Here’s what happened in crypto today

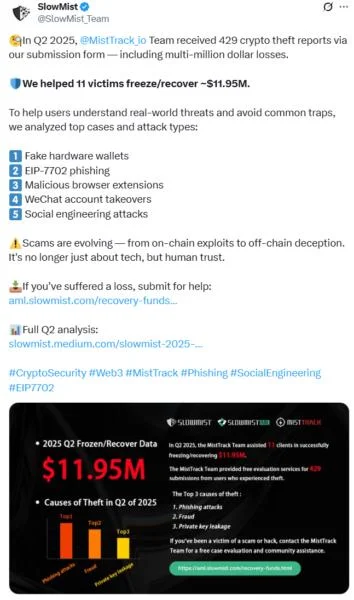

Today in crypto, Coinbase has continued its 2025 acquisition spree, blockchain security firm SlowMist has warned of five emerging crypto attack methods in Q2, and the US Securities and Exchange Commission is weighing a new token listing standard that could ease regulatory hurdles for crypto exchange-traded funds.Coinbase acquires token management platform LiquifiMajor US cryptocurrency exchange Coinbase continued its 2025 buying spree, acquiring token management platform Liquifi.Coinbase on Wednesday announced a strategic acquisition of Liquifi, a token management platform focused on early-stage tokenization projects.“Acquiring Liquifi gives us best-in-class capabilities in token cap table management, vesting, and compliance, and positions Coinbase to support builders earlier in their journey,” Coinbase’s vice president of institutional product, Greg Tusar, said in the announcement.The latest acquisition is Coinbase’s fourth this year, following its $2.9 billion acquisition of Deribit, one of the world’s biggest crypto derivatives trading platforms, in May.According to Tusar, Coinbase’s acquisition of Liquifi aims to address the complexity of token launches by onchain builders, including issues like fragmented legal, tax and compliance hurdles, regulatory matters and more. “We want to remove these barriers by providing both the product and the expertise to make token launches simple, compliant, and scalable,” Tusar said, adding:“Liquifi solves these pain points by automating core workflows while reducing token launch risk. This acquisition will enable us to partner more effectively with builders earlier in their lifecycle — before tokens are launched or listed.”He added that the acquisition aligns with Coinbase’s vision and goal to make token launches “easier, faster and more global than issuing traditional startup equity.”SlowMist warns of five “insidious” crypto scams emerging from Q2Crypto users faced a rise in “psychologically manipulative” attacks in the second quarter as hackers dreamt up advanced and creative ways to try and steal crypto, according to blockchain security firm SlowMist.SlowMist’s head of operations, Lisa, said in the firm’s Q2 MistTrack Stolen Fund Analysis report that while it didn’t see an advancement in hacking techniques, the scams have become more sophisticated, with a rise in fake browser extensions, tampered hardware wallets and social engineering attacks.“Looking back on Q2, one trend stands out: attackers’ methods may not be getting technically more advanced, but they are becoming more psychologically manipulative.”“We’re seeing a clear shift from purely on-chain attacks to off-chain entry points — browser extensions, social media accounts, authentication flows, and user behavior are all becoming common attack surfaces,” said Lisa.US regulator considers simplified path to market for crypto ETFsThe United States Securities and Exchange Commission (SEC) is reportedly exploring a simplified listing structure for crypto exchange-traded funds (ETFs) that would automate a significant portion of the approval process.Under the proposed overhaul, ETF issuers could potentially sidestep 19b-4 application filings, the form entities submit to the SEC before listing a financial product on exchanges, according to crypto journalist Eleanor Terrett.Instead, issuers would submit SEC form S-1, the initial listing registration filing, and wait for 75 days. If the SEC does not object to the application, the issuer would be free to list the ETF, reducing the back-and-forth communication between fund managers and the regulator.Terrett says that details of the proposal, including the eligibility criteria for cryptocurrencies qualifying for the expedited process, are yet to be confirmed by the issuers and the regulatory body.Crypto ETF approvals are a hot-button topic, as US-listed altcoin ETFs could attract fresh capital into altcoin markets, potentially triggering a sustained altcoin rally, or altseason.