockchain security firm CertiK.Four public US firms to spend $844 million on Bitcoin, HYPEAt least three publicly-traded US firms said on Tuesday that they would spend a total of nearly $800 million buying Bitcoin (BTC), while another said it raised $50 million to buy the Hyperliquid (HYPE) token.The heat-and-eat meal seller DDC Enterprise Ltd said it entered into three purchase agreements totaling $528 million, all of which will be used to expand the firm’s Bitcoin holdings, which was partly backed by the venture capital arm of Animoca Brands.Bitcoin financial services firm Fold Holdings Inc also said on Tuesday that it secured a $250 million equity purchase facility, with the net proceeds “primarily intended” to fund additional Bitcoin purchases.Meanwhile, Bitcoin mining equipment rental firm BitMine Immersion Technologies finished its purchase of $16.3 million worth of Bitcoin using proceeds from a recent stock offering.Eyenovia, a digital eye exam tech developer, said it would set aside $50 million to buy HYPE, the token of the decentralized crypto derivatives exchange. The firm said it would also rebrand to “Hyperion DeFi” under the ticker HYPD.US Senate passes GENIUS stablecoin bill in 68–30 voteThe Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act, is one step closer to becoming law in the US after the US Senate voted to pass an amended version of the bill.In a Tuesday vote of 68-30, a majority of the US Senate chose to pass the GENIUS Act roughly six weeks after Tennessee Senator Bill Hagerty introduced the legislation. The bill’s companion, the STABLE Act, may be considered in the House of Representatives next, where it could face additional proposals for amendments.“With this bill, the United States is one step closer to becoming the global leader in crypto,” said Hagerty from the Senate floor before the Tuesday vote, adding: “Once the GENIUS Act is law, businesses of all sizes, and Americans across the country will be able to settle payments nearly instantaneously rather than waiting for days or sometimes even weeks.”The GENIUS Act initially failed a cloture vote in the Senate in May in response to Democratic opposition to US President Donald Trump’s connections to the cryptocurrency industry. The Trump family has a significant stake in World Liberty Financial, which issued its own USD1 stablecoin in March. It’s unclear whether the stablecoin legislation will have enough support to pass in the House, where Republicans also hold a slim majority over Democrats. Trump’s AI and crypto czar, David Sacks, suggested in May that the president would support the bill passed by a Republican-controlled Congress.