Here’s what happened in crypto today

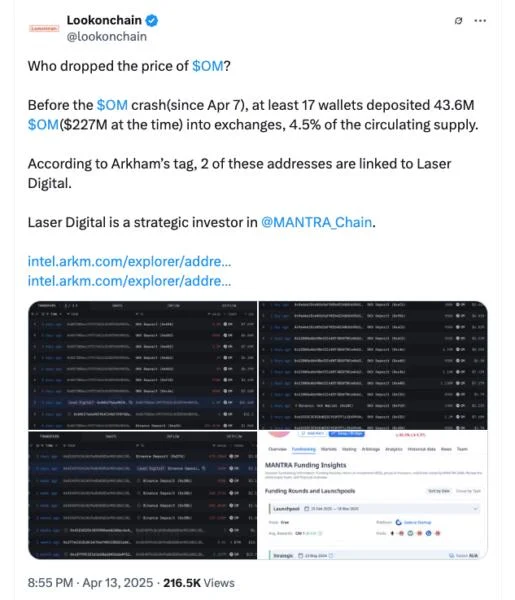

Today in crypto, Anchorage Digital Bank is reportedly under investigation by the US Department of Homeland Security. Meanwhile, Mantra CEO John Mullin has denied claims of insider token sales by investors — including Laser Digital — ahead of OM’s 90% price crash, despite onchain data suggesting otherwise. Mullin also pointed to a specific exchange that may have contributed to the token’s sudden collapse.Anchorage Digital faces scrutiny from US Homeland Security — ReportThe US Department of Homeland Security's El Dorado Task Force has reportedly launched an investigation into Anchorage Digital Bank, a Wall Street-backed cryptocurrency firm. According to an April 14 Barron's report, members of the task force have contacted former employees of the company over the past weeks to examine its practices and policies. The report cites unidentified sources. The reported Homeland task force probe hints at cross-national financial activities. Established in 1992, the El Dorado Task Force focuses on “transnational money laundering” activities and financial crimes carried out by organizations. Anchorage is co-founded by Portuguese-American entrepreneur Diogo Mónica and Nathan McCauley, according to its website. Along with its US businesses, Anchorage has operations in Singapore and Portugal. Its investors include Andreessen Horowitz, Goldman Sachs and Visa, among others. Mantra CEO denies insider OM token dump, says Arkham “mislabeled” walletsMantra CEO John Mullin denied reports suggesting large-scale token transfers by major Mantra investors in the days leading up to the sharp collapse of the OM token, while speaking in an AMA hosted by Cointelegraph on April 14.“The Mantra association, our key investors, our advisers — no one has sold, and we are going to categorically deny and also provide verifiable proof onchain proof that this is the case,” Mullin stated in the AMA.Previous reports suggested that Laser Digital, a strategic Mantra investor, cashed out large portions of Mantra (OM) tokens before the cryptocurrency collapsed on April 13.At least two wallets linked to Laser Digital were among 17 wallets that moved a combined 43.6 million OM tokens — worth about $227 million at the time — to exchanges before the crash, the blockchain analytics platform Lookonchain reported on April 13, citing Arkham Intelligence data.Laser Digital is a digital asset business backed by Nomura. The firm announced a strategic investment in Mantra in May 2024.According to Arkham data, one Laser Digital-linked wallet had moved about 6.5 million OM tokens ($41.6 million at the time) to OKX in seven transactions since April 11.The last recorded transaction from the wallet occurred on April 11 at around 10:00 pm UTC, days before the Mantra crash, which took place on April 13 at roughly 7:00 pm UTC, according to data from CoinGecko.Another wallet sent about 2.2 million OM (worth $13 million) to Binance in a series of transfers starting April 3.The data also indicated that Laser Digital may have started reducing its OM holdings as early as February. The wallets linked to the firm reportedly received a large portion of their OM from crypto trading firm GSR in 2023.Laser Digital subsequently denied reports alleging its involvement in the OM volatility, claiming that the referenced wallets did not belong to it.Mantra says one exchange “in particular” may have caused OM collapseThe team behind real-world tokenized asset blockchain Mantra says its native token’s sudden 90% plunge was caused by exchanges forcibly closing positions without notice, with one currently unnamed exchange potentially to blame. On April 13, Mantra (OM) price dropped from $6.30 to below $0.50, rapidly shedding over 90% of its $6 billion market cap.“We have determined that the OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders,” Mantra co-founder John Mullin wrote in an April 13 statement on X.“The timing and depth of the crash suggest that a very sudden closure of account positions was initiated without sufficient warning or notice,” he added. Mullin told an X user they believe one exchange “in particular” was to blame but said they were still “figuring out the details.” He told others that the centralized exchange in question wasn’t Binance.