Here’s what happened in crypto today

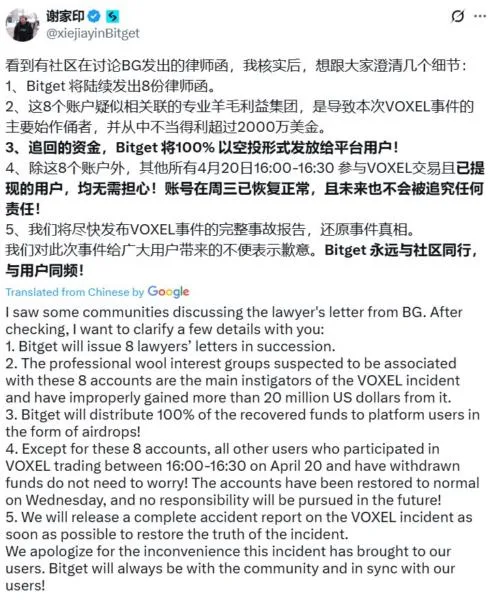

Today in crypto, Bitget sent legal letters to users it accused of manipulating token contracts, Donald Trump says federal income taxes will be reduced or eliminated, and Adam Back said Strategy and other Bitcoin-buying firms are some of the earliest bettors on Hyperbitcoinization, which may see Bitcoin’s market cap soar over $200 trillion.Bitget sends legal letters to alleged VOXEL manipulatorsBitget’s lawyers have sent letters to eight account holders at the crypto exchange, accusing them of manipulating the price of perpetual futures contracts tied to the VOXEL token and pocketing $20 million in total.Bitget’s head of Chinese operations, Xie Jiayin, said in an April 27 X post that those behind the eight accounts will receive the legal letters in “quick succession,” and it will redistribute any recovered funds to its other users.VOXEL is the native utility token of Voxies, a free-to-play, 3D turn-based tactical RPG game built on the Ethereum blockchain.Bitget said on April 20 that it found “abnormal trading activity” on its perpetual futures contract and paused accounts it suspected of market manipulation.The trading pair clocked over $12 billion in volume, dwarfing the metrics of the same contract on Binance. After the pause, Bitget rolled back the irregular trades to claw back the gains.Trump says federal income taxes will be “substantially reduced” or eliminatedUS President Trump said federal income taxes would be "substantially reduced" or eliminated altogether once the proposed trade tariffs take full effect.The US President said that the accompanying tax reduction will focus on those earning less than $200,000 per year."It will be a bonanza for America. The External Revenue Service is happening," Trump wrote in an April 27 Truth Social post.President Trump previously floated the idea of eliminating the federal income tax collected by the Internal Revenue Service (IRS) and replacing revenues from income taxes with tariffs collected on imported goods.The US President's April 27 Truth Social post revealed the first concrete details of the proposed plan since Trump and members of his cabinet began touting comprehensive tax reform in October 2024.Bitcoin treasury firms driving $200 trillion hyperbitcoinization — Adam BackInvestment firms with Bitcoin-focused treasuries are front-running global Bitcoin adoption, which may see the world’s first cryptocurrency soar to a $200 trillion market capitalization in the coming decade.Institutions and governments worldwide are starting to recognize the unique monetary properties of Bitcoin (BTC), according to Adam Back, co-founder and CEO of Blockstream and the inventor of Hashcash.“$MSTR and other treasury companies are an arbitrage of the dislocation between the bitcoin future and todays fiat world,” Back wrote in an April 26 X post.“A sustainable and scalable $100-$200 trillion trade front-running hyperbitcoinization. scalable enough for most big listed companies to move to btc treasury,” he added.Hyperbitcoinization refers to the theoretical future where Bitcoin soars to become the largest global currency, replacing fiat money due to its inflationary economics and growing distrust in the legacy financial system.Bitcoin’s price outpacing fiat money inflation remains the main driver of global hyperbitcoinization, Back said, adding:“Some people think treasury strategy is a temporary glitch. i’m saying no it's a logical and sustainable arbitrage. but not for ever, the driver is bitcoin price going up over 4 year periods faster than interest and inflation.”