Here’s what happened in crypto today

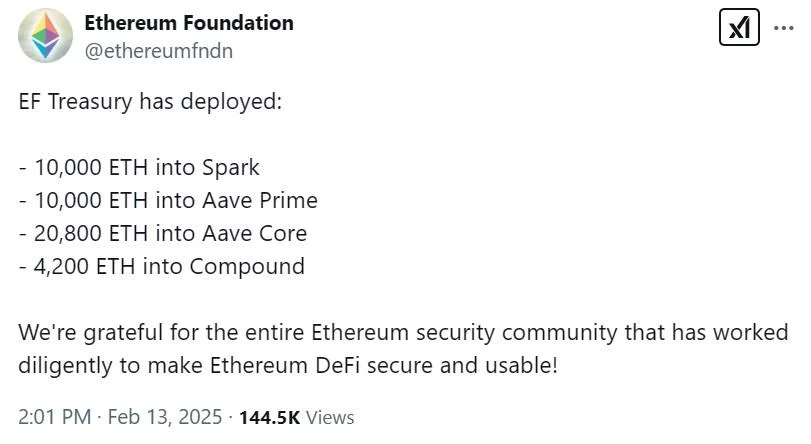

Today in crypto, the Ethereum Foundation has responded to recent criticism by deploying 45,000 Ether to decentralized finance protocols Aave, Spark and Compound, the US Federal Reserve’s Chris Waller said banks should be allowed to issue stablecoins, and the co-founders of HashFlare copped to wire fraud in the US.Ethereum Foundation deploys $120 million to DeFi appsThe Ethereum Foundation allocated $120 million of Ether to decentralized finance (DeFi) protocols, responding to community concerns about the foundation’s reliance on ETH sell-offs for funding.On Feb. 13, the Ethereum Foundation’s multisignature address deposited 4,200 Ether into Compound, 10,000 ETH into Spark and 30,800 ETH into Aave. With ETH hovering at around $2,600, the total value of the 45,000 ETH deployed was about $120.4 million. Aave founder and CEO Stani Kulechov said the 30,800 ETH (about $82.4 million) deployed into Aave Prime and Aave Core is the Ethereum Foundation’s “biggest allocation in DeFi.” Kulechov also said, “DeFi will win,” expressing optimism as the foundation added liquidity to Aave. Apart from Kulechov, many community members celebrated the move, as it may reduce the need for the foundation to dump ETH to secure funds for expenses. In January, many called out the Ethereum Foundation for selling ETH to cover its operating expenses and pay its staff.Fed’s Waller says banks should be able to issue stablecoinsUS Federal Reserve Governor Christopher Waller called for a regulatory framework that would allow banks to issue stablecoins, arguing they could expand the reach of the US dollar.Waller said at a conference in San Francisco on Feb. 12 that stablecoins are an “important innovation for the crypto ecosystem with the potential to improve retail and cross-border payments.”He said the stablecoin space had matured and “would benefit from a US regulatory and supervisory framework that addresses stablecoin risks directly, fully and narrowly,” adding that both non-banks and banks should be able to issue them.Waller, however, did note some challenges for stablecoin adoption, namely a lack of clear and balanced regulations in the US, but also differences in state and international regulations.He also highlighted the risks of stablecoin failures. One notable example is the multibillion-dollar crypto market wipeout in 2022 caused by Terraform Labs’ stablecoin losing its US dollar peg.HashFlare co-founders plead guilty to wire fraud in USThe co-founders of crypto mining service HashFlare agreed to plead guilty to one count of conspiracy to commit wire fraud as part of a deal with US authorities.In Feb. 12 hearings in the US District Court for the Western District of Washington, Sergei Potapenko and Ivan Turogin pleaded guilty to one felony count out of the 18 charges they had been facing from US prosecutors.The Estonian nationals were responsible for running HashFlare, which defrauded users out of more than $550 million between 2015 and 2019, and raising $25 million from investors in 2017, claiming they would establish a digital bank called Polybius — but the company was never created.Speaking to Cointelegraph after the hearings, Reed Smith partner and defense counsel Mark Bini said both defendants had “agreed to forfeit their interests in assets that the government froze in 2022” and to provide assistance “so that there will be zero financial harm to anyone.” According to the attorney, Potapenko, Turogin and HashFlare returned $350 million in crypto payments to users between 2015 and 2022.